Speculation comes down to a (seemingly) simple two-step process:

Step 1. Spot opportunity

Step 2. Exploit opportunity

Sure, there are a lot of potential “details” built into those two steps. And there are other ancillary considerations, like for example, “don’t lose your shirt” in the process. And then of course there is the fascination with “predictions”. While “spotting opportunity” and “making a prediction” may seem like the same thing, in reality they are not.

Making a prediction means discerning today what will happen tomorrow (or on some subsequent day after that). Predictions also tend to involve a fair amount of “ego.” “I think [your prediction here]” pretty much puts your ego on the line. If your prediction fails to pan out you can and typically do look and feel kind of stupid.

“Spotting opportunity” simply means you believe that there is a chance that things may go a certain way and wanting to take advantage of that occurrence should it pan out. “Exploiting opportunity” simply means figuring out a way to give yourself, a) a chance to make good money if things work out, while ALSO, b) taking steps to limit the amount of risk you expose yourself to since – let’s be brutally candid here – any trade you might enter has a chance of failing.

Spotting Opportunity: The U.S. Dollar

Take for instance, the U.S. Dollar. I have no real mechanism for “predicting” what will happen next to the dollar. I do know that it has been in a pretty strong uptrend since January of 2018. So on one hand, as a pretty avid “trend-follower”, I would normally be looking at the bullish side of things for an opportunity. However, I also know that:

a) it is looking at a significant resistance level at slightly higher prices, and

b) it is about to enter its seasonally unfavorable time of year.

So, have I spotted an opportunity? Well, that the other thing about opportunity. Each potential one is “in the eye of the beholder.”

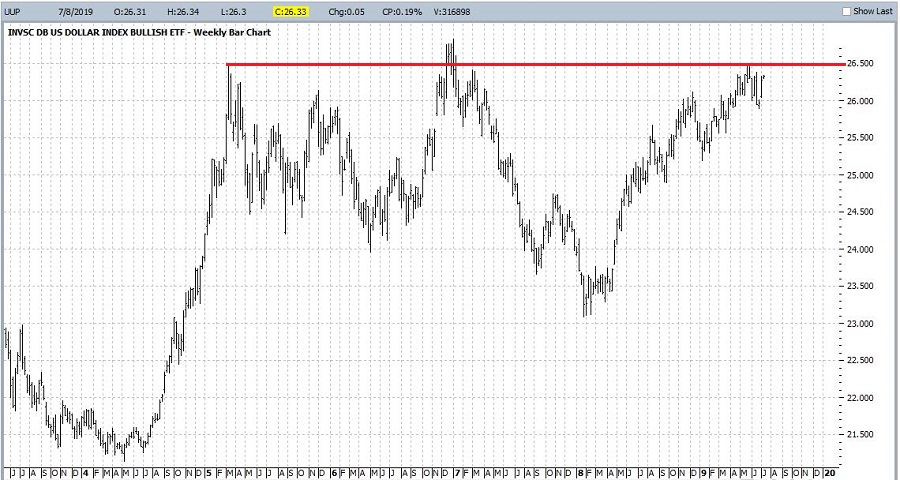

In Figure 1 we see that ticker UUP – an ETF that tracks the U.S. Dollar versus a basket of foreign currencies has an obvious resistance level that it needs to take out in order to remain in an established uptrend. Will it do so? The truth is I haven’t the slightest idea. Figure 1 – Ticker UUP with overhead resistance (Courtesy ProfitSource by HUBB)

Figure 1 – Ticker UUP with overhead resistance (Courtesy ProfitSource by HUBB)

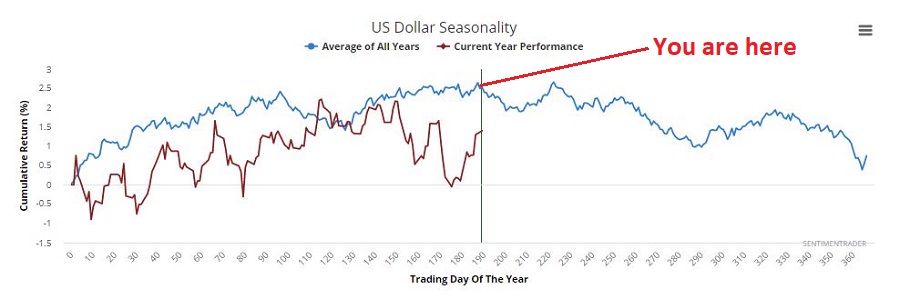

In Figure 2 we see the annual seasonal trend for U.S. Dollar futures courtesy of www.Sentimentader.com. As you can see we are about to enter the “typical” period of weakness.

Figure 2 – Annual seasonal trend for U.S. Dollar (Courtesy Sentimentrader.com)

Figure 2 – Annual seasonal trend for U.S. Dollar (Courtesy Sentimentrader.com)

