Let’s face it, many investors have a problem with riding a trend. When things are going well they fret and worry about every blip in interest rates, housing starts, earnings estimates and the price of tea in China, which often keeps them from maximizing their profitability. Alternatively, when things really do fall apart they suddenly become “long-term investors” (in this case “long-term” is defined roughly as the time between the current time and the time they “puke” their portfolio – just before the bottom).

Which reminds me to invoke:

Jay’s Trading Maxim #6: Human nature is a detriment to investment success and should be avoided as much as, well, humanly possible.

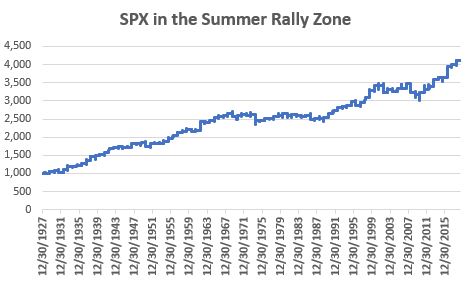

So, it can help to have a few “go to” indicators, to help one objectively tilt to the bullish or bearish side. And we are NOT talking about “pinpoint precision timing” types of things here. Just simple, objective clues. Like this one.

Monthly MACD

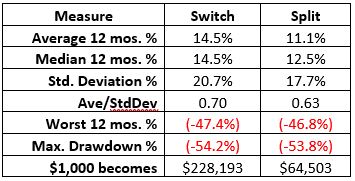

Figure 1 displays the S&P 500 index monthly chart with the monthly MACD Indicator at the bottom. Figure 1 – Monthly S&P 500 Index with MACD (Courtesy AIQ TradingExpert)

Figure 1 – Monthly S&P 500 Index with MACD (Courtesy AIQ TradingExpert)

The “trading rules” we will use are pretty simple:

*If the Monthly MACD closes a month above 0, then hold the S&P 500 Index the next month

*If the Monthly MACD closes a month below 0, then hold the Barclays Treasury Intermediate Index the next month

*We start our test on 11/30/1970.

*For the record, data for the Barclays Treasury Intermediate Index begins in January 1973 so prior to that we simply used an annual interest rate of 1% as a proxy.

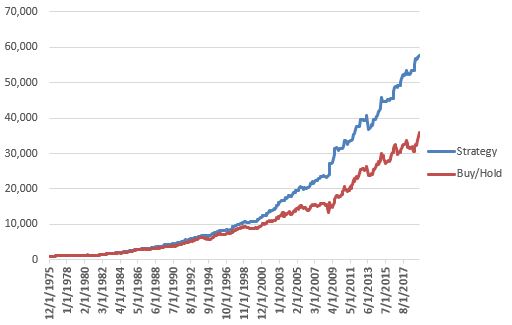

Figure 2 displays the equity curves for:

*The strategy just explained (blue line)

*Buying and holding the S&P 500 Index (orange) line

Figure 2 – Growth of $1,000 using MACD System versus Buy-and-Hold

Figure 2 – Growth of $1,000 using MACD System versus Buy-and-Hold

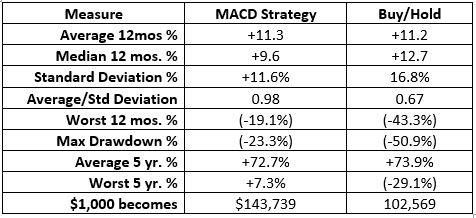

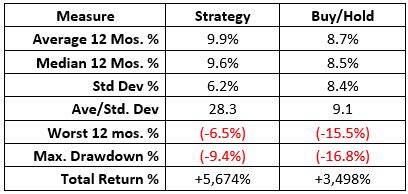

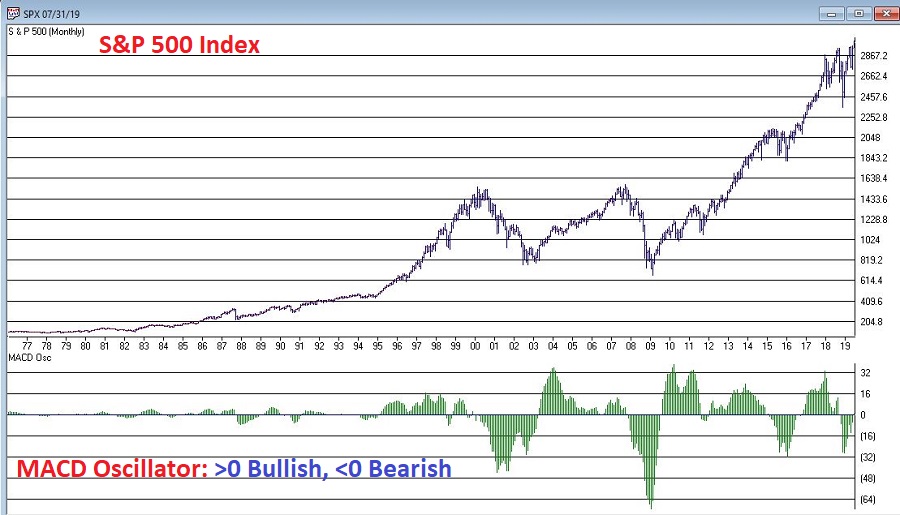

Figure 3 displays some “Facts and Figure” regarding relative performance.

