In this article, I wrote about the connection between long-term treasury bonds and the four-year presidential election cycle. In this piece we will look at one way to turn that information into a trading method.

The Calendar

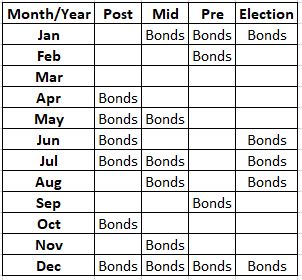

Figure 1 displays my own “calendar” for long-term treasuries as it relates to the 4-year cycle.

Figure 1 – Jay’s Election Cycle Bond Calendar

The Test

For testing purposes (though not necessarily for trading purposes) we will use:

*Ticker VWESX (Vanguard Long-Term Treasury Fund) which has data going back to 1973

*The Bloomberg Barclay’s Treasury 1-3 Index which has data starting in January 1976

We will “trade” as follows:

*During the months listed “Bonds” in Figure 1 we will hold ticker VWESX

*During all other months we will hold the Bloomberg Barclay’s Treasury 1-3 Index

*We will also track an investment using VWESX on a buy-and-hold basis as our benchmark.

In a nutshell, we will hold long-term treasuries during the “favorable” months and retreat to the relative safety of short-term treasuries during all other months.

IMPORTANT NOTE: For actual trading purposes ticker VWESX is likely NOT a viable candidate as Vanguard has certain switching restrictions which may limit the ability of a trader to move in and out as often as dictated by the schedule in Figure 1. An alternative fund might be long-term treasury funds offered by ProFunds or Rydex and another viable alternative might be the ETF ticker TLT – the iShares ETF that track’s long-term treasuries. On the short-term side one alternative is ticker SHY – an ETF that tracks short-term treasuries.

The Results

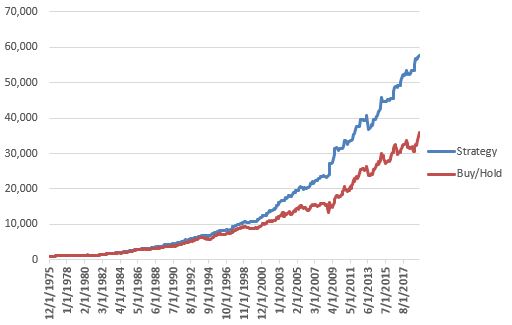

Figure 2 displays the cumulative growth of $1,000 invested using the rules above (blue line) versus buying and holding VWESX (red line) starting in January 1976.

Figure 2 – Growth of $1,000 using the Election Cycle strategy versus buying-and-holding VWESX

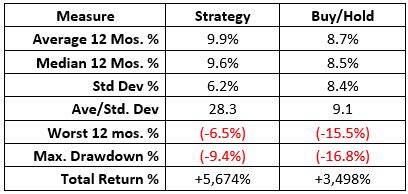

Figure 3 displays the relative performance figures.

Figure 2 – Election Cycle Strategy versus Buy/Hold

In a nutshell, the Strategy generated more profit with less volatility and risk than simply buying-and-holding long-term treasuries.

Summary

So, is the strategy detailed above a viable approach to investing? That’s up to the reader to decide. There are many potential caveats, including the fact that there is no guarantee that anybody’s “seasonal calendar” will prove accurate ad infinitum into the future. Also, the past four decades have been very favorable for bonds overall. If and when interest rates actually rise once again, profits in bonds may be harder to come by.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Hi Jay

What parameters did you use for the MACD?

Thanks

Glenn