I have assiduously avoided writing about Covid-19 up until now. This is a financial website. Covid is a medical issue. I know little about medical issues (although I have noticed that it takes more ibuprofen then it used to to make the parts stop hurting. But I digress).

I also believe that financial market analysts should spend a lot less time focusing on Covid and more time focusing on the markets. If I had a dollar for every post from every analyst discussing how “cases are spiking” here or there or everywhere and how that “is going to affect the markets” I would have a lot more dollars than I would by following their opinions on how “spiking cases will affect the markets.” (Psst. There is no correlation.)

Here is a new one for the list:

Jay’s Trading Maxim #322: DO NOT attempt to use Covid-19 data to time the markets.

All that being said, as an avowed numbers geek I have been following “the numbers” very closely, and have struggled to find a way to pull anything that might be meaningful out of the data. Well, I finally found something that makes sense to me (although you may not be moved, which is fine).

The problem is that the majority of people (it would seem) look at “Cases” and think “Deaths.” Thus, the focus is on “New Cases” (the shiny object) and that a sharp increase in new cases will automatically result in a commensurate sharp increase in deaths.

As I will attempt to illustrate in a moment, the next month will tell us a lot (I think) about how this looks going forward.

The succinct version is this:

*The majority of deaths to date are among older people

*The majority of new cases since the economy has re-opened (sort of) is among younger people

*Younger people die of Covid at an exponentially lower rate than older people

*Therefore – the theory goes – a spike in cases among younger people will not result in a commensurate spike in deaths

Here’s the slightly longer version…

Covid 19 – Analyzing the Numbers

The next month should tell us a lot about where we are headed.

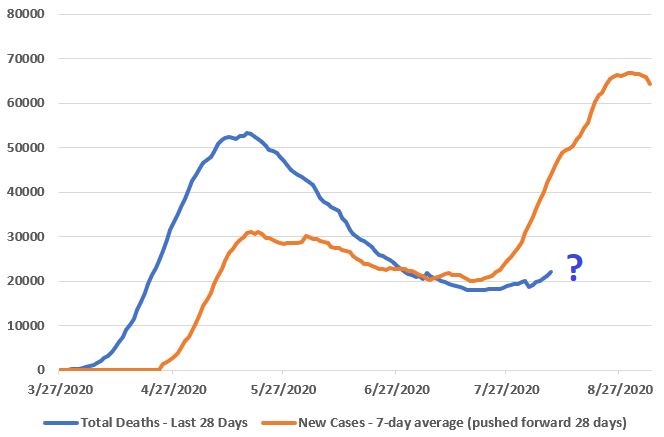

The chart below tries to make some sense of the relationship between “Cases” and “Deaths”.

*Orange line = 7-day average of New Cases per day (pushed 28 days into the future)

*Blue line = Total # of deaths in previous 28 days

Figure 1 – Cases versus Deaths (Data source: www.CovidTracking.com)

Looking at this chart the first inclination is to expect that deaths will spike rapidly in the next month, as more cases result in more deaths. And that is obviously a possibility.

HOWEVER: I am cautiously optimistic that deaths WILL NOT spike commensurately (although they are certainly likely to rise to some degree)

This is based on the fact that the people testing positive now are younger, and the mortality rate among younger people is extremely low.

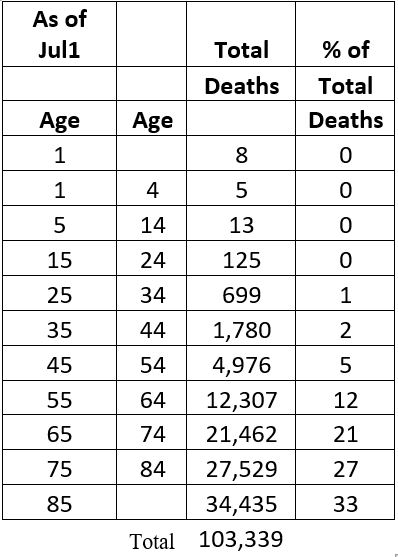

Through July 1:

*60% of deaths were people aged 75 or older

*81% of deaths were people 65 and older

*93% of deaths were people aged 55 or older

*7% of deaths were people 0 to 54

Figure 2 – Deaths by Age group (through 7/1/20)

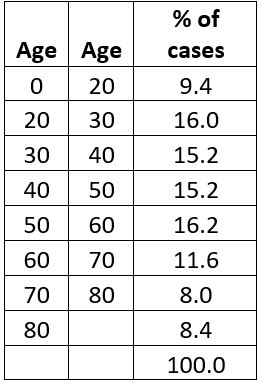

Figure 3 is CDC data but I am unsure of the exact date of data, but it is relatively recent. It shows the age breakdown of people who have tested positive recently.

Figure 3 – Who’s testing positive?

*55% of the cases are people aged 0 to 50

*72% of the cases are people 60 or under

i.e., the majority of the new cases recently are among those less likely to die of Covid.

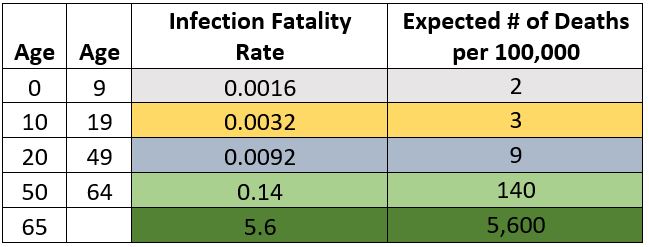

How likely? Figure 4 displays the Mortality Rate of people who get infected with Covid by Age Group per the CDC

Figure 4 – Mortality rates by Age Group

People 65 or over who contract Covid have died 5.6% of the time (i.e., 94.4% of people over 65 who contract Covid DO NOT die of Covid)

The Bottom Line

The next month will tell us a lot about where we are headed.

If in fact:

*The majority of new cases are among people in younger demographics

*Mortality rates to date hold in the same general range

*Then we can reasonably hope that the blue in Figure 1 (Deaths over the latest 28 days) will NOT “spike” to anywhere the same degree that the orange line in Figure 1 (7-day average of Cases pushed 28 days forward) has.

Here’s hoping.

So:

*If Covid deaths DO spike sharply in the next month then we have a(n even more) serious problem going forward. If re-opening the economy leads to a sharp increase in cases and if a sharp increase in cases leads to a sharp increase in deaths, then re-opening the economy becomes that much more problematic. Oh, and by the way, try also to remember that the longer we go without more fully re-opening the greater the likelihood that we end up living the rest of our lives in a serious Depression. Just so you know.

*If Covid deaths DO NOT spike in the month ahead (despite the spike in new cases that we have seen of late) we can:

a) Take even more steps to protect the more vulnerable (i.e., older and/or sicker) demographics, and

b) Allow the rest of the population to get back to some semblance of normality.

Again, here’s hoping.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.