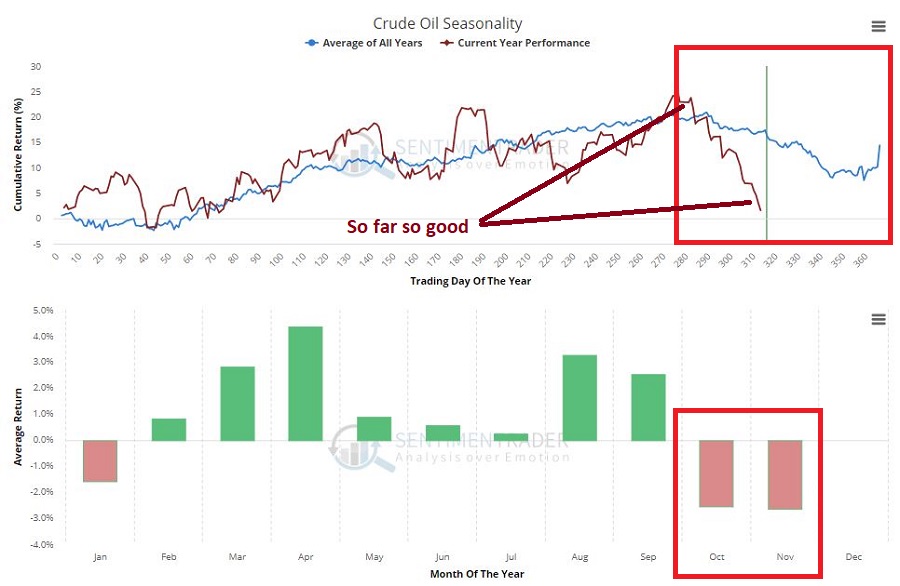

In this article I highlighted a hypothetical seasonal play in crude oil. As you can see in Figures 1 and 2 – so far so good. The crude oil market sold off almost exactly in line with its seasonal tendency to be weak during this time of year (just don’t go thinking that it is an automatic thing every year). Figure 1 – Crude Oil following annual seasonal trend (Courtesy Sentimentrader.com)

Figure 1 – Crude Oil following annual seasonal trend (Courtesy Sentimentrader.com)

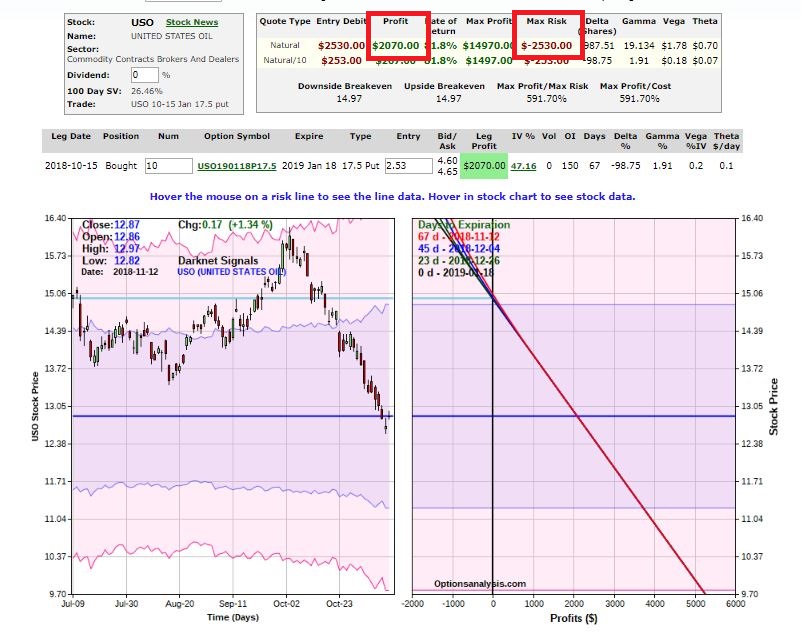

Now the example trade I highlighted in the original article has:

*A very nice open profit

*The potential to give it all back and more if crude rebounds

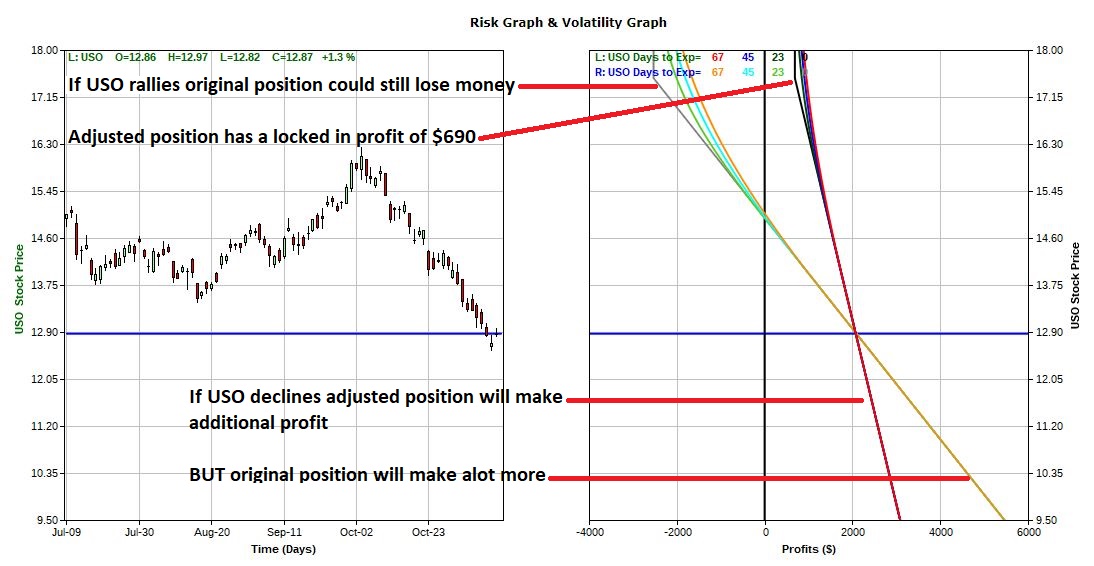

Figure 2 – USO example trade with an open profit (Courtesy www.OptionsAnalysis.com)

Figure 2 – USO example trade with an open profit (Courtesy www.OptionsAnalysis.com)

One great thing about options is the ability to “adjust” a trade as situations change. In this example, it is not so much an “adjustment” per se, but rather more like “taking a lot of chips off the table.”

So here goes:

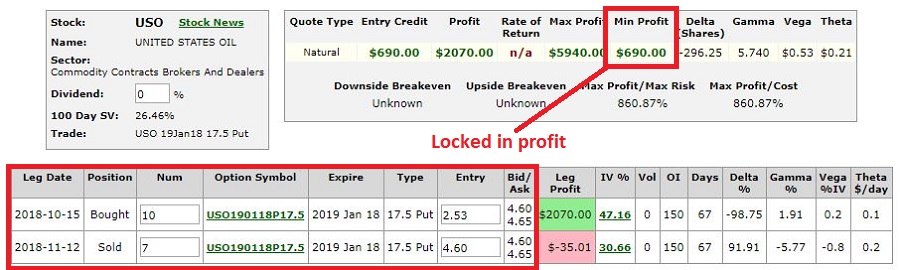

*Sell 7 Jan2019 USO 17.5 puts

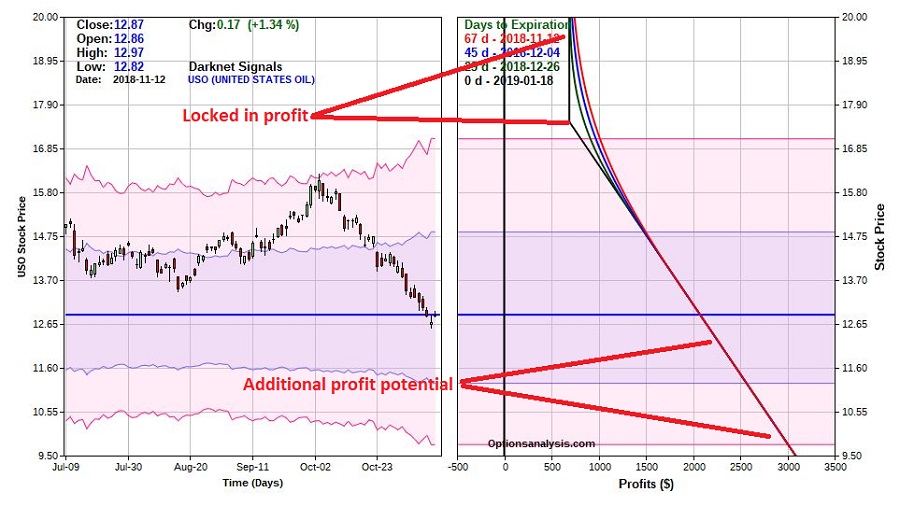

This leaves us with 3 Jan2019 USO puts as shown in Figures 3 and 4. The good news is that we still have more profit potential if USO continue to decline AND we have now locked in a minimum profit of +$690. Figure 3 – Adjusted USO trade details (Courtesy www.OptionsAnalysis.com)

Figure 3 – Adjusted USO trade details (Courtesy www.OptionsAnalysis.com)

Figure 4 – Adjusted USO trade risk curves (Courtesy www.OptionsAnalysis.com)

Figure 4 – Adjusted USO trade risk curves (Courtesy www.OptionsAnalysis.com)

The Bad News

The one “quirk” is that – as you can see in Figure 5, which overlays the original position with the adjusted position – if USO does continue to decline the adjusted position will make a lot less money than the original position. Figure 5 – The “Original” USO trade versus the “Adjusted” USO trade (Courtesy www.OptionsAnalysis.com)

Figure 5 – The “Original” USO trade versus the “Adjusted” USO trade (Courtesy www.OptionsAnalysis.com)

The Choice

So, the question comes down to:

*Do you want to lock in a profit and let the rest ride (albeit with less potential)?

*Or, do you want to play for the maximum profit?

As always, there is no “correct” answer. The key is to make your choice based on your best thinking at the moment – then let the chips fall where they may and NEVER look back in anger or regret.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.