I have written in the past about the “dangers” of September (see here and here) and a lot of investors are aware that it has historically been the worst month of the year for the stock market overall. But the truth is things can vary a lot from year to year – except for this week. This week – defined as the week after the 3rd Friday in September – has been pretty awful pretty consistently for a pretty long time. As you may gather, no, it has not been pretty.

Two of my favorite analysts – Wayne Whaley of Witter & Lester and Rob Hanna of www.QuantifiableEdges.com both made light of this recently. The bottom line:

*The week after the 3rd Friday in September has seen the S&P 500 decline in 24 of the last 30 years.

Being the numbers geek that I am I went back to the start of my own database in 1928. I found that in the prior 31 years this week was up 14 times and down 17 times.

While at first blush this “doesn’t sound as bad”, the reality is that given the magnitude of the overall market advance since 1928, that this particular week is so consistently NOT bullish is downright dismal. Especially when we consider the magnitude of the ups versus the downs and the overall long-term trend.

The Numbers

Since 1928, the week after the 3rd Friday in September has seen the S&P 500 Index:

*Advance 33 times

*Decline 54 times

*Unchanged once

*Average gain = +1.64%

*Average loss = (-2.04%)

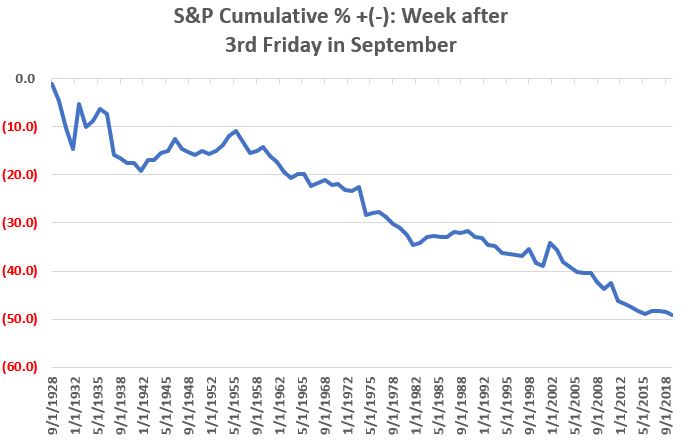

Figure 1 displays the cumulative % +(-) achieved by the S&P 500 Index since 1928 during the week after the 3rd Friday in September.

Figure 1 – Cumulative % return for S&P 500 Index ONLY during week after 3rd Friday in September

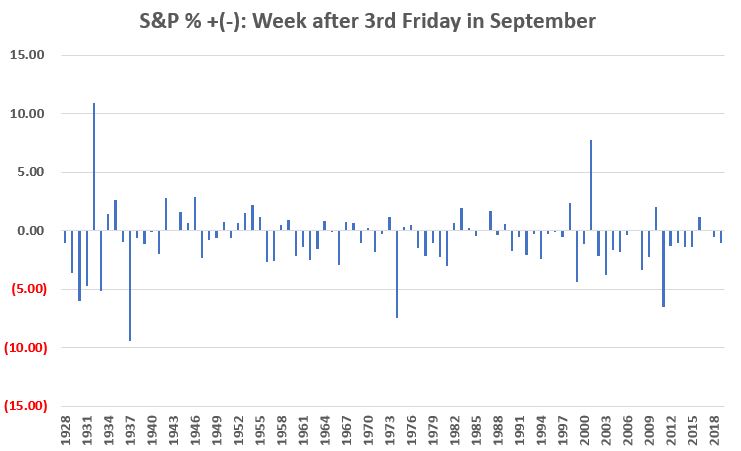

Figure 2 displays the year-by-year results.

Figure 2 – Week after 3rd Friday in September Year-by-Year % +(-)

September “Hell Week” for 2020 is off to a pretty dismal start. Will things improver anytime soon? It beats me. But I am of the mind that during September and October “anything can happen” so investors should be prepared. I am also of the mind that starting in November the bullish trend will re-assert itself.

Here’s hoping.

On a slightly separate note – even a down September is not totally without value thanks to the “September Barometer” (see here and here).

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.