It’s April. So, it “should” be a good time to own energy related stocks. IMPORTANT NOTE: “Should” is definitely the key word in the previous sentence.

To take a look back, we will consider four Fidelity Select funds that deal in energy-related securities.

*Energy (FSENX) launched in 1981

*Energy Services (FSESX) launched in 1986

*Natural Gas (FSNGX) launched in 1993

*Natural Resources (FNARX) launched in 1997

During each year starting in 1982, we will take the average performance of any of the four that were trading at the time only during the month of April. So:

*From 1982 through 1985 FSENX was the only fund.

*From 1986 through 1993, we use the average of FSENX and FSESX

*From 1994 through 1996 we average FSENX, FSESX and FSNGX

*And since then we take the average of all four of the above

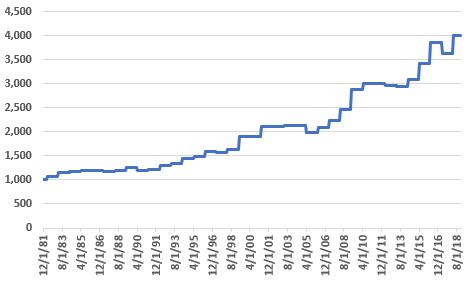

Figure 1 displays the cumulative growth of $1,000 invested in energy (as described above) ONLY during the month of April each year.

Figure 1 – Growth of $1,000 invested ONLY during April in Fidelity Select Sector energy-related funds

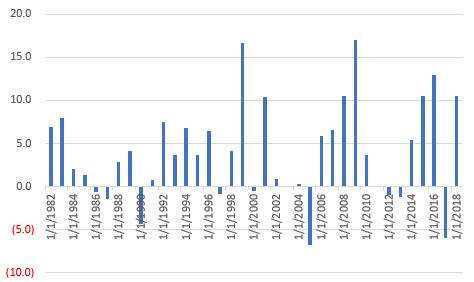

Figure 2 displays the year-by-year results for the month of April

Figure 2 – Annual April % +/- ONLY during April in Fidelity Select Sector energy-related funds

Things to note:

*# times UP = 28 (76% of the time)

*# times DOWN = 9 (24% of the time)

*Average UP month = +6.1%

*Average DOWN month = (-2.5%)

*Largest UP month = +17.0% (2009)

*Largest DOWN month = (-6.8%) (2005)

Summary

The Fidelity energy sector funds have showed a gain during the month of April 76% of the time since 1981. The average up month has been 2.4 times that of the average down month.

So, does this mean that energy funds are “a sure thing” during April 2019? Far from it. The reality is that anything can happen. But successful investing has a lot to do with putting the odds on your side as much as possible.

Historically, the odds seem to favor energies in the month of April.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.