Traders are a silly bunch sometimes. Sometimes they forget the basics like – markets go up, markets go sideways, markets go down, markets get quiet, markets get volatile, and so on. And then when they get so used to something going one way or doing one thing for so long they start to think that that state of affairs will never end. Like now. In a variety of markets.

One way to tell when this is happening is to look at the implied volatility of the options on a given security. When traders reach that “well, whatever” state of being it is typically accompanied by a decline in IV (The short lesson: all options have some time premium built into their price prior to expiration. High IV means lots of time premium, low IV means very little time premium) as traders simply lose interest and start to figure that “nothing will ever happen” with that given security.

And of course, markets being what they are, very often they are wrong.

A Cross Section of the Blahs

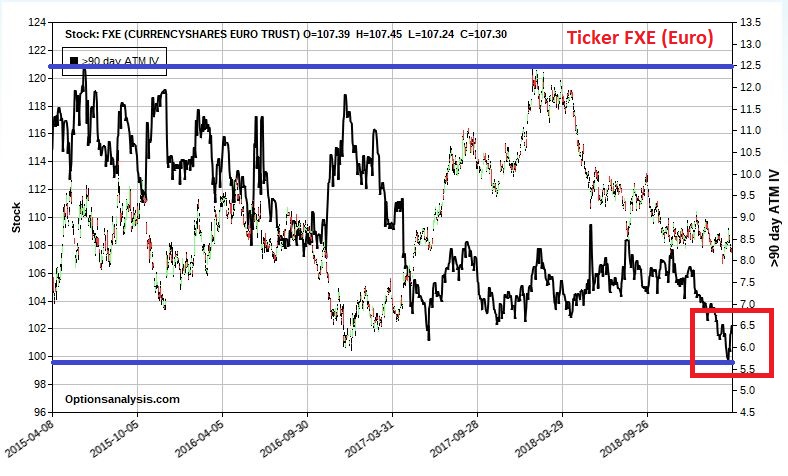

The charts below display the price action for a variety of ETFs as well as the historical and current IV levels for the options on each. The point should be self-evident. Figure 1 – Ticker FXE with IV (Courtesy www.OptionsAnalysis.com)

Figure 1 – Ticker FXE with IV (Courtesy www.OptionsAnalysis.com)

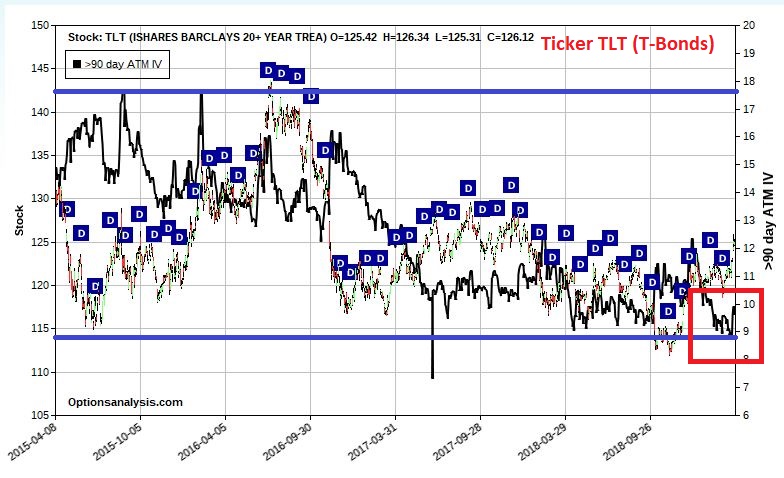

Figure 2 – Ticker TLT with IV (Courtesy www.OptionsAnalysis.com)

Figure 2 – Ticker TLT with IV (Courtesy www.OptionsAnalysis.com)

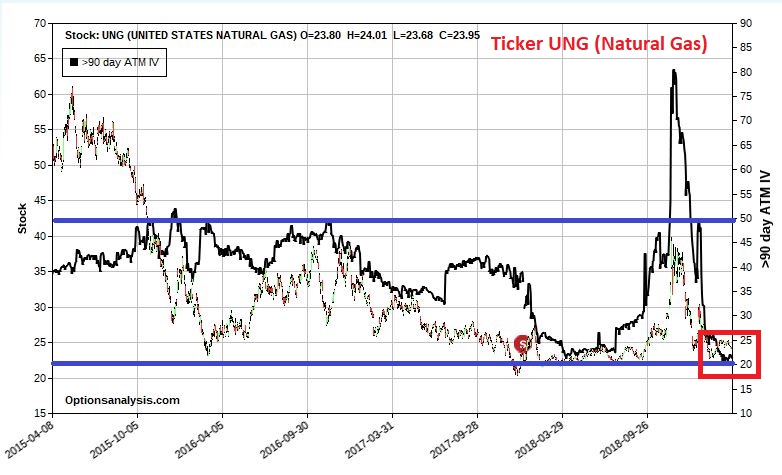

Figure 3 – Ticker UNG with IV (Courtesy www.OptionsAnalysis.com)

