In this article I wrote about a simple trade using options on ticker GDX to alleviate “gold angst”. For just a “few dollars” a trader could guarantee participation in the much anticipated “gold is about to soar” prognostications that seemed to be prevalent at the time. And with over a year and half for things to work out.

Well, lo and behold, things worked out! As you can see in Figure 1, GDX burst higher – rising 14% in just 8 trading days. Figure 1 – GDX shots higher (Courtesy ProfitSource by HUBB)

Figure 1 – GDX shots higher (Courtesy ProfitSource by HUBB)

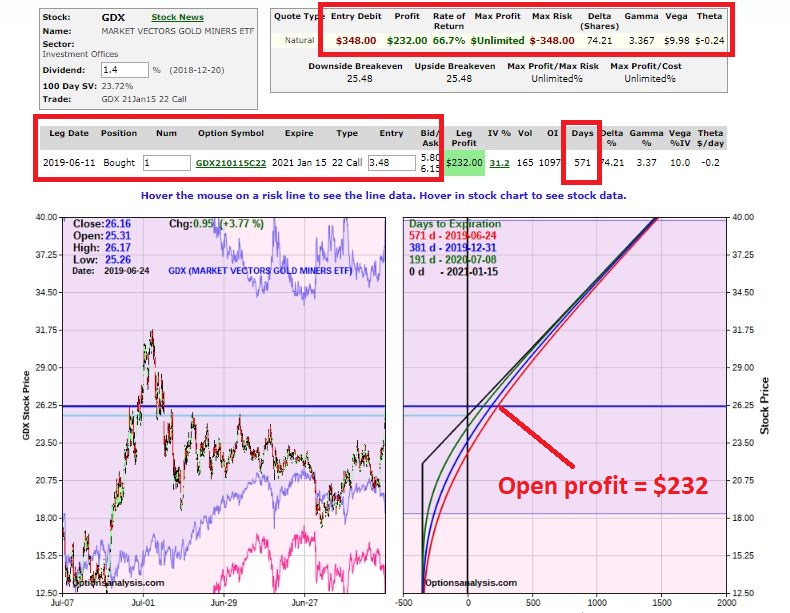

In Figure 2 we can see that the initial trade now has an open profit of +66.7%.

Figure 2 – Initial GDX call options position (Courtesy www.OptionsAnalysis.com)

Figure 2 – Initial GDX call options position (Courtesy www.OptionsAnalysis.com)

This is great! Except, now we have a new kind of “angst”. Does one “let it ride”? Or is it time to “take some chips off the table?”

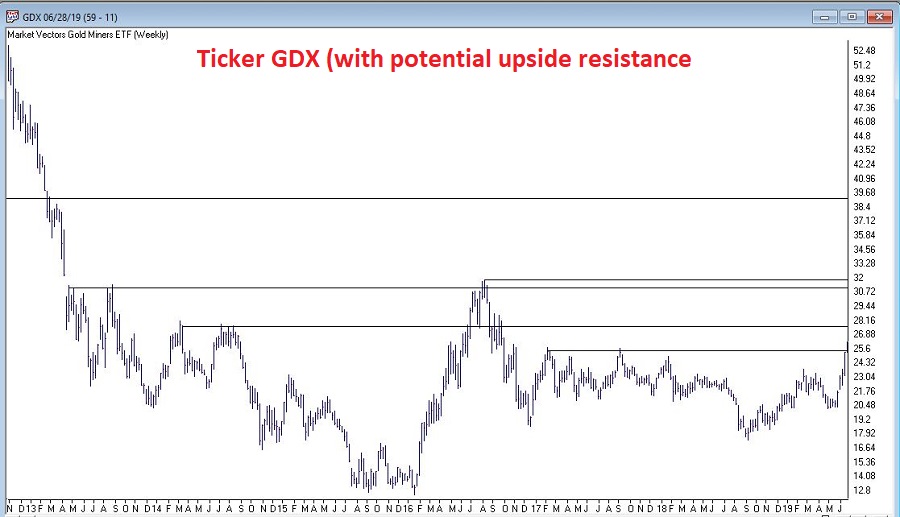

In Figure 3 we are hit with the sober reality that – despite the nice rally – there is a lot of potential overhead resistance, so the idea of “ringing the cash register” is tempting.

Figure 3 – Potential overhead resistance for GDX (Courtesy AIQ TradingExpert)

Figure 3 – Potential overhead resistance for GDX (Courtesy AIQ TradingExpert)

The good news is that option trading offers a lot of possibilities. The bad news is that there are no “right” or “wrong” answers. A trader must simply decide where their priorities lie and craft a position to fit those priorities.

