There are certain patterns/situations in the financial markets that arise on a fairly regular basis. Take for example, the “Coil.”

The “Coil” simply involves a security trading into an ever-narrower range. The theory is that when price finally breaks out of the coil it will make a significant price move. Like most things, sometimes things work out that way and sometimes they don’t. But often enough they do which makes the “Coil” so intriguing to a lot of traders.

The “Catch” to the “Coil” and the Potential Solution

The “catch” to the “Coil” is that if you are buying or selling short shares or futures contracts, you still must get the direction right. In other words, if you buy shares in expectation that price will break out of a coil to the upside, and price instead breaks hard to the downside, you’re out of luck (not to mention a certain percentage of your trading capital).

The potential solution is a strategy known as the “strangle”. Let’s illustrate with an example.

The Example

As always, please note that I am NOT “recommending” the trade below. It serves solely as an example of using a “strangle” to play the “coil”.

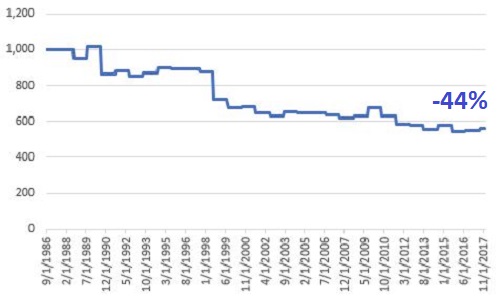

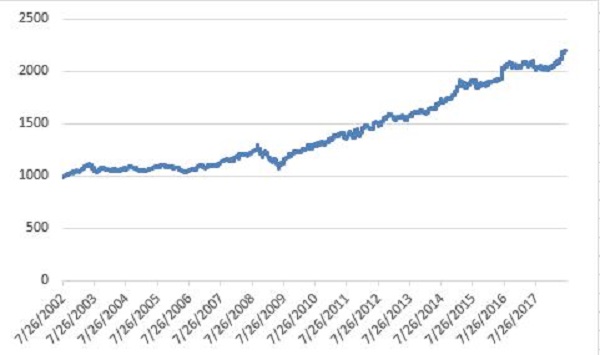

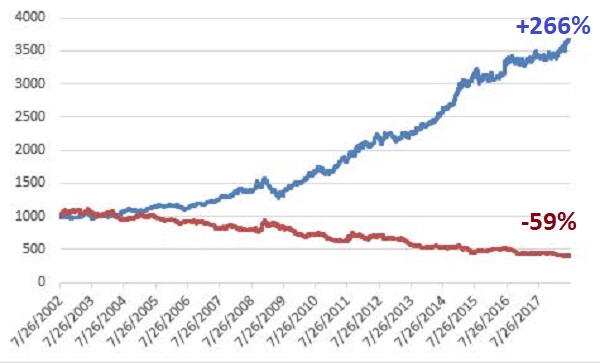

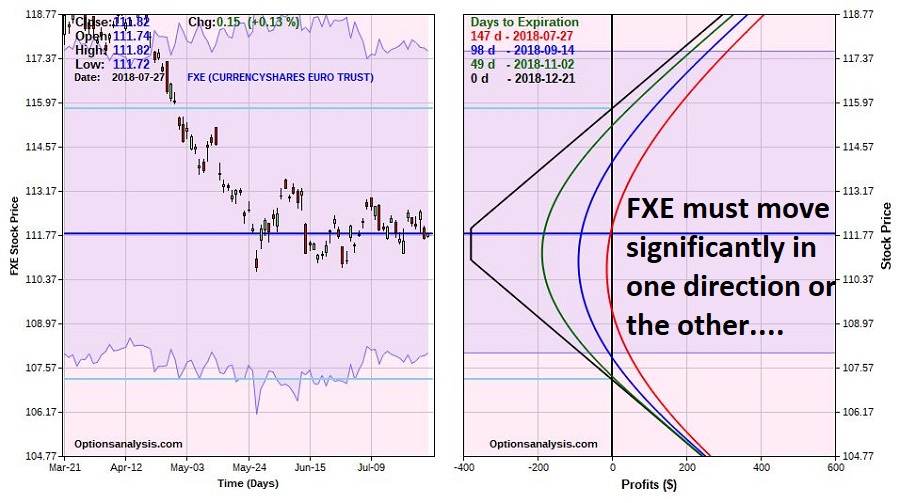

Figure 1 displays a daily bar chart of ticker FXE – an ETF that tracks the price of the euro currency. You will note that it tends to “coil” and then breakout and run. At present, it appears to be “coiling” again.