Figure 3 – Ticker UNG with IV (Courtesy www.OptionsAnalysis.com)

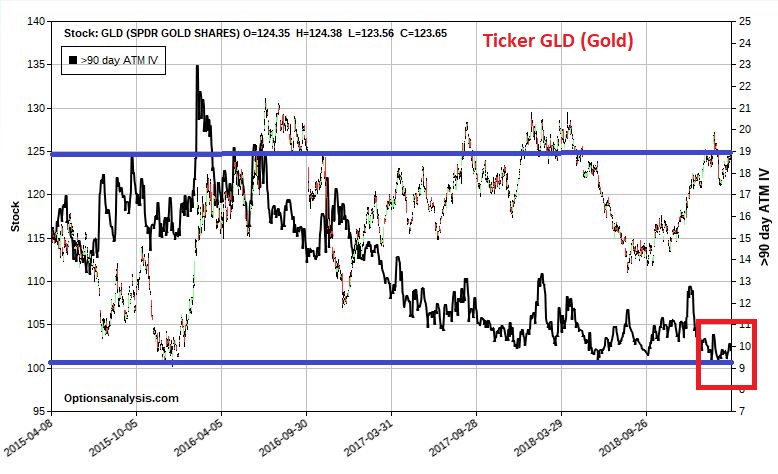

Figure 4 – Ticker GLD with IV (Courtesy www.OptionsAnalysis.com)

Figure 4 – Ticker GLD with IV (Courtesy www.OptionsAnalysis.com)

Figure 5 – Ticker SLV with IV (Courtesy www.OptionsAnalysis.com)

Figure 5 – Ticker SLV with IV (Courtesy www.OptionsAnalysis.com)

What should be obvious is that IV for these securities is extremely low – i.e., traders have determined that there is nothing going on in these tickers and there is no expectation for a pickup in volatility any time soon.

Now here are 3 things to note:

*I have no “predictions” to make for any of these, bullish or bearish

*When traders as a group get this complacent they are typically (though importantly, not always) wrong

*When IV is “low”, the options are “cheap”

So, from there we can make the following leap:

*Something surprising may be coming in these markets that will surprise traders

*We don’t know if the surprises will be to the upside or the downside

*We know that the options are cheap

There is an option strategy for that scenario. It is called a “strangle”, which involves buying both a call and a put at the same strike price and waiting for the underlying security to make a meaningful move in one direction or the other. Another alternative is the “strangle”, which involves buying a call and a put with different strike prices.

Some Examples

As always, the trades displayed below are NOT “recommendations”, only “examples.” One thing to note:

*In the world according to me the “correct” range for straddles is options with 60 to 140 days left until expiration.

*Anything less and time decay can work against you heavily and there may not be enough time for the underlying security to make the move required to generate a profit.

*Beyond 140 days you often are dealing with less liquid options which can also be less price sensitive

In this case I am making an exception and going out a little further. Two reasons for this:

*I have no idea if or when these tickers may actually make a significant move, so I want to give them a lot of time.

*The options are about as cheap as they have ever been, plus longer-term options are more sensitive to changes in volatility. So, if volatility picks up these options may get more of a time premium “bump”.

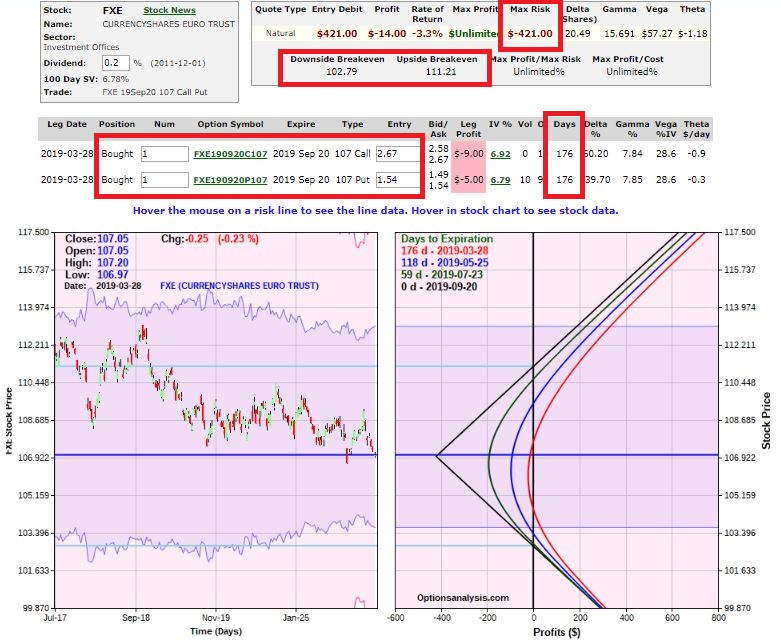

Figure 6 – FXE Sep 107 straddle (Courtesy www.OptionsAnalysis.com)

