If there is one thing we all hate it is when things are going very well in the market and the “Gloomers and Doomers” chime in with their incessant gloom and doom. Usually it’s people who got the market wrong and don’t want to come to grips with that fact and as a result try to “bring everybody else down.”

So I don’t want to be that guy.

I am enjoying the rally and am happy to see it go just as far as it wants to run. For the record, back in March one indicator I follow gave a buy signal the very day after the low (see here and here). So, I am not attempting to issue any ominous “call to action” below. Its more of a “call to pay attention going forward.”

Looking Ahead by Looking Back

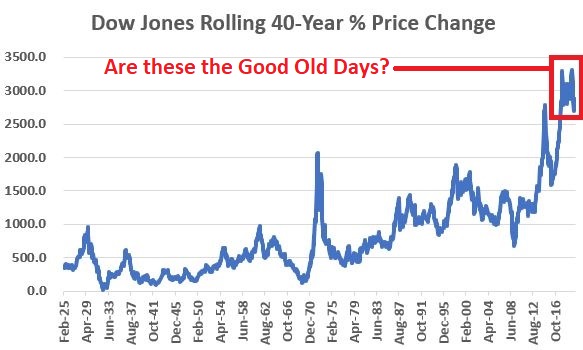

As a thought experiment, let’s look at the stock market on a very, very long-term basis. Specifically, I am looking at Dow Jones Industrial monthly closing prices since about 1885 and look at rolling 40-year returns (price only, no dividends). So, starting in 1925, every month we look back at the total gain or loss for the Dow over the previous 40-year period.

Peruse Figure 1.

Figure 1 – 40-Year rolling return for Dow Industrials (1925-2020)

There is Good News and Bad News:

*The Good News is that the market has never had a losing 40-year stretch. (Which is great news if you are in your 20’s!).

*The (potential) Bad News is that – as noted by the red box – the last 40 years have been very, very good to me, and to you and to anyone who has invested since roughly the Reagan administration. In essence, these are “the Good Old Days.”

The obvious question is “will this last forever?” Based on what I know about the cyclical nature of financial markets, I have “concerns.”

THE POINT: The correct response to the information in Figure 1 is NOT “Oh My God, the market is going to crash I should sell everything!!” The correct response is to say “I am going to go with the trend as long as it lasts, but I also recognize that things may be much less favorable in terms of the overall trend in the years ahead, so I will remain vigilant and be prepared to act defensively.”

OK, that was kind of wordy. More succinctly, “I will NOT get stars in my eyes and expect that large-cap/growth/tech/momentum stocks will lead forever and ever into the future.” Because chances are – just a personal opinion here –they won’t.

Why do I say that? Simple, the cyclical nature of financial markets

The Cyclical Nature of Financial Markets

I should mention that I am on record as predicting that ten years from now we will look back and find that:

*International stocks

*Commodities

*Value stocks

*and possibly Energy

…will have all outperformed the S&P 500 Index. Of course, I should probably also mention that I am also previously on record as making all kinds of other predictions that I don’t wish to discuss at this time. In essence, I am not so much “predicting the future” as I am “analyzing the past” and recognizing the cyclical nature of markets. To wit, history has demonstrated that:

