In a yield deprived investment world, it is getting harder and harder to generate income from one’s investments. Buying and holding a 10-year treasury note essentially involves locking in a whopping 0.72% annual yield for the next 10 years. Not exactly the type of return most of us are looking for. As a result, many investors are “reaching” for yield. Not surprising. The real question is “how much risk do you have to take in order to generate the yield you desire?”

A lot of investors are turning to the stock market. And this too is not surprising. It is “going up”, you can buy stocks that pay dividends and you don’t lock yourself into a 0.72% annual return. On the flip side, for those who can remember back about 7 months or so, there can be, ahem, a bit of downside risk associated.

Others are looking at closed-end funds – many of which offer tempting yields and often trade at a discount to net-asset value. Yet, here to it is often difficult to get a true handle on risk. “Wait a minute, if yields on bonds are presently in the 0% to 2% range, how exactly is this CEF yielding 8%?” is a fair question. For the record, I actually think there are opportunities in closed-end funds. But you have to be willing to do the hard work of understanding EXACTLY what you are buying and more importantly, to quantify the risks involved. A number of CEFs – MORT, CEFL to name two – had nearly 20% “yields” in early 2020. MORT is still about 44% off of its high and CEFL is out of business. A good rule of thumb – the higher the yield, the greater the risk.

An Alternative “Income Play”

First the caveats. Like everyone else I am trying to figure out how to get by in a low yield world. What I am about to discuss IS NOT the “magic bullet” nor the be all, end all of income investing. It is NOT necessarily the “best way” – it is simply “one way.” To paraphrase Rod Serling, “submitted for your consideration.”

The play is selling naked put options. REEEE!REEEE!REEEE! (que the scary music!)! OK, how about if I call it a “cash secured put”, then it sounds a lot less scary. Here is an example of how it works:

*Stock XYZ is trading $20 a share

*The January 2021 10 strike price put is trading at say $1. There are 93 days left until the option expires.

*An investor sells – or “writes” – a January 2021 10 strike price put for $1. and receives $100 ($1 option price x 100 shares per option) in “premium” from the option buyer.

*To sell or “write” this option an investor must have $1,000 in their account (as we will see in moment, if the stock price drops below $10 a share the investor will need to buy 100 shares of XYZ stock at $10, hence the need for $1,000 in the account to guarantee that the investor can meet his or her obligation).

*As it turns out, because the investor took in $100 of premium, he or she only needs to put up $900 of their own money to cover the $1,000 requirement.

So, let’s do the math: If XYZ remains above $10 a share between trade entry and option expiration in 93 days the investor makes $100 on a $900 investment, or 11.1% in 93 days.

Quantifying Risk

11% in 3 months is something that would get most investors attention. But the cash secured put – like anything else – involves unique risks. An investor MUST understand the risk they are taking BEFORE engaging in any trade. So, let’s consider the potential scenarios:

*If XYZ stays above $10 a share for the next 93 days (i.e., if it does not drop 50% or more in 3 months) the trader earns 11.1%

*If XYZ does drop below $10 a share within 93 days, the investor will wind up owning 100 shares of XYZ stock at an effective price of $9 a share ($10 strike price minus $1 of premium received for writing the put). If the stock rises in price from there the investor makes money and if the stock declines in price from there the investor loses money.

*If XYZ the company goes bankrupt in the next 93 days (our worst-case scenario), the investor loses $900.

BEFORE selling a cash-secured put an investor MUST do some research regarding, a) the company’s fundamentals and b) ideally identifying a support level for the stock price somewhere between the current price of the stock and the strike price of the option sold.

If you are not willing to do these two things prior to any trade then you can stop reading at this point. And DO NOT sell cash-secured puts.

An Important Note

Big moneyed investors may use cash-secured puts as a method for accumulating a position in a given stock, i.e., they sell puts just out-of-the-money. If the stock goes up, they keep the premium, if the stock goes down, they buy the stock. This is NOT what I am advocating in this piece.

What I am talking about is an approach in which – ideally – we would never buy shares of stock. In other words, the goal is to sell far enough out-of-the money puts so that:

*We take in an acceptable level of income

*The stock is highly unlikely to drop to the strike price prior to expiration

This is an “income generating idea”, NOT a “stock accumulation idea.”

The Key Questions

Question #1:

I will be blunt – the first question is harsh: “What is the likelihood that the company will go bankrupt prior to option expiration?”

To explain: Like everywhere else, in the realm of cash-secured puts you will naturally be drawn to those offering the highest potential returns. However, typically the highest returns are associated with higher risk. If you start digging and learn that the company is teetering on the edge and that there is a “major announcement” forthcoming and so on, steer clear. There are ALWAYS plenty more opportunities out there.

Question #2:

“In the event you are required to purchase the shares, are you comfortable holding this company’s stock?”

Analyzing any companies future prospects is of course subjective, but the primary point is this: If a stock is trading now at $20 a share and you ultimately are required to buy it at an effective price of $9 (10 strike price minus $1 premium received from example above), are you OK with that? If you absolutely, positively do not want to own this stock (even at a 50% or more discount from today’s price) then you should not sell a put against that stock.