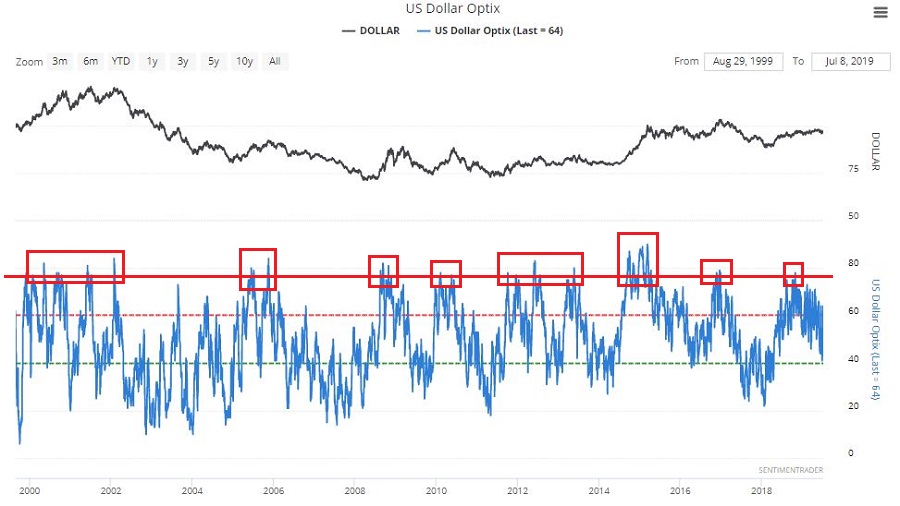

Figure 3 displays trade sentiment for the U.S. Dollar (also from www.Sentimentrader.com). Note that it recently exceeded the horizontal red line that I drew in the range of about 75% or so. Note the action of the dollar following previous readings in this area. Figure 3 – Trader optimism for the U.S. Dollar (Courtesy Sentimentrader.com)

Figure 3 – Trader optimism for the U.S. Dollar (Courtesy Sentimentrader.com)

Does any of this guarantee that the dollar – and ticker UUP – are going to decline anytime soon. Not at all. But it does highlight a potential opportunity. The next question then is, “is there a way to exploit this potential opportunity that gives us good profit potential without a lot of risk?”

Exploiting Opportunity using options on UUP

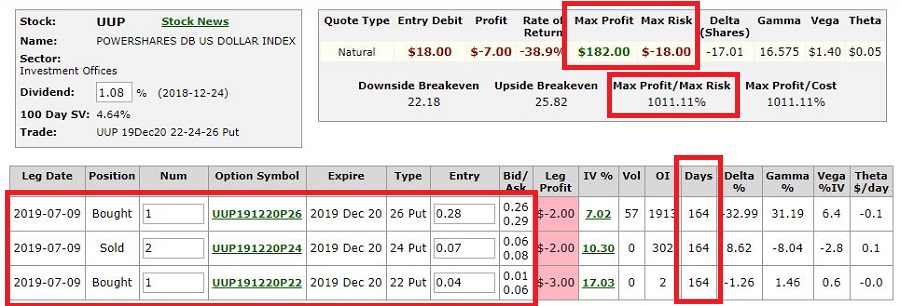

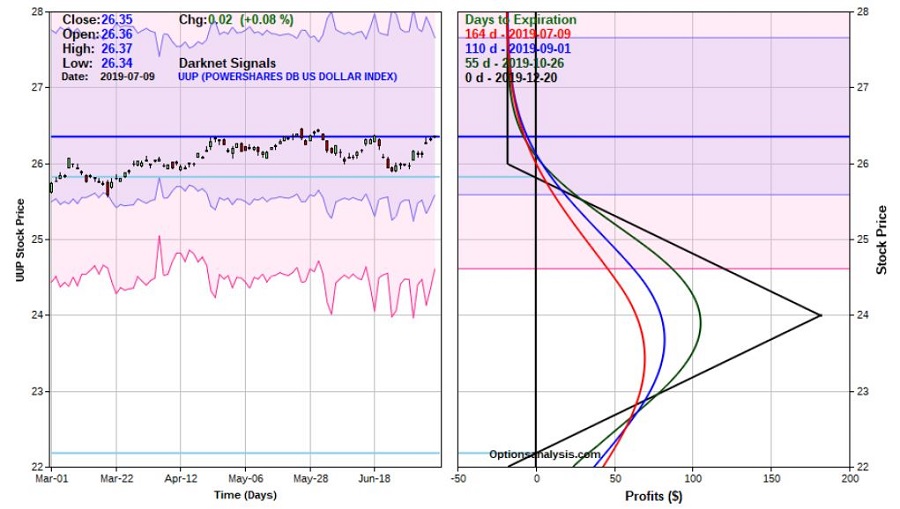

Figures 4 and 5 display the particulars and risk curves for an “out-of-the-money put butterfly” spread (OTM put fly for short) using put options on UUP.

Figure 4 – OTM butterfly using UUP put options (Courtesy www.OptionsAnalysis.com)

Figure 4 – OTM butterfly using UUP put options (Courtesy www.OptionsAnalysis.com)

Figure 5 – Risk curves for OTM butterfly using UUP put options (Courtesy www.OptionsAnalysis.com)

Figure 5 – Risk curves for OTM butterfly using UUP put options (Courtesy www.OptionsAnalysis.com)

A few things to note:

*This trade is using December options which are NOT very actively traded. Still, via the use of a limit order this trade might be able to be entered for a cost of just $18 for a 1 by 2 by 1 butterfly spread.

*In addition to a low dollar risk the position also has plenty of profit potential and roughly 5 months of time for things to pan out.

*From a risk management position, a trader must decide what they will do if price does breakout to the upside. The most obvious choices are, a) exit the trade and cut one’s loss, or b) due to the low initial dollar risk, just let it ride for awhile and see if there is a failure after the breakout.

*On the profit side, I have no reason to believe that UUP will decline sharply in the months ahead. However, it does, I also know that this trade will make a large percentage return. If UUP drops to its March low of $25.56 a share, the trade will likely show an open profit in the $14 to $38 range depending on how soon that price is reached.

Summary

As always, I don’t make “recommendations” and the trade highlighted here is intended to serve only as an example of a way to spot opportunity and to exploit said opportunity. So note what is and is not happening here:

I am not shouting (i.e., predicting) that “the dollar is headed lower!” I am merely noting that if a person is willing to risk $18 (per a 1 x 2 x 1-lot) on the possibility that it might be, there is a way to do it.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.