Well I hate to say it but I have to alert you to a major update/correction to my last piece titled A Simple Asset Allocation Model (The 60/40 NOT Method).

In testing various iterations I used leverage of 1.25-to-1 for the stock portion during one test. However, when I put the numbers in the article I forgot to switch back to the non-leveraged results.

So the results in the original article assume the use of leverage even though no mention was made of this fact in that article. My bad.

So again, the results that appeared in the original article actually assumed using leverage of 1.25-to-1 for the stock portion of the portfolio.

In other words, the numbers are correct, BUT no mention was made in the original article that the results reflected the use of leverage of 1.25 to 1 in the stock portion of the monthly allocations.

Regarding the results in the original article:

*If for example, the month was December then the allocation model said to be 100% in stocks (in this case, the S&P 500 Index).

*Let’s say the S&P 500 Index showed a gain in December of +2.00%.

*The results displayed in the article were based on leverage of 1.25-to-1, i.e., the calculations assumed a December gain of +2.50% (+2.00% actual SPX gain times 1.25).

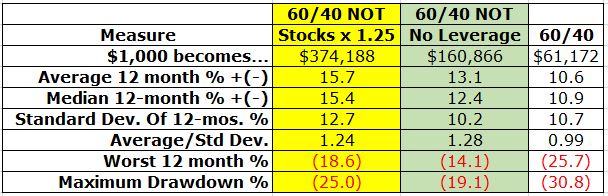

So here are the results – leveraged and unleveraged:

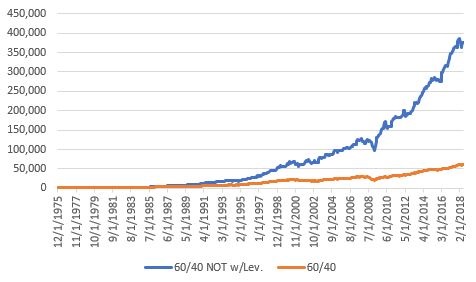

LEVERAGED:

Stock allocations assume SPX monthly total return x 1.25 plus Aggregate Bond Index total return x 1

Figure 1 – Leveraged Results for Jay’s 60/40 NOT Method versus 60/40

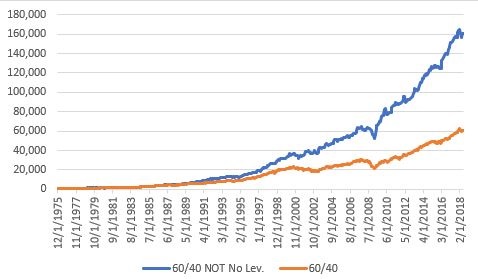

NON-LEVERAGED:

No leverage is used. Stock allocations assume SPX monthly total return x 1 plus Aggregate Bond Index total return x 1

Figure 2 – Non-Leveraged Results for Jay’s 60/40 NOT Method versus 60/40

Figure 3 displays the results for the 1.25 leveraged version as well as the unleveraged version (and also the standard 60/40 annual rebalance method). Figure 3 – Comparative results (Leveraged method, non-leveraged method, standard 60/40 method)

Figure 3 – Comparative results (Leveraged method, non-leveraged method, standard 60/40 method)

Clearly using leverage raises the stakes – higher returns, but also higher risks. The average annual return for the non-leveraged version is still a respectable 13.1%.

And, sorry again for the confusion….

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Hi Jay,

In your estimate would an ETF advertised as “Daily S&P 500 Bull 1.25X ETF” be an appropriate means for the use of leverage in the stock portion?

Thank you.

Two things, first and as always I am not “recommending” this method…I just put ideas out there and people can take it from there. Second, “yes” a 1.25 fund would theoretically be ideal. The only question I would raise is liquidity if it is an ETF. Another alternative is this: Stock allocation x 0.625 into a 2-to-1 SPX leveraged fund and the rest in cash. Mathematically it works out to 1.25 leverage (with the potential for a little interest earned on the cash). Take Care, Jay