There is one school of thought that claims “Timing is Everything” (and in life in general, you can make a pretty good case that that is true). When it comes to the financial markets however, there is another school of thought that says, “Timing is Impossible” (and you can make a pretty good case that that is also true – IMPORTANT DISCLAIMER: Despite the fact that you can make a pretty good case that that is also true, interestingly that fact does little to dissuade millions of investors – myself included – from trying).

Now this desire to time the markets is only a natural part of human nature as we can pretty easily recognize that if we are the markets on “the good days” and out of the markets on “the bad days” we are going to do pretty well for ourselves. Unfortunately, human nature is sort of a pesky thing when it comes to investing (fear, greed, all that stuff). Which leads us directly to:

Jay’s Trading Maxim #17: Human nature is a detriment to trading and investment success and should be voided as much as, well, humanly possible.

Still, he persisted.

Bonds: Good Days

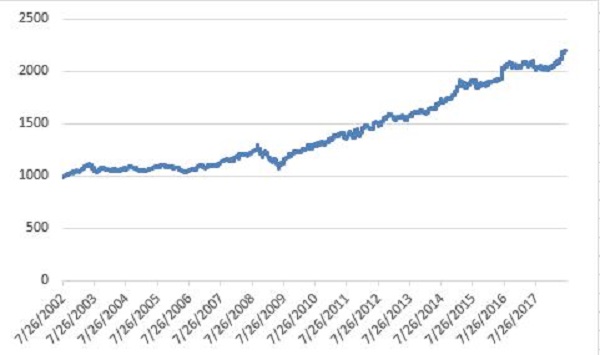

Figure 1 displays the growth of $1,000 invested in ticker TLT – an ETF that tracks the long-term treasury bond ONLY during the last 5 trading days of every month since TLT started trading in 2002. Figure 1 – Growth of $1,000 invested in TLT last 5 trading days of month (2002-present)

Figure 1 – Growth of $1,000 invested in TLT last 5 trading days of month (2002-present)

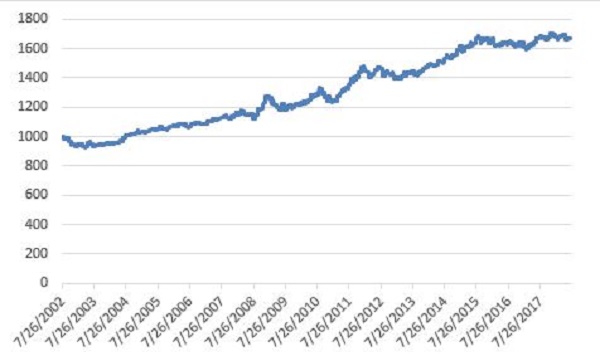

Figure 2 displays the growth of $1,000 invested in ticker TLT ONLY on Trading Days of the Month #10, 11 and 12 (these are trading days, not calendar days).

Figure 2 – Growth of $1,000 invested in TLT trading days of month #10, 11 and 12 (2002-present)

Figure 2 – Growth of $1,000 invested in TLT trading days of month #10, 11 and 12 (2002-present)

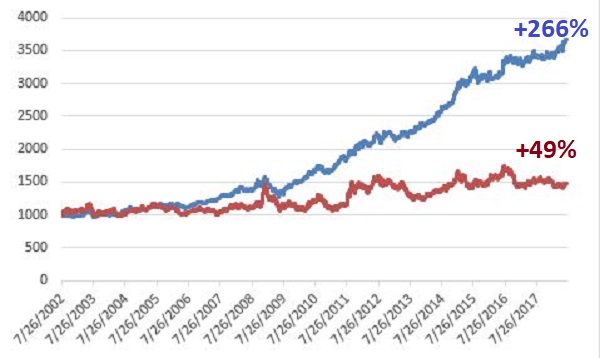

Figure 3 displays the growth of $1,000 invested in TLT ONLY during the 8 trading days of the month listed above versus buying-and-holding TLT since it started trading in 2002 (using price data only, not total return).

Figure 3 – Growth of $1,000 invested in TLT last 5 trading days of month and trading days of month #10, 11 and 12 (blue) versus buy-and-hold (red); (2002-present)

Figure 3 – Growth of $1,000 invested in TLT last 5 trading days of month and trading days of month #10, 11 and 12 (blue) versus buy-and-hold (red); (2002-present)

Bonds: Bad Days

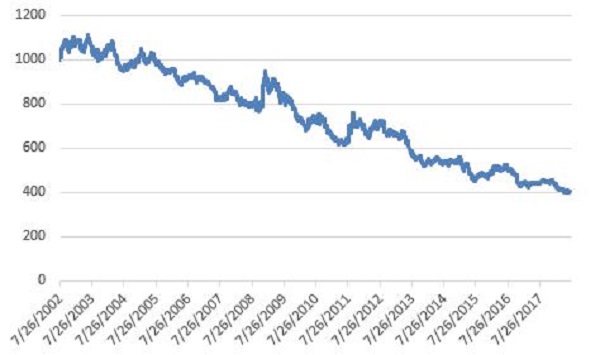

To put things in perspective, Figure 4 displays the growth of $1,000 invested in ticker TLT ONLY during ALL OTHER TRADING DAYS (i.e., you skip trading days of the month #10, 11 and 12 and the last 5 trading days of the month and hold TLT during all remaining days.)

Figure 4 – Growth of $1,000 invested in TLT during all other trading days of the months (2002-present)

Figure 4 – Growth of $1,000 invested in TLT during all other trading days of the months (2002-present)

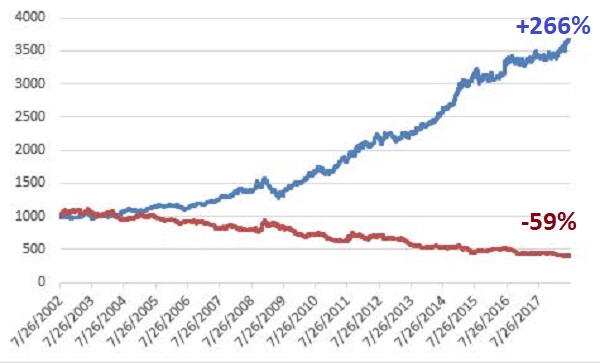

Figure 5 displays Good Days versus Bad Days.

Figure 5 – Growth of $1,000 invested in TLT during “Good Days” (blue) versus “Bad Days” (red); (2002-present)

Figure 5 – Growth of $1,000 invested in TLT during “Good Days” (blue) versus “Bad Days” (red); (2002-present)

Summary

For the record:

*The Good Days gained +266%

*The Bad Days lost -59%

Notice a difference? Does any of this mean that people should start trading in and out TLT a couple of times every month? Not necessarily. Results from month to month can vary greatly. Likewise, the middle of the month trading period has “flattened out” a bit in recent years as yields have started to rise. What happens in a true bond bear market? That’s an excellent question that should be pondered.

Still, as they say, “Opportunity is where you find it.” And “finding an edge” here and there can sometimes make a difference. Food for thought if nothing else.

Have a “Good Day”.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.