Jason Goepfert, the Editor of www.Sentimentrader.com has done yeoman’s work in chronicling just how ugly things have gotten in the energy sector, how much the sector is loathed and how this type of action – usually – leads to a rally. More on that a little later.

I highlighted some info from www.Sentimentrader.com regarding energy executive insider buying here. So, is this the exact right time to take the plunge and dive headlong into the deep end of the energy pool? It beats me. I certainly do find the “washed out” case to be compelling. But I for one will be waiting at least until December 1st.

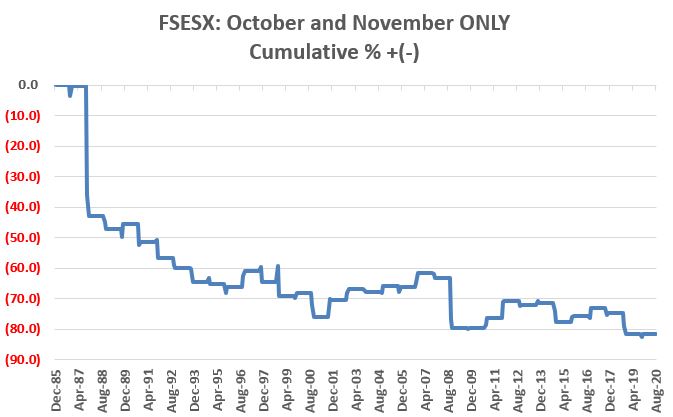

Figure 1 displays the cumulative % gain for Fidelity Select Energy Services (used as a proxy for the energy industry) ONLY during the months of October and November every year since 1986. It’s not pretty.

Figure 1 – FSESX Oct-Nov ONLY cumulative %; 1986-2019

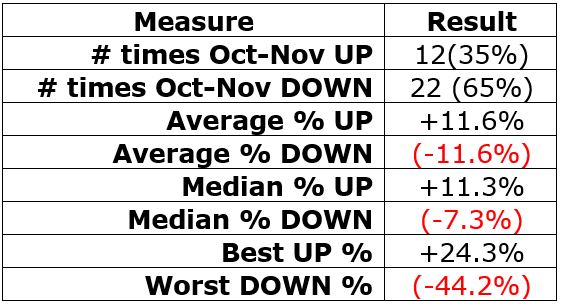

Figure 2 displays the relevant facts and figures.

Figure 2 – Relevant Facts and Figures

Figure 3 displays year-by-year total return results for FSESX during the months of October and November.

| Year | FSESX Oct/Nov % +(-) |

| 1986 | (0.2) |

| 1987 | (42.7) |

| 1988 | (7.5) |

| 1989 | 3.2 |

| 1990 | (11.2) |

| 1991 | (10.7) |

| 1992 | (7.1) |

| 1993 | (11.8) |

| 1994 | (1.4) |

| 1995 | (3.5) |

| 1996 | 15.6 |

| 1997 | (8.9) |

| 1998 | (12.7) |

| 1999 | 2.4 |

| 2000 | (24.2) |

| 2001 | 23.3 |

| 2002 | 12.2 |

| 2003 | (3.0) |

| 2004 | 5.8 |

| 2005 | (0.7) |

| 2006 | 13.4 |

| 2007 | (4.7) |

| 2008 | (44.2) |

| 2009 | (0.8) |

| 2010 | 16.1 |

| 2011 | 24.3 |

| 2012 | (4.6) |

| 2013 | 1.9 |

| 2014 | (22.1) |

| 2015 | 10.0 |

| 2016 | 10.5 |

| 2017 | (5.8) |

| 2018 | (27.8) |

| 2019 | (0.4) |

Figure 3 – FSESX October-November Year-by-Year

Summary

In 2001 FSESX advanced +23.3% during Oct/Nov and in 2011 it rallied +24.3% during Oct/Nov. So, there is no reason energy stocks cannot surprise the investment world and launch a rip-roaring rally in the months directly ahead, especially given how beaten down and unloved they are at the moment.

Still, investing is a game of odds. Given that energy stocks have showed a gain only 35% of the time during October and November, I for one intend to “exhibit a bit more patience.”

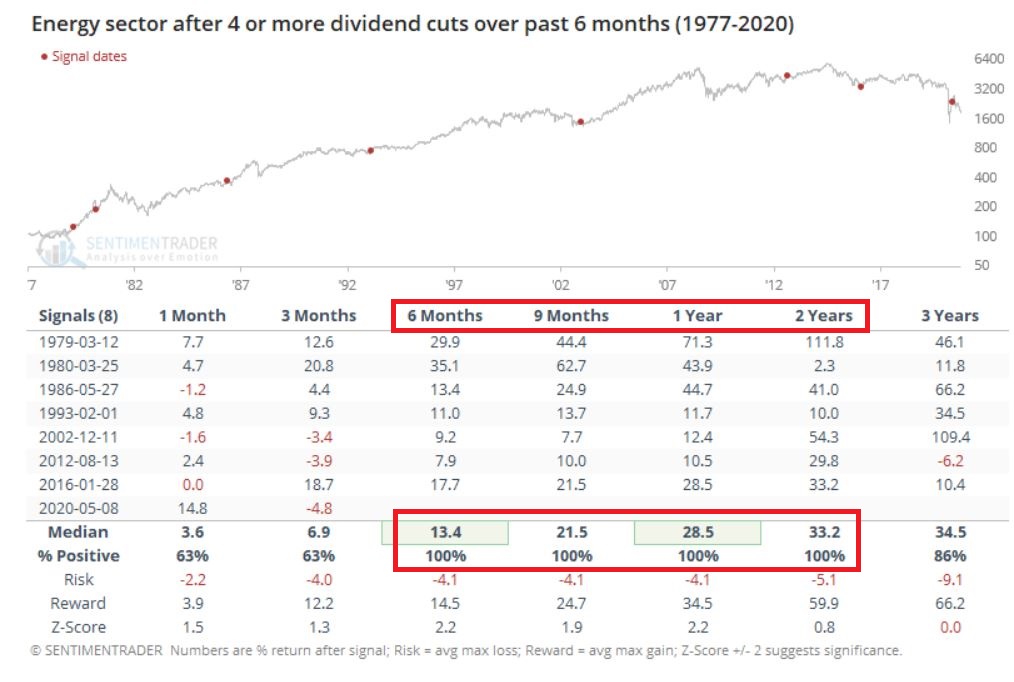

For a possible glimpse of the future however, please consider Figure 4 from www.Sentimentrader.com, which displays what has happened in the past after a flurry of dividend cuts in this sector. 6 months to 2-year returns have been positive 100% of the time.

Figure 4 – Energy sector performance after 4 or more dividend cuts among constituent stocks of ticker XLE (Courtesy Sentimentrader.com)

Bottom line: Don’t go to sleep on energy stocks – but maybe hit the “Snooze” button one more time.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.