For the record, I come from a futures trading background. So – to paraphrase – I’ve seen a lot of “stuff”. I’ve seen people literally go from rags to riches. And I’ve seen people go from riches to rags. And yes, a few people who did both. This experience is the reason why Rule #1 goes like this:

Jay’s Trading Maxim #1: Your #1 job as a trader is to be able to come back and be a trader again tomorrow.

Sounds pretty obvious, no? But the reality is that once you take a huge hit financially, it becomes exponentially harder to come back.

I knew a commodity broker many years ago, a guy in New Orleans named Mike. And despite the fact that he was a commodity broker he was a great guy (go figure). And whenever he opened a new account he would offer the new client his “Trade Guarantee”. It went like this – “I guarantee you that there will be losing trades.”

This was probably not what a lot of people wanted to hear but the truth is that he did them a gigantic favor by properly setting expectations. This also dovetails nicely with:

Jay’s Trading Maxim #5: It’s not how much you make when everything goes right that matters, it’s how much you keep when everything goes wrong.

re Losing Trades

Let’s be blunt, losing trades suck. Financially of course, but even more so sometimes mentally. When you put a lot of time, effort and energy – not to mention your “best thinking” into finding just the “right” trading opportunity, and then you get into a trade and the market goes “Pffft” and laughs in your face and almost immediately runs in the wrong direction – it hurts. Well, at least if you let it. Which leads to:

Jay’s Trading Maxim #16: What happens to your account equity during a losing trade can impact your ability to trade effectively in the near-term. What happens between your ears during (and following) a losing trade can affect your ability to trade effectively in the long-term.

Which leads to:

Jay’s Trading Maxim #33: Successful traders, a) control risk ruthlessly, and, b) have short memories when it comes to losing trades.

Re Gold

Sometime late last year and into 2018 I looked at the “coiling” nature of the gold (and silver) market and got it in my head that they were destined to break out huge to the upside (fortunately, I never actually did anything about it, but forget that for now). Eventually I realized that things could go sideways for a very long period of time and also that the breakout could be to the downside – although I was still setting my sights on the stars (i.e., an upside breakout).

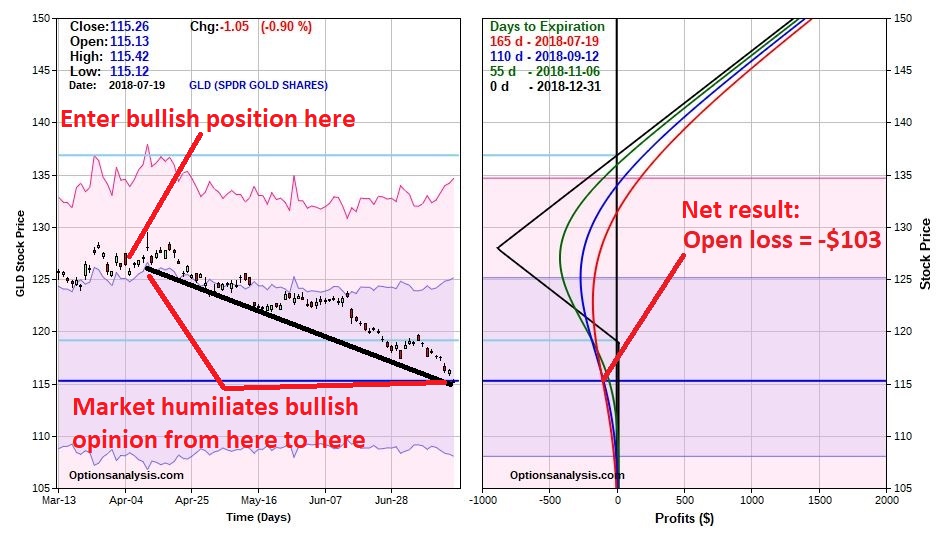

Early in April I posted an article titled “Yes, Gold is at a Critical Juncture”, that included a hypothetical trade designed to make money if and when the “big upside explosion” took place in gold. Oops. Nice call, huh?

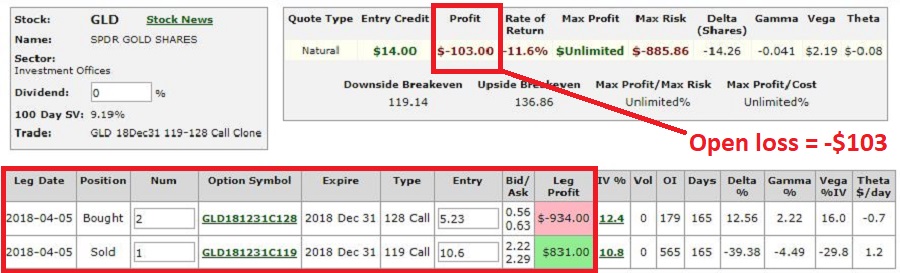

Ticker GLD – an ETF that tracks the price of gold bullion – closed at $125.80 on that day. Four trading days later it closed at $128.11 – and it’s been all downhill ever since. As I write GLD is trading at $115.26 – down almost 9% from the date of entry. Impressed with my market timing abilities? Not likely. But here’s the thing. The “example trade” I wrote about was a “ratio backspread. The current status of that trade appears in Figure 1 below.

Figure 1 – GLD Dec 119-128 backspread (Courtesy www.OptionsAnalysis.com)

Figure 1 – GLD Dec 119-128 backspread (Courtesy www.OptionsAnalysis.com)

Figure 2 – GLD Dec 119-128 backspread risk curves (Courtesy www.OptionsAnalysis.com)

Figure 2 – GLD Dec 119-128 backspread risk curves (Courtesy www.OptionsAnalysis.com)

So here’s the thing. The Bad News is that the timing of this “bullish” trade was embarrassingly wrong. Gold has been in a steady decline almost from the day the trade was highlighted. But wait, there is “Good News” (at least from a real-world trading perspective). The “Good News” is that despite being essentially 100% wrong about timing and direction, this example trade is presently showing an open loss of -$103.

So, here’s the tricky part. Is it a ‘good thing” to be horrifically wrong it terms of timing a trade? Obviously not. Is it a “good thing” to lose $103? No, of course not. But (foreshadowing alert – here comes “the point”) is it a good thing to “only lose $103 when you are essentially 100% wrong in your thinking?

You can decide your own answer for yourself. For my answer please refer again to Trading Maxim’s #1 and #5 above.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.