This article is intended to be a quick update to this article. The original idea is based on the theory propounded by Ken Fischer that suggests that one should not worry about a “top” in the stock market until after the market goes at least 3 months without making a new high.

Three things to note:

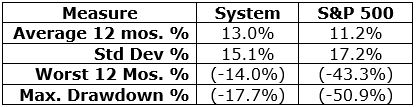

*Like all trend-following methods the one detailed in the linked article will experience an occasional whipsaw, i.e., a sell signal at one price followed some time later by a new buy signal with the market at a higher price.

*Like any good trend-following method the real purpose is to help you avoid some significant portion of any major longer-term bear market, i.e., 1973-74, 2000-2002, 2007-2009).

*The secondary purpose is to relieve an investor of that constant “Is this the top, wait, what about this this, this looks like the top, OK never mind, but this, this time it definitely has to be the top” syndrome.

The Rules

For a full explanation of the rules please read the linked article. In general, though:

*A “Sell alert” occurs when the market makes a 6-month high, then goes 3 full calendar months without piercing that high

*The “trigger” price is the lowest low for the 3 months following the previous high

*A “Sell signal” occurs at the end of the month IF the “trigger” price is pierced to the downside during the current month

*The “trigger” is no longer valid if the S&P 500 makes a high above the high for the previous 6 months prior to an actual “Sell signal”

*If a “Sell signal” occurs then a new “Buy signal” occurs when the S&P 500 makes a high above the high for the previous 6 months

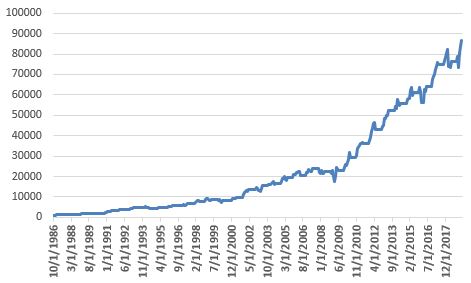

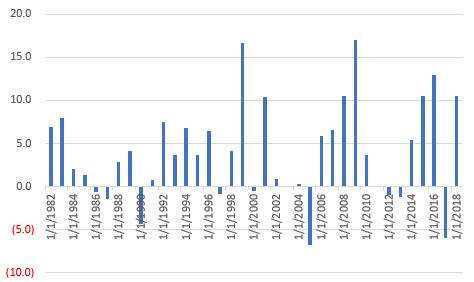

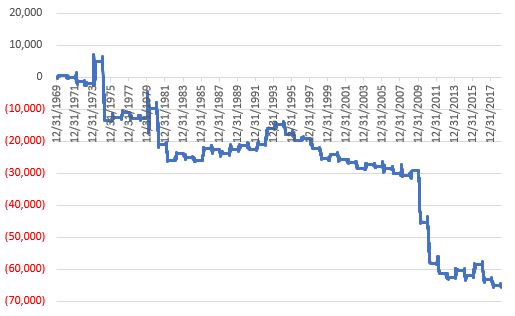

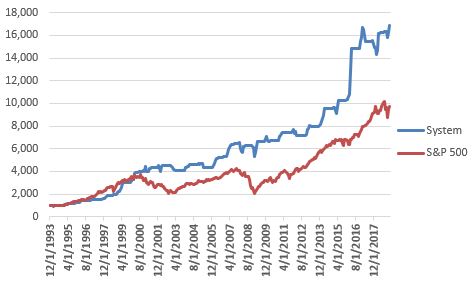

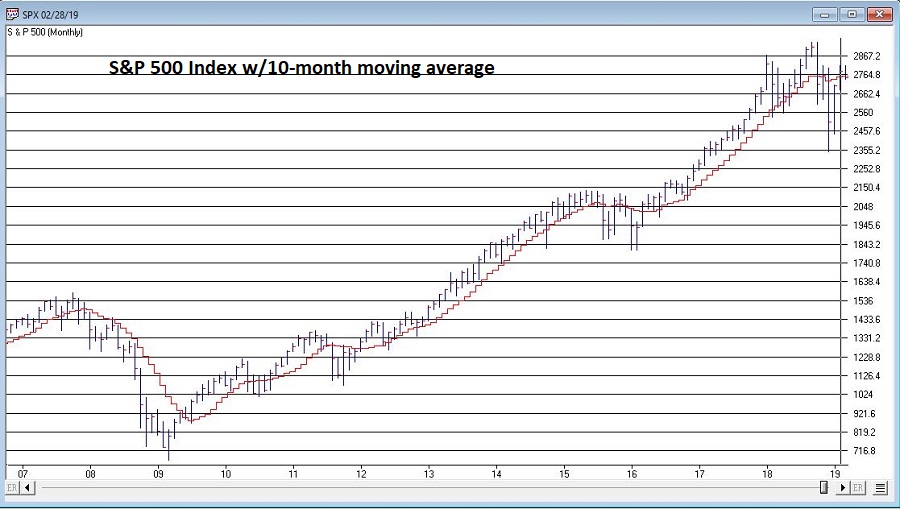

Sounds complicated, but its’s not. Figure 1 displays the signals and alerts and trigger prices since 2005.

Green Arrows = Buy Signal

Red Arrows = Sell Signal

Red horizontal lines = Sell trigger price

Figure 1 – One Minute a Month Trend-Following Alerts, Trigger prices and Signals (Courtesy AIQ TradingExpert)

Figure 1 – One Minute a Month Trend-Following Alerts, Trigger prices and Signals (Courtesy AIQ TradingExpert)

Note that actual sell signals occurred in 2008, 2011 and 2015. The signal in 2008 was a life-saver, while the signals in 2011 and 2015 resulted in small whipsaws. Sorry folks, that’s just the nature of the beast.

Interestingly, there have been two “Sell alerts” in the last year. The first occurred at the end of April 2018, however, that alert was invalidated at the end of August 2018 when the S&P 500 pierced the previous 6-month high. Another alert occurred at the end of December 2018. The “Trigger price” is the December 2018 low of 2346.58. That trigger is still active but could be invalidated if the month of May 2019 makes a high above whatever the high for April 2019 turns out to be.

The key point here is that despite the volatility and painful sell-offs in October and December of 2018, the “system” has remained on a buy signal.

Where to from here? We’ll just have to wait and see.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.