#1. Let it Ride

This one is simple. It involves doing nothing. The option doesn’t expire until January of 2021 so there is plenty of time for “the big move” to unfold. Assuming of course that your priority is making as much money as possible from the big move. In Figure 2 note that this position has

Delta=74.21

Gamma=3.367

Vega=$9.98

This means that if GDX keeps rising, this position – which is currently roughly equivalent to holding 74 shares of GDX – will gain $74.21 for each $1 GDX rises AND that delta value will increase by 3.367 for each $1 GDX rises in price. Likewise, if implied volatility rises by 1 percentage point this trade will tack on another $9.98 in profit.

Bottom line: this trade exudes profit potential. The bad new is that the option could also still expire worthless resulting in a 100% loss of investment.

#2. Take the Money and Move On

This involves simply selling the call, taking the profit and moving on to something else. The good news is you will have made money and there is no chance of giving it back. The bad news is that you may once again experience the “gold angst” the prompted this trade in the first place – if gold and gold stocks continue to rally.

#3. Play for a Pause

For a trader who:

a) wants to retain a bullish position

b) doesn’t want to end up with a loss after registering such a quick profit and/or

c) is concerned about all that overhead resistance

…one possibility might be to “adjust” the trade by selling an out-of-the-money call.

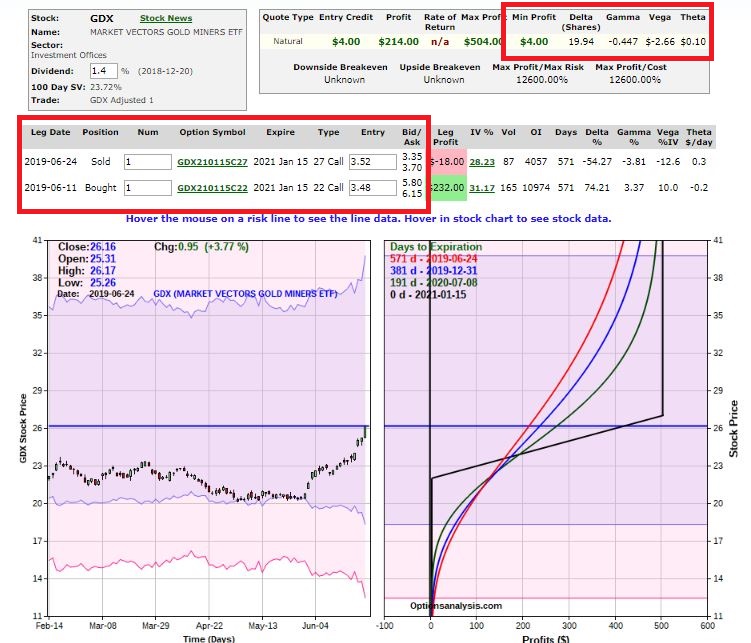

Such a trade appears in Figure 4. This trade involves selling one Jan2021 27 strike price call for $3.52 (the midpoint of the bid/ask spread). Figure 4 – Adjusted position in GDX (Courtesy www.OptionsAnalysis.com)

Figure 4 – Adjusted position in GDX (Courtesy www.OptionsAnalysis.com)

As you can see in Figure 4 there is good news and bad news. The good news is that this adjusted position cannot turn into a losing trade if GDX subsequently falls apart. The bad news is that it has a lot less upside potential than the original position (Delta=20, Gamma=-.45, Vega=-$2.66).

A trader choosing this approach might be looking for a pullback in GDX and for an opportunity to buy back the 27-strike price call at a lower price in order to generate an interim profit and to re-establish the naked long call position.

Another possibility is “rolling up”, which means selling the 22-strike price call and buying one at a higher strike price at a lower cost. The purpose of this adjustment is to “lock in a profit” while still retaining a bullish position. Unfortunately, at the moment, with GDX at $26.16 a share , a trader who sold the 22 call with a profit of $232 would have to go up to about the 31 strike using the Jan 2021 calls (currently at $2.16 bid/$2.42 ask) in order to lock in a net profit. One can do this, but it involves buying a call option that is presently 18% out-of-the-money.

Summary

Jay’s Trading Maxim #45: The good news about option trading is the same as the bad news about option trading. The good news is that there are so many choices. The bad news is that there are so many choices. This is why traders who are successful using options are those who:

*Decide what their priorities are

*Craft a position that plays to their priorities

*Simply “deal with it” when things don’t work out (i.e., they don’t kick themselves or second guess)

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.