Figure 1 – Ticker FXE: Coils followed by breakouts and price runs (Courtesy ProfitSource by HUBB)

Figure 1 – Ticker FXE: Coils followed by breakouts and price runs (Courtesy ProfitSource by HUBB)

So, will FXE breakout of its current coil and run? And if so, in which direction. As always, I have to go with my standard answers of, “It beats me” and “It beats me.”

But what if I still felt like a breakout of some sort was quite possible. In that case I could consider the example trade of:

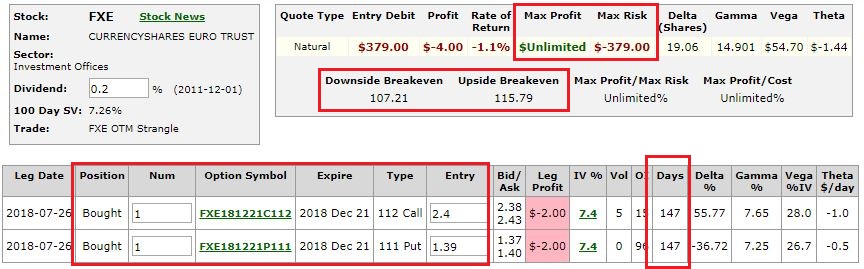

*Buy 1 Dec2018 FXE 112 call @ 2.40

*Buy 1 Dec2018 FXE111 put @ 1.39

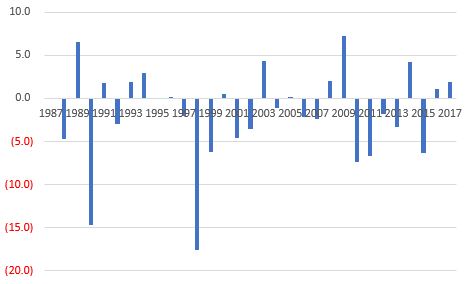

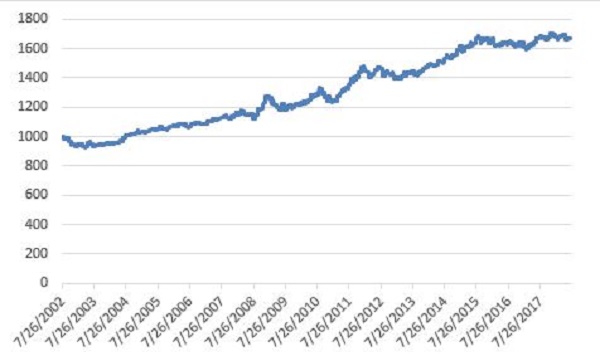

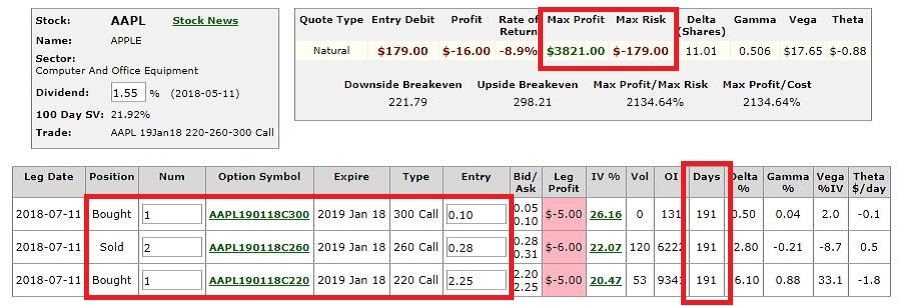

The particulars of this trade appear in Figure 2 and the risk curves in Figure 3.

Figure 2 – FXE strangle (Courtesy www.OptionsAnalysis.com)

Figure 2 – FXE strangle (Courtesy www.OptionsAnalysis.com)

