Sometimes it’s “what you hold.” Sometimes it’s “when you hold it.” And sometimes, it’s both. With the stock market about to enter the “seasonally favorable” period of November through April – despite all of the massive doubts that surround the market (COVD, economy, election, debt, etc., etc.) it may be a good time for investors to put aside all of today’s “news” and to consider a more objective approach for the months ahead.

The Fab Five

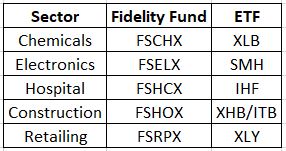

Let’s consider a portfolio that holds the following sectors from November 1st through April 30th every year no matter what.

Figure 1 – The Fab 5 sectors

NOTE: Figure 1 was updated on 10/29/20. Previously it contained a misprint listing ticker XLP as the ETF choice for Retailing. The correct ticker is XLY.

The Test

For our purposes we will use monthly total return data for the Fidelity Select Sector funds listed above (which allows us to go back to 1986) and examine how the performed as a group during November through April.

The Rules

*Buy the five Fidelity sector funds (20% to each) on the last trading day of October each year

*Sell the funds on the last day of April the following year

As a benchmark, we will compare holding these five to holding ticker VFINX (Vanguard S&P 500 Index fund) also ONLY during the months of November through April.

The Results

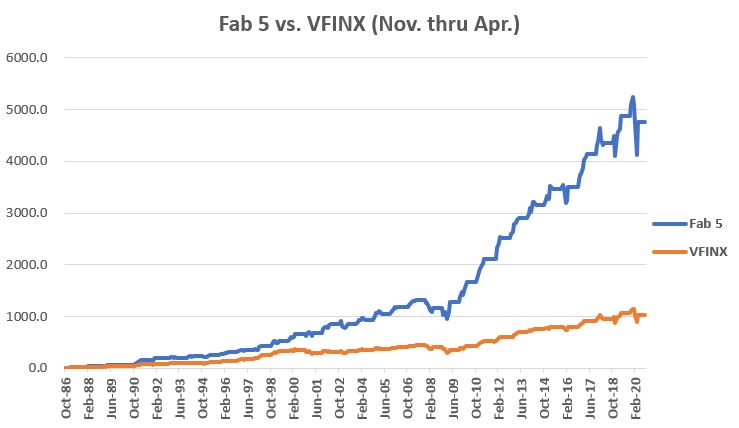

The cumulative returns for both approaches appear in Figure 2

Figure 2 – Cumulative return for Fab 5 versus VFINX held ONLY during November through April

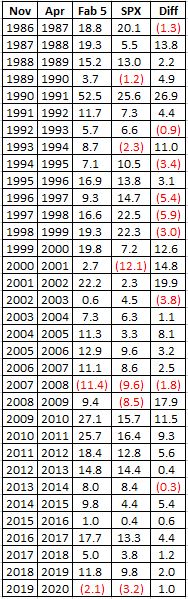

The year-by-year results appear in Figure 3. The far-right column labeled “Diff” displays the amount by which the Fab 5 outperformed or underperformed the VFINX benchmark.

Figure 3 – Year-by-Year Comparison of Fab 5 versus VFINX (November through April only)

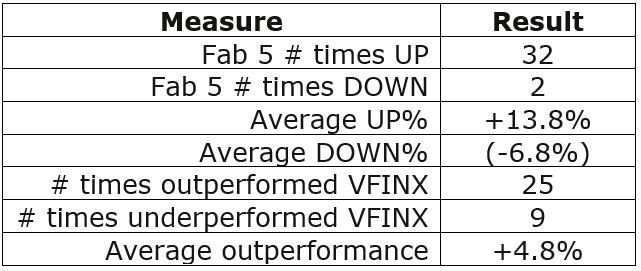

For the record:

Figure 4 – Comparative Figures

Things to note:

*The Fab Five showed a gain between November and April 94% of the time (32 out of 34 years)

*The Fab Five outperformed VFINX in 74% of the years (25 out of 34 years)

Summary

What IS NOT in question is whether or not the Fab 5 have outperformed the S&P 500 Index historically during November through April.

What IS very much in question is “what happens going forward?”

Are the Fab 5 “guaranteed” to continue to perform well in the future and outpace the broader market? Sorry folks, it doesn’t work that way. There are no guarantees.

As an investor, you analyze the data, you decide what you think will work, you place your bets and the Market Gods take it from there…

Same as it ever was.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.

Hi Jay. I’ve been a fan of your work for years – ever since I had the good fortune of wandering into Kaeppel’s Corner back in the early 2000s. For as long as I’ve followed your writing, however, you’ve always used XLY or XRT as an ETF proxy for the Fidelity Retailing Fund, so I’m curious as to why in this article you’ve gone with XLP Consumer Staples. Is this just a misprint, or do you anticipate that XLP will have a higher correlation to FSRPX in the coming months?

Al, Excellent catch! For the record, I don’t use ETFs myself with this strategy. XLP is a misprint. It should say XLY, which is much more closely correlated to FSRPX and broader retailing indexes.

Thank you for the kind words and also for having such a sharp eye and bringing this to my attention. As soon as I find out who is in charge of quality control here at JOTM heads are gonna, er, well, wait, um…never mind. Take Care, Jay