*U.S. stocks lead for years at a time and then International stocks lead

*Stocks lead for awhile and then commodities lead

*Growth beats values for some period of time and then value leads

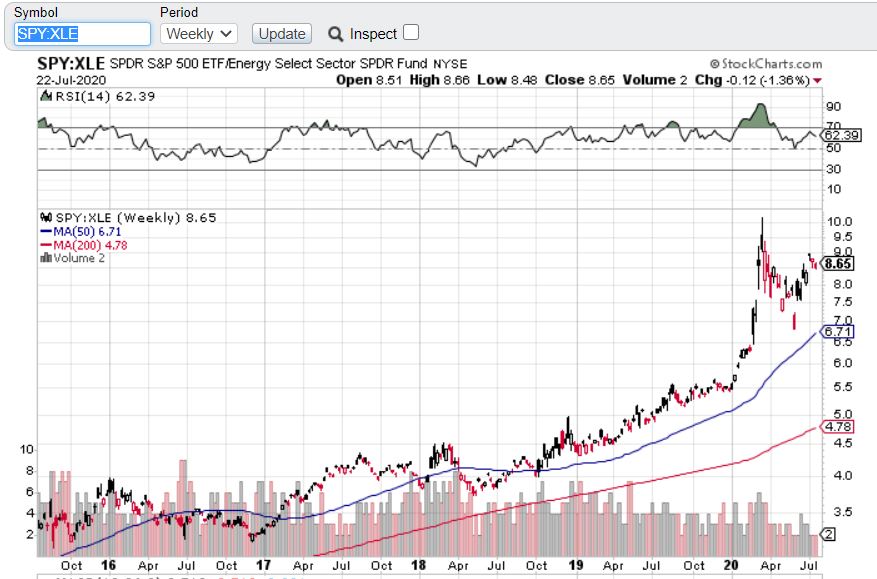

*Over a period of years Energy gets crushed then rallies strongly, repeat

So, given the obvious and sizeable outperformance of large U.S. growth stocks for a sustained number of years, it is actually not even really a “bold prediction” to state that “this probably will not last forever.”

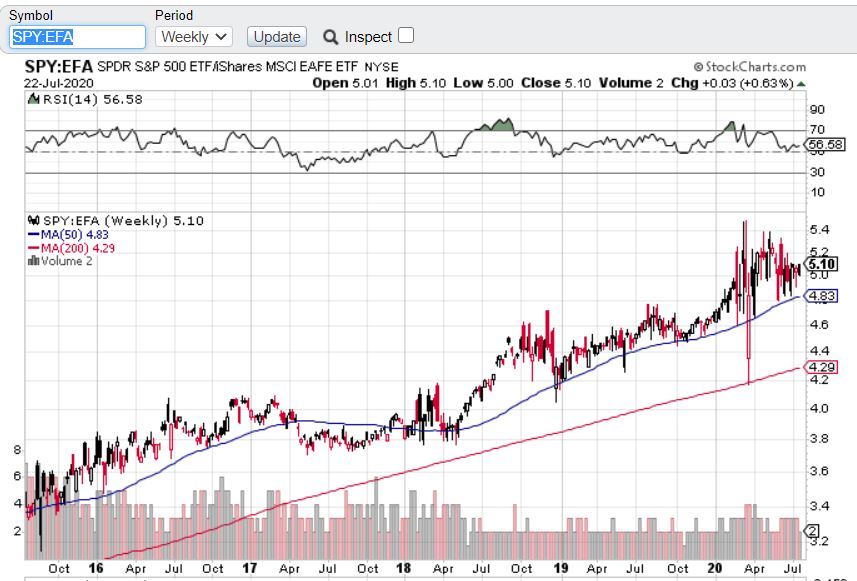

Again, this is not a “call to action”. The current trends remain pretty much strongly in force and I do not suggest trying to identify the exact turning point. But there is a way to get a sense of when that might be occurring. Figures 2 through 5 are from www.StockCharts.com and measure the performance of one “asset class” versus another “asset class.”

Figure 2 – U.S. Stocks outperforming International (Courtesy StockCharts.com)

Figure 3 – Stocks outperforming Commodities(Courtesy StockCharts.com)

Figure 4 – Growth outperforming Value (Courtesy StockCharts.com)

Figure 5 – S&P 500 outperforming Energy (Courtesy StockCharts.com)

I am not advocating “fighting City Hall” and trying to fade the current trends. What I am saying is “Do not fall in love with these trends because they WILL NOT last forever.”

Nothing ever does. Especially in the markets.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.

Thank you, Jay.