Is there even such as thing as the “Ides of October”? Probably not. But perhaps there should be. At least when it comes to gold stocks.

First a great big caveat: Seasonality overall has not been as useful in 2020 as in previous years. So, there is no reason gold stocks cannot register a meaningful gain in October of this year. But investing and trading is as much a game of odds as anything else. And the odds, generally speaking, are unfavorable for gold stocks in the month of October.

Gold Stocks in October

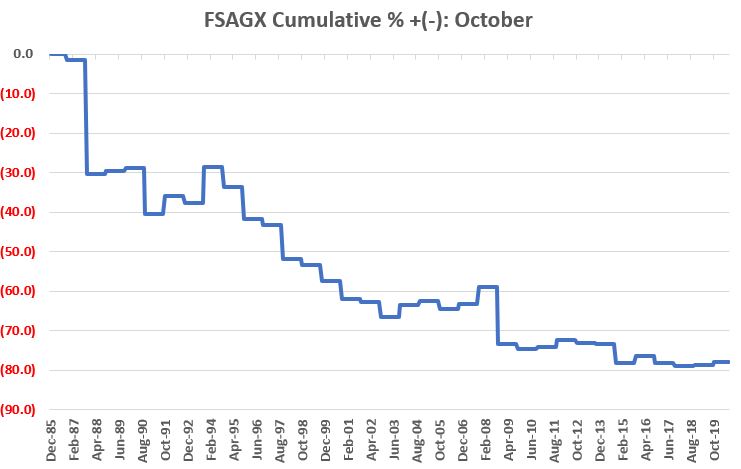

We will use Fidelity Select Gold (FSAGX) as our proxy as there is monthly data going back to 1986. Figure 1 displays the cumulative return an investor would have achieved by buying and holding FSAGX every year since 1986 ONLY during the month of October. For the record, the result to date is a loss of -78%.

Figure 1 – Cumulative %+(-) for FSAGX only during month of October; 198-2019

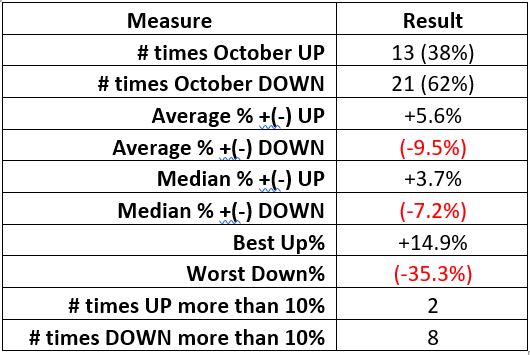

Things to note:

Figure 2 – Relevant Facts and Figures

Figure 3 displays year-by-year total return results for FSAGX during the month of October.

| Year | % +(-) |

| Oct-86 | (1.4) |

| Oct-87 | (29.2) |

| Oct-88 | 1.0 |

| Oct-89 | 1.0 |

| Oct-90 | (16.4) |

| Oct-91 | 7.7 |

| Oct-92 | (3.0) |

| Oct-93 | 14.9 |

| Oct-94 | (7.2) |

| Oct-95 | (12.1) |

| Oct-96 | (2.7) |

| Oct-97 | (15.3) |

| Oct-98 | (3.0) |

| Oct-99 | (8.4) |

| Oct-00 | (11.0) |

| Oct-01 | (1.9) |

| Oct-02 | (10.5) |

| Oct-03 | 9.6 |

| Oct-04 | 2.6 |

| Oct-05 | (5.7) |

| Oct-06 | 3.7 |

| Oct-07 | 12.1 |

| Oct-08 | (35.3) |

| Oct-09 | (4.4) |

| Oct-10 | 1.9 |

| Oct-11 | 6.7 |

| Oct-12 | (3.1) |

| Oct-13 | (0.7) |

| Oct-14 | (17.9) |

| Oct-15 | 7.6 |

| Oct-16 | (7.3) |

| Oct-17 | (3.4) |

| Oct-18 | 1.2 |

| Oct-19 | 2.9 |

Figure 3 – FSAGX in October Year-by-Year; 1986-2019

Summary

In the current market environment, there is no reason that gold stocks cannot rally substantially to the upside in the month ahead.

Gold stocks (using FSAGX as a proxy) have showed a gain in each of the last 2 Octobers and have done so 38% of the time. So, the proper way to look at the data above IS NOT to say “gold stocks are doomed to fall in the month ahead.”

The proper response is to ask yourself the question, “is this where I want to allocate money right now?”

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.