One school of thought these days suggests that the FAANG stocks are the “only place to invest” since they seemingly dominate the investment landscape (and/or their various industries, more or less). Another school of thought is more of the “trees don’t grow to the sky” and/or “what goes up, must come down” variety. The second school of thought has been taking it on the chin from FAANG stocks for some time now.

A Strategy to Play (Either Way)

I make no claim to know where the high flyers are headed next. Regardless, there is a strategy that traders can use to express an opinion – be it bullish or bearish – without risking the thousands, or even tens of thousands of dollars required to buy or sell short even 100 shares of some of these stocks. This strategy is referred to as the “Out-of-the-money butterfly spread”, or “OTM Fly” for short.

Let’s take a look at how this strategy can be used. Please note, that the following two examples are just that – examples. They are not intended to be viewed as “recommendations” and traders should note that there are myriad other variations of this strategy that can be explored.

AAPL: Bullish

So, let’s say you are thinking that AAPL might break out to a new high and that if it does it is going to go on another extended run to the upside. One choice is to buy 100 shares of AAPL – which will cost $18,788. Another choice is this:

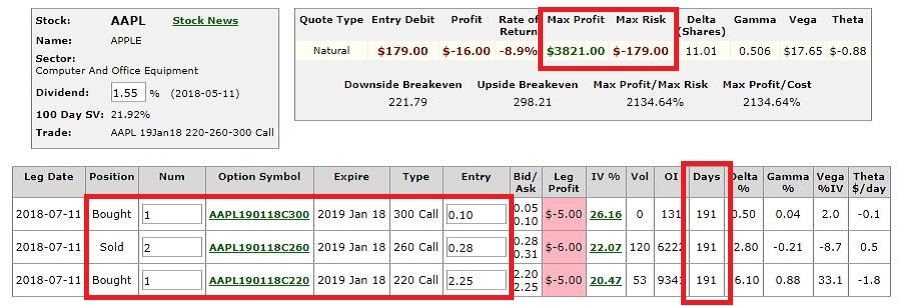

*Buy 1 Jan2019 AAPL 220 call @ 2.25

*Sell 2 Jan2019 AAPL 260 calls @ $0.28

*Buy 1 Jan2019 AAPL 300 call @ $0.10

The cost to enter this trade is $179. The particulars appear in Figure 1 and the risk curves in Figure 2. Figure 1 – AAPL OTM Call Butterfly (Courtesy www.OptionsAnalysis.com)

Figure 1 – AAPL OTM Call Butterfly (Courtesy www.OptionsAnalysis.com)

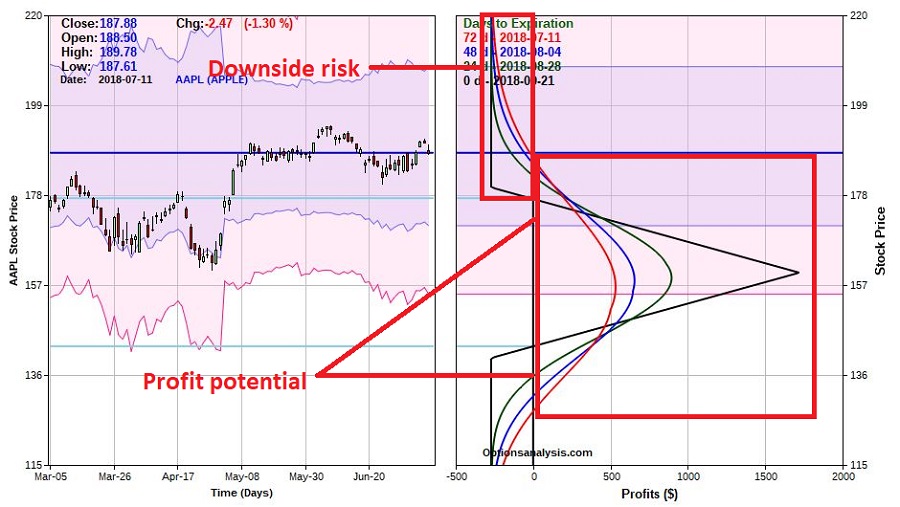

Figure 2 – AAPL OTM Call Butterfly (Courtesy www.OptionsAnalysis.com)

Figure 2 – AAPL OTM Call Butterfly (Courtesy www.OptionsAnalysis.com)

*If AAPL rallies one standard deviation (to roughly $223 a share) between now and January 2019 expiration this trade will generate a profit of somewhere between $162 and $717, depending on how soon that price is hit.

*If AAPL rallies two standard deviation (to roughly $261 a share) between now and January 2019 expiration this trade will generate a profit of somewhere between $1,257 and roughly $3,700, depending on how soon that price is hit.

*If AAPL fails to rally the maximum risk is -$179.

AAPL: Bearish

Let’s look at an alternative outlook. Let’s say you think AAPL may sell off between now and late September. You could sell short 100 shares of AAPL in a margin account. Another choice is this:

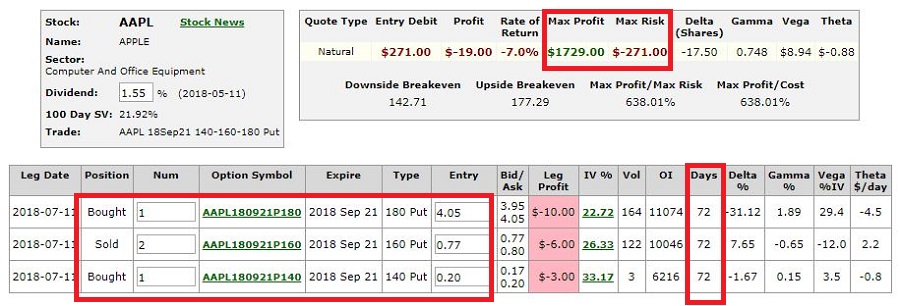

*Buy 1 Oct2018 AAPL 180 put @ $4.90

*Sell 2 Oct2018 AAPL 160 put @ $1.15

*Buy 1 Oct 2018 AAPL 140 put @ $0.32

The cost to enter this trade is $292. The particulars appear in Figure 3 and the risk curves in Figure 4. Figure 3 – AAPL OTM Put Butterfly (Courtesy www.OptionsAnalysis.com)

Figure 3 – AAPL OTM Put Butterfly (Courtesy www.OptionsAnalysis.com)

Figure 4 – AAPL OTM Put Butterfly (Courtesy www.OptionsAnalysis.com)

Figure 4 – AAPL OTM Put Butterfly (Courtesy www.OptionsAnalysis.com)

*If AAPL declines one standard deviation (to roughly $170 a share) between now and October 2018 expiration this trade will generate a profit of somewhere between $340 and $850, depending on how soon that price is hit.

*If AAPL declines to the mid strike price of $160 between now and October 2018 expiration his trade will generate a profit of somewhere between $430 and roughly $1,667 depending on how soon that price is hit.

*If AAPL fails to rally the maximum risk is -$292.

Summary

I can’t tell you where AAPL is headed next. I certainly cannot guarantee that either of the examples detailed above will generate a profit. I can tell you that if you are looking for a way to play a bullish or bearish opinion – without risking lots of $$$ – the OTM Fly is worthy of some consideration.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Dear Jay, love to read this stuff which I find fascinating. Thanks for sharing all this knowledge.

Tom, Thanks for the kind words! Jay