Remember: Every once in awhile you will end up buying shares of stock. This will happen. But also remember that as long as the company remains in business there is always an opportunity for the stock price to increase after the shares are purchased.

Examples

Below are examples ONLY. I HAVE NOT looked into the answers to the questions above regarding the stocks below and I AM NOT “recommending” these positions, only using them to highlight the concept.

But a useful exercise would be to look into the companies and see what you think.

Ticker INO

*Trade: Sell the INO Feb 5 put for $0.60

*Investor commits $440 ($5 strike x 100 shares minus $60 in premium)

*So here is a position that offers a tempting 13.9% return in 133 days

*The stock is trading at $12.31 a share, the strike price ($5) is 60% lower and the breakeven price is $4.39.

Figure 1 – INO Feb Cash Secured Put (Courtesy www.OptionsAnalysis.com)

The company is in the Covid-19 vaccine sweepstakes.

Relevant links pro and con:

https://markets.businessinsider.com/news/stocks/avoid-inovio-ino-stock-like-the-plague-1029670372#

Remember, the question IS NOT “will the stock go up from here?” The question IS “will the stock stay above $5 until February?”

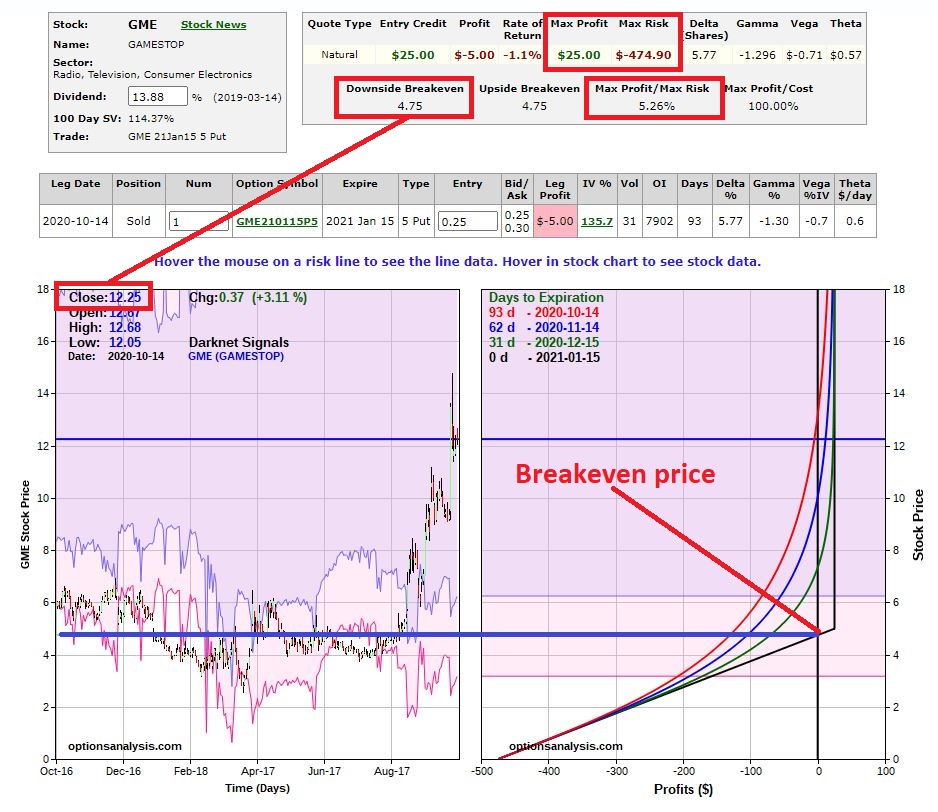

Ticker GME

Gamestop appeared to be left for dead and traded as low as $2.57 a share in early April 2020. Then they signed a deal with Microsoft and the shares soared.

*Trade: Sell the GME Jan 5 put for $0.25

*Investor commits $475 ($5 strike x 100 shares minus $25 in premium)

*If GME holds above $5 a share the return is 5.26% in 93 days

*The stock is trading at $12.25 a share, the strike price ($5) is 59% lower and the breakeven price is $4.75.

Figure 2 – GME Jan Cash Secured Put (Courtesy www.OptionsAnalysis.com)

Relevant links:

https://www.reuters.com/article/us-gamestop-microsoft-idUSKBN26T3CM

https://www.fool.com/investing/2020/10/14/gamestop-stock-has-climbed-too-high/

Again, the analysis that needs to be done does not involved wondering whether GME will continue to rise in price from its current level. Rather, the only thing that matters is “will the stock stay above $5 until January?”

Summary

Selling cash-secured puts may or may not be your “cup of tea.”

The stocks/trades highlighted here might be “perfectly acceptable”, a “question mark”, or “way too speculative” depending on your own view of things.

But the real point is that in a world of little or no yield, it may be worthwhile to at least consider some alternatives for generating income.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.