As people age, very often investing becomes more about “keeping what you have” and less about “making more.” Oh sure, more is still always better. But the bottom line is there comes a point when Will Rogers old adage below becomes relevant.

“I’m less interested in the return on my money as I am the return of my money” Will Rogers

To this end, in this piece we will focus on one possible approach to “low risk investing” (which of course makes the assumption that there is such a thing).

The Components

Ticker VTIP ( Vanguard Short-Term Inflation-Protected Securities Index Fund ETF)

VTIP holds short-term TIPs bonds. TIPs are treasury bonds that are indexed to inflation. A newly issued TIPs bond has a principal value of $1,000 and pays a stated percentage of interest on that principal. Moving forward, if the Consumer Price Index rises, the principal amount of the bond is adjusted upward, and interest is paid as a percentage of the higher principal amount. If inflation were to soar, a TIPs bond could end up paying a lot of interest, hence the reason they are considered a hedge against inflation.

On the other side of the coin, if we have deflation and the CPI declines, then the principal amount for a TIPs bond gets adjusted lower and interest is paid on this lower amount. HOWEVER, keep in mind that each TIPs security is repaid the full $1,000 original face value at maturity and the effective maturity of VTIP is roughly 2.9 years. So even if the principal amount gets adjusted lower temporarily (resulting in lower interest payments for the time being), at maturity the full $1,000 is repaid. This makes deflation less of a concern for a short-term TIPs holder than for a long-term TIPs holder.

Speaking of long-term versus short-term bonds, long-term TIPs can get hurt by rising interest rates. Short-term bonds are less impacted by rising rates as they mature much sooner.

Ticker SHY ( iShares 1-3 Year Treasury Bond ETF)

Ticker SHY holds treasury securities that mature in 1 to 3 years. The reality is that with interest rates presently so low the only way to make money on short-term bonds is if rates go even lower, or possibly even into negative territory. However, this portion of the portfolio is a play on safety and low volatility. If interest rates were to rise, a) short-term bonds would be much less sensitive in terms of any price decline than longer-term bonds, and, b) if interest rates were to embark on a sustained increase, short-term bonds would be able to roll over into higher yielding securities sooner and on a more frequent basis than longer-term bonds.

Ticker SWAN ( Amplify BlackSwan Growth & Treasury Core ETF)

I am always a bit leery of securities that seem “gimmicky”. SWAN may be thought of as such by some investors. But in the context of our “lower risk approach” it can be a portfolio enhancer. Ticker SWAN holds roughly 90% of its portfolio in treasury securities (with a duration roughly equivalent to a 10-year treasury). This portion of the portfolio has no credit risk and moderate interest rate risk (i.e., the value of the bond holdings may increase if rates decline or decrease if rates rise).

The other 10% holds exposure to the S&P 500 Index in the form of LEAPs call options. This gives the portfolio the potential to gain during an advance in stocks. While this portion of the portfolio will decline during a stock market decline, the bond holdings can serve as a “buffer”, as treasury securities often rally during stock market declines as investors flee to investments perceived to be “safe”.

Putting the Portfolio Together

First a few caveats/footnotes:

*For the record, I am not actually advocating that anyone run out and put money into this idea. At the moment, it is just that – an idea, food for thought. This portfolio will rarely make a lot of money, AND it is possible that a given scenario (possibly an excessively large “spike” in interest rates, perhaps) could create a larger loss than what was experienced in back testing.

*For testing purposes, I used ETF total return data wherever possible. Prior to that I used either index data or a comparable ETF in order to generate a longer back test. So DO NOT mistake the results below as “real time” results. The results depicted are strictly a hypothetical representation of hat real world results might have resembled. And as always, past performance is no guarantee of future results.

*For VTIP, I used Adjusted Close data from Yahoo (which is believed to account for price changes and dividend income) for ticker TIP (which has a longer duration that ticker VTIP) from 12/6/2005 through 10/16/2012, when VTIP started trading. From that date forward VTIP Adjusted Close data from Yahoo is used.

*For SHY, I used Adjusted Close data from Yahoo (which is believed to account for price changes and dividend income) for ticker SHY from 12/6/2005 to the present.

*For SWAN, I used total return daily data for the Index that ticker SWAN is designed to track from 12/6/2005 through 11/6/2018, when SWAN started trading. From that date forward SWAN Adjusted Close data from Yahoo is used.

Are we having fun yet?

The Portfolio

For our purposes we will keep it simple – 1/3 in each ETF with a rebalance at the beginning of every year.

VTIP = 33%

SHY = 33%

SWAN = 33%

The Results

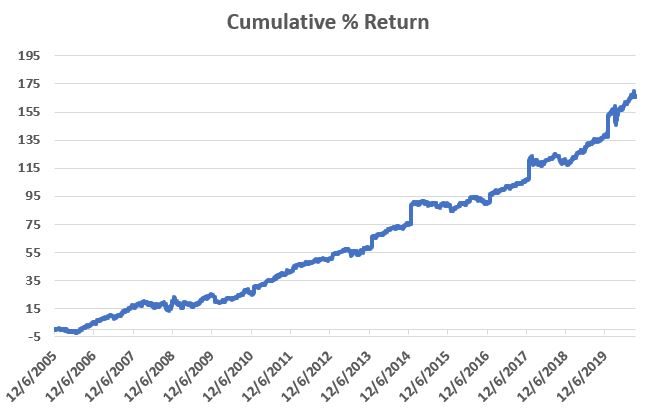

Figure 1 displays hypothetical cumulative return for the portfolio from December 6, 2005 through 9/16/2020.

Figure 1 – Portfolio Hypothetical Cumulative % + (-)

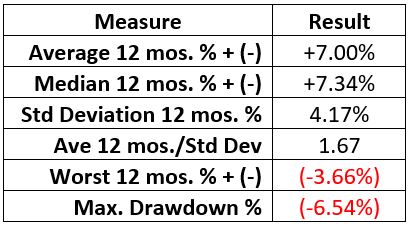

Figure 2 displays some relevant statistics

Figure 2 – Relevant statistics

Three key things to note:

*The median 12-month return was +7.34%

*The standard deviation of 12-month returns is 4.17% (i.e., low)

*The maximum % drawdown was -6.54% (i.e., low)

Figure 3 displays the annual % gain on a calendar year basis.

Figure 3 – Annual hypothetical results

*The key thing to note is that – so far – there have been no down years.

Summary

Once more for the record, I am not “recommending” this portfolio. I am merely pointing out that for a person who was seeking decent returns with relatively low risk and low volatility, hypothetically speaking this one hasn’t been half bad.

Still, one has to consider potential risks before committing real money to anything. I can envision at least one scenario – the stock market tanks BECAUSE interest rates are spiking BUT inflation remains relatively low – where this portfolio could have some more serious trouble. There may be others.

All in all, though, not the worst idea as food for thought for investors looking for a low risk approach.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.

Late last year I used SWAN to create two portfolios that would provide low risk growth. The portfolio that closely matches the returns of yours consists of 25% SWAN, 10% VGIT, 50% VMBS, and 15% VGSH. The other portfolio provides lower returns but uses a small allocation to SPY instead of SWAN. That portfolio consists of 6% SPY, 14% VGIT, 50% VMBS, and 6% VGSH.

But one doesn’t need to get too crazy over this since a simple portfolio of 70% VGIT and 30% VCIT would likely provide similar returns. Though if inflation does hit in a significant way the portfolio you provided with VTIP exposure would like outperform the ones I listed. I’m curious, how did you simulate historical returns prior to 2018 for SWAN?

Correction: In my posting the last portfolio contains an allocation of 30% VGSH, not 6%.