Well, that’s a catchy title, no? Of course, please note that the title does NOT read, “How to Make Incredible Sums of Money in Energy Services.” This is an important distinction because making money in energy stocks has been a pretty tough thing to do since about 2008. Still, avoiding 94% losses is probably a good thing to know how to do. So, let’s proceed, shall we?

The Proxy for Energy Service Stocks

For our purposes we will use Fidelity Select Energy Services fund (ticker FSESX).

You will probably think I am kidding at first but, the way to avoid losing 94% in oil service stocks is simply to avoid investing in FSESX (or any security highly correlated to it) during the months of June through November.

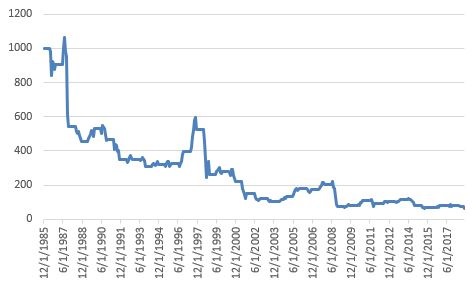

That’s it. Why, you might ask? Simple. Figure 1 displays the growth (Jay, that word “growth”, I do not think it means what you think it means) of $1,000 invested in FSESX ONLY during the months of June through November every year starting in 1986.

Figure 1 – Growth of $1,000 invested in ticker FSESX June through November; 12/31/1985-10/31/2018 (Source: PEP database from Callan Associates)

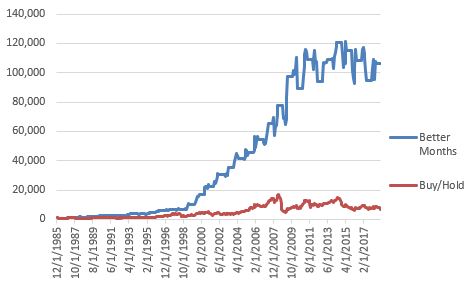

It’s not pretty. And it is a great thing to avoid. But here comes the not so great part. Figure 2 displays the growth of $1,000 invested in FSESX:

*Only during the months of December through May

*On a buy-and-hold basis

Figure 2 – Growth of $1,000 invested in ticker FSESX December through May (blue) versus on a buy-and-hold basis (red); 12/31/1985-10/31/2018 (Source: PEP database from Callan Associates)

As I intimated earlier, even avoiding the “Bad Months” has not resulted in much in the way of capital appreciation in the last decade. But please remember the point of this article is essentially as follows: if you invest in Energy Service stocks between the end of May and the end of November and you expect to make money, you may be, um, disappointed. Or at least, that is what history strongly seems to suggest.

For the record:

*$1,000 invested on a buy-and-hold basis grew to $6,800

*$1,000 invested only December through May each year grew to $106,300

*$1,000 invested only June through November declined to $64 (i.e., -94%)

Summary

If you want to know how to make 94% in energy service stocks you will unfortunately have to find another article. But for now, at least we know how to avoid losing 94%.

Hey, it’s a step in the right direction.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.