On September 14th I posted a piece titled “What’s Up with Silver?” It detailed a “potentially bullish” setup for silver that included:

*A bullish daily Elliott Wave projection

*A bullish weekly Elliott Wave projection

*A positive seasonal trend

*A lack of over exuberance among silver traders

Sure, sounded good. Since then – and as you can see in Figure 1 – the bottom has dropped out for silver.

Figure 1 – Silver plummets (Courtesy ProfitSource by HUBB)

Now back in the day I might have been embarrassed to write an ostensibly bullish piece titled “What’s Up with [Whatever]?” only to have [Whatever] completely fall apart immediately thereafter. But here are the important parts:

First:

*There is a critical distinction between identifying a “potentially bullish” situation and actually risking money

Second:

The trading process – at least for me – involves:

*Identifying a potential bullish or bearish setup

*Identifying a catalyst or trigger

*Making a trade

The original article covered only Step #1 of the trading process – identifying a setup. The closing sentences from the 9/14 piece stated, “But if one was considering making a bullish play in silver, it may be getting close to time to do so. My favorite play would be something using options with a relatively low cost and low dollar risk. Stay tuned…”. In other words, no action is warranted at the moment, let’s see what transpires. Well now we know:

*Spectacularly, ridiculously, (almost) embarrassingly wrong in terms of direction and timing.

*But the setup was there, so as a trader the proper response is to prepare to make a trade

*At the time (although I did not mention this specifically in the original article) I was looking for a breakout of consolidation to the upside as a catalyst to make a bullish trade

And then BLAM – the bottom drops out. As a trader I put this down as “No Harm, No Foul”.

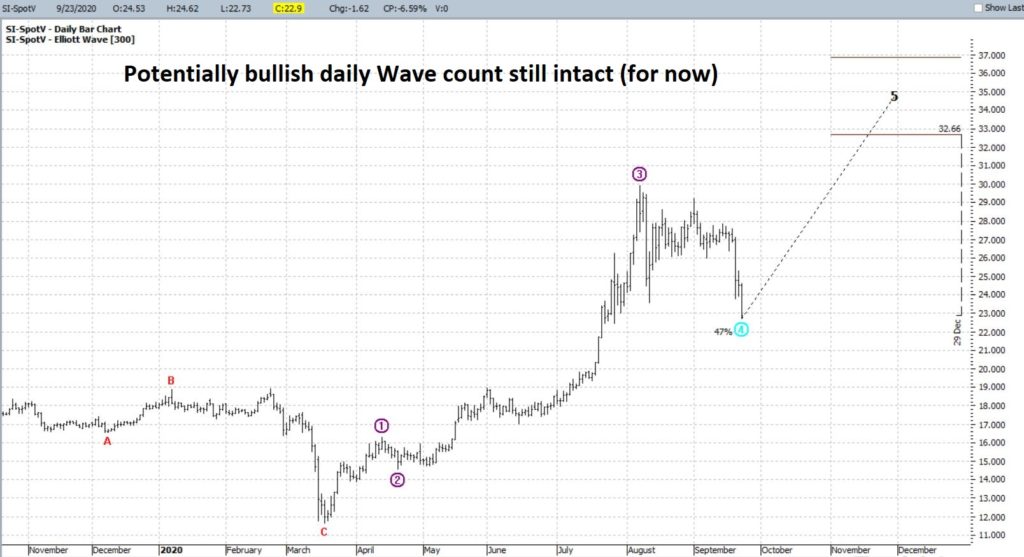

So, is that “The End”? Not for me. As you can see in Figures 2 and 3, the daily and weekly Elliott Wave counts from ProfitSource by HUBB are both still potentially bullish, believe it or not.

Figure 2 – Silver daily (Courtesy ProfitSource by HUBB)

Figure 3 – Silver weekly (Courtesy ProfitSource by HUBB)

Three important related notes:

*The longer silver stays down the more likely these wave counts will ultimately get “redrawn” (which is why I am not a fully committed “Elliott Head” but use it only when the daily and weekly counts agree)

*As you can see in Figure 3, silver has now fallen to a level which could complete Wave 3 down and (possibly) set the stage for a Wave 4 up

*In Figure 2 the bullish daily Wave 4 count remains intact (although as I just mentioned “for how long?” does remain an issue)

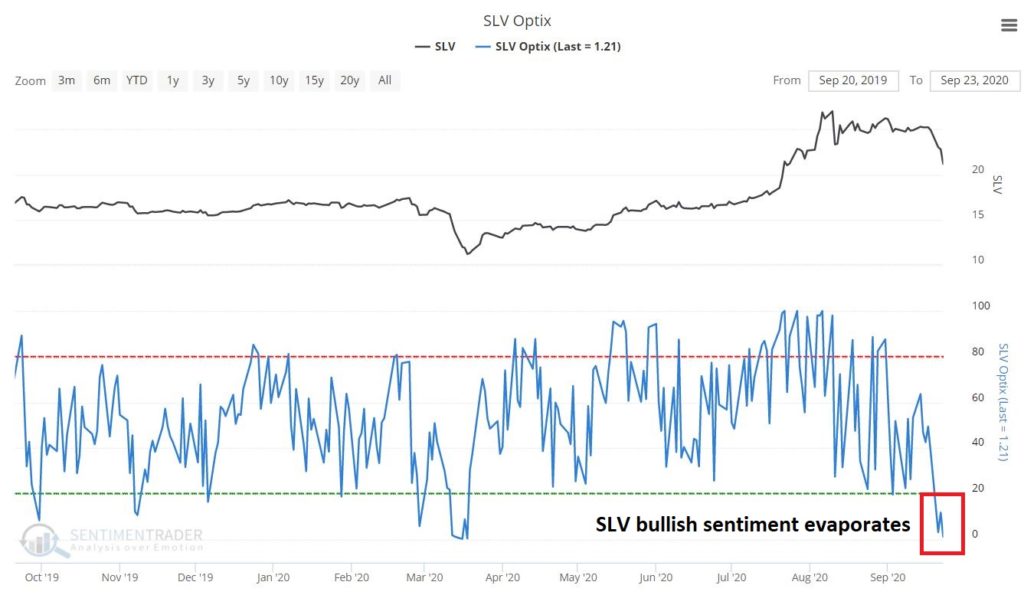

As you can see in Figure 4, the recent plunge in silver has driven bullish sentiment for the silver ETF ticker SLV to an extremely low level (only 1.2% of SLV traders surveyed are presently bullish!).

Figure 4 – SLV bullish sentiment (Courtesy Sentimentrader.com)

So where does it all stand in terms of the trading process?

*We are still in Phase 1 – the Setup. There is no action to be taken at the moment

*On the daily chart we would need to see, a) silver stop plunging by huge amounts day after day, b) some signs of an actual bullish reversal

Will I ever make a bullish trade in silver based on this potentially bullish setup?

*It makes no difference to me. If a catalyst emerges while the setup is still in place, then yes, it’s very possible.

*If a catalyst does emerge I will likely look to do something involving options on ticker SLV.

*If no catalyst emerges and/or the setup falls apart – Cest la vie, and onto the next setup.

Sometimes in the trading game patience is key.

In the immortal words of Tom Petty, “the waiting is the hardest part.”

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.