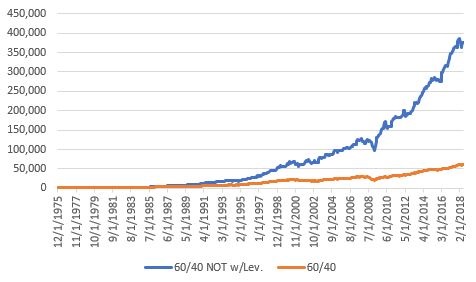

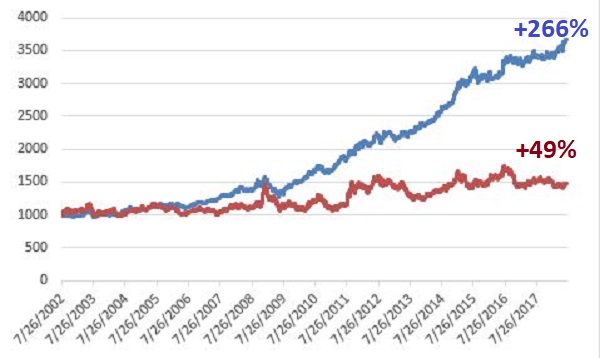

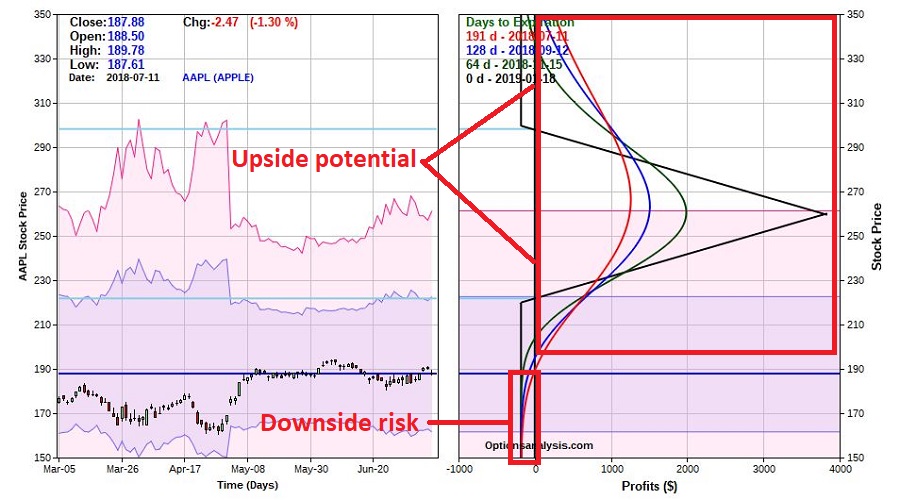

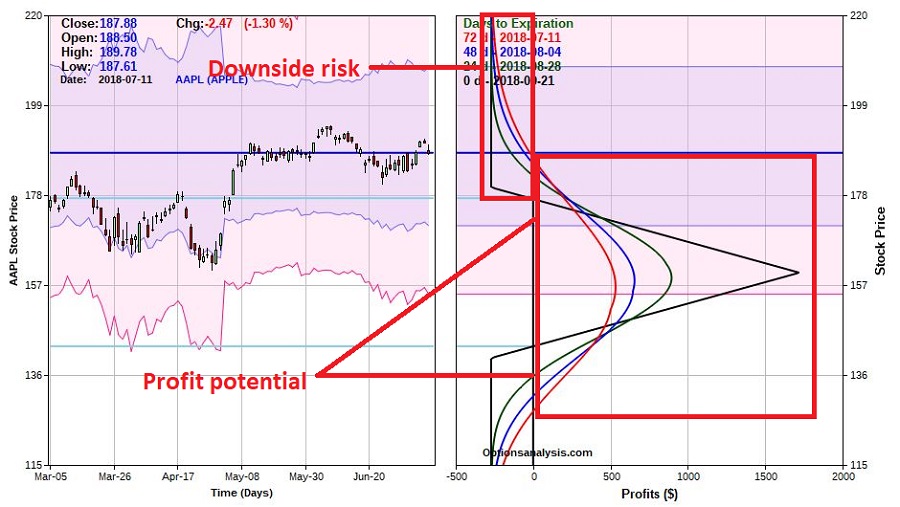

Figure 3 – FXE strangle risk curves (Courtesy www.OptionsAnalysis.com)

Figure 3 – FXE strangle risk curves (Courtesy www.OptionsAnalysis.com)

A few things to note:

*FXE absolutely, positively must make a move of at least 4.00 points (or more) in order for this trade to generate any kind of a profit (i.e., this trade is pure speculation and should involve a small percentage of your investment capital).

*The bulk of any losses would accumulate in the last 30-50 days prior to expiration. Looking at the green risk curve line in Figure 3, at its nadir the open loss is about -$188. As you can see, this loss would grow to -$379 by December expiration if FXE remained unchanged (i.e., if FXE hasn’t shown any sign of movement by about the middle of November, a trader might consider throwing in the towel in order to avoid the negative effects of time decay as expiration nears).

Summary

So, is this a great trade? We’ll only know in hindsight (and remember, I am in no way suggesting that it is ). Is it a good example of one potential way to play a “Coiling” market. I leave that to the reader to decide.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.