Figures 3 – Comparative Results

For the record:

*$1,000 invested using the “System” grew to $143,739 by 6/30/2019

*$1,000 invested using buy-and-hold grew to $102,569 by 6/30/2019

*The “System” experienced a maximum drawdown (month-end) of -23.3% and the Worst 5-year % return was +7.3% (versus a maximum drawdown of -50.9% and a Worst 5-year % return of -29.1% for Buy-and-Hold)

So, from the chart in Figure 2 and the data in Figure 3 it is “obvious” that using MACD to decide when to be in or out of the market is clearly “better” than buy-and-hold. Right? Here is where it “gets interesting” for a couple of reasons.

First off, the MACD Method outperforms in the long run by virtue of missing a large part of severe bear markets every now and then. It also gets “whipsawed” more often than it “saves your sorry assets” during a big bear market. So, in reality it requires ALOT of discipline (and self-awareness) to actually follow over time.

Consider this: if you were actually using just this one method to decide when to be in or out of the market (which is NOT what I am recommending by the way) you would have gotten out at the end of October 2018 with the S&P 500 Index at 2,711.74. Now nine months later you would be sitting here with the S&P 500 Index flirting with 3,000 going “what the heck was I thinking about!?!?!?” In other words, while you would have missed the December 2018 meltdown, you also would have been sitting in treasuries throughout the entire 2019 rally to date.

Like I said, human nature, it’s a pain.

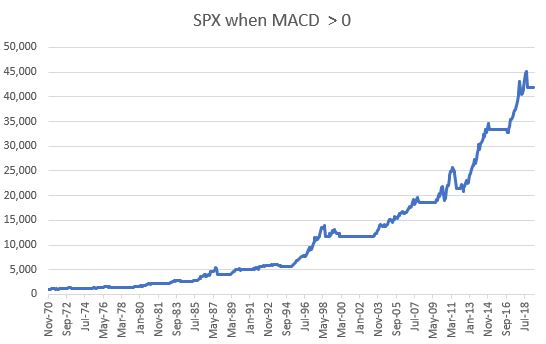

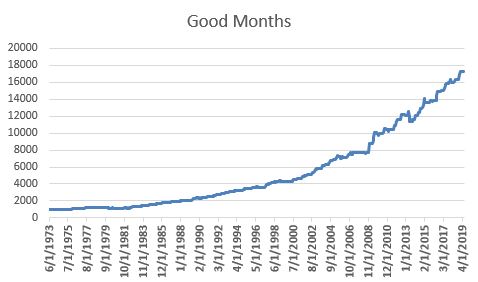

To fully appreciate what makes this strategy “tick”, consider Figures 4 and 5. Figure 4 displays the growth of equity when MACD is > 0 (during these times the S&P 500 Index is held).

Figure 4 – Growth of $1,000 invested in S&P 500 Index when MACD > 0.

Sort of the “When things are swell, things are great” scenario.

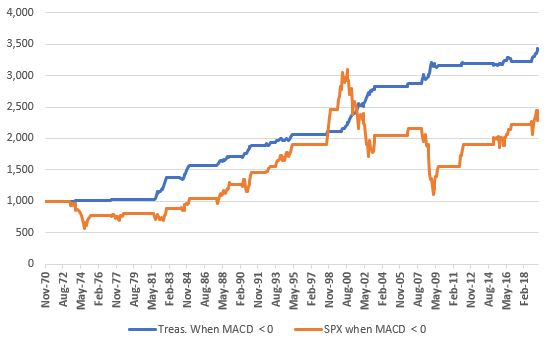

Figure 5 displays the growth of $1,000 for both intermediate-term treasuries AND the S&P 500 Index during those times when MACD > 0.

Figure 5 – Growth of $1,000 invested in Intermediate-term treasuries (blue) and the S&P 500 (orange) when MACD < 0.

Essentially a “Tortoise and the Hare” type of scenario.

Summary

Simple trend-following methods – whether they involve moving average using price, trend lines drawn on charts or the MACD type of approach detailed herein – can be very useful over time.

*They can help an investor to reduce that “Is this the top?” angst and sort of force them to just go with the flowing while the flowing is good.

*They can also help an investor avoid riding a major bear market all the way to the bottom – which is a good thing both financially and emotionally.

But everything comes with a cost. Trend-following methods will never get you in at the bottom nor out at the top, and you WILL experience whipsaws – i.e., times when you sell at one price and then are later forced to buy back at a higher price.

Consider it a “cost of doing business.”

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.