Figure 6 – FXE Sep 107 straddle (Courtesy www.OptionsAnalysis.com)

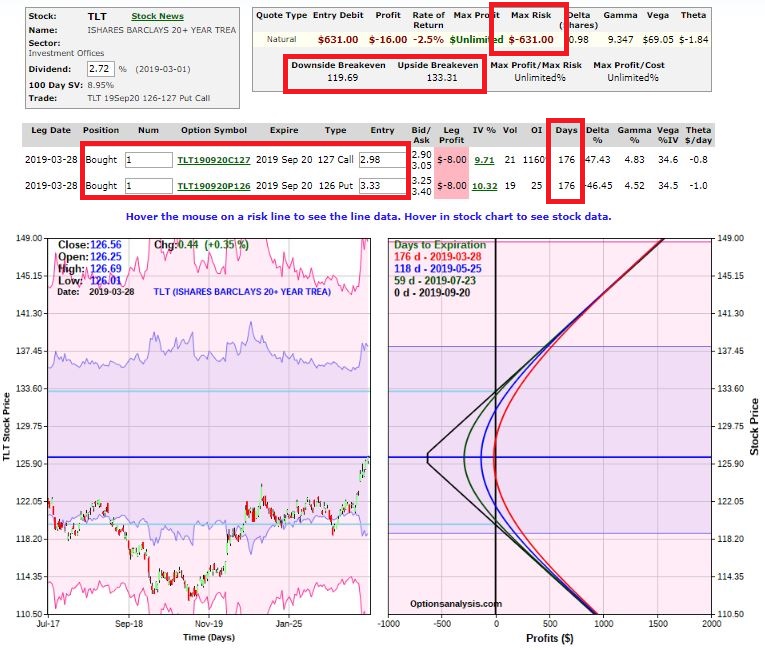

Figure 7 – TLT Sep 126-127 strangle (Courtesy www.OptionsAnalysis.com)

Figure 7 – TLT Sep 126-127 strangle (Courtesy www.OptionsAnalysis.com)

Figure 8 – UNG Oct 124 straddle (Courtesy www.OptionsAnalysis.com)

Figure 8 – UNG Oct 124 straddle (Courtesy www.OptionsAnalysis.com)

Figure 9 – GLD Sep 122 straddle (Courtesy www.OptionsAnalysis.com)

Figure 9 – GLD Sep 122 straddle (Courtesy www.OptionsAnalysis.com)

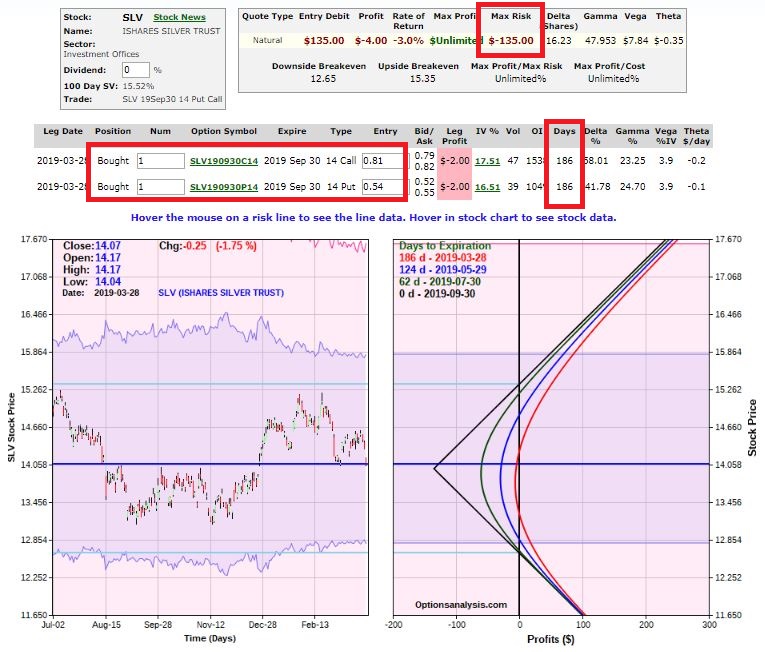

Figure 10 – SLV Sep 14 strangle (Courtesy www.OptionsAnalysis.com)

Figure 10 – SLV Sep 14 strangle (Courtesy www.OptionsAnalysis.com)

With all of the above:

*A significant up move or down move in price will generate a profit

*A continued sideways movement will likely generate a loss

*A sharp rise in implied volatility will help the trade by inflating the time premium built into the options.

Summary

Will the markets highlighted continue to drift or trade within a range between now and September/October? It’s certainly possible. Will the example trades highlighted generate a profit? It beats me. But that is not the point of this piece.

The point of this piece is simply to highlight:

*That low extremely low IV often highlights complacency and may be followed by more volatile than expected price action

*Options offer a way to play this situation

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.