Everybody invests for income.

Maybe not even consciously in many cases (think of any cash you have anywhere – checking, savings, money-market, brokerage account but not invested in anything at the moment, etc.), but most investors are “earning interest” on some portion of their assets. Not much interest. Not in the current “low interest rate environment”, but interest nevertheless.

Yet the interesting (har) thing is that the vast majority of investors never think about how changes in interest rates affect things. For our example, we will go to the far end of the bond spectrum – the 30-year treasury bond. Long-term treasuries are essentially the “purest play” on interest rates because treasury bonds are assumed to entail no “credit risk”, they trade solely based on “interest rate risk”, i.e.:

*When long-term interest rates go DOWN, long-term treasury price go UP

*When long-term interest rates go UP, long-term treasury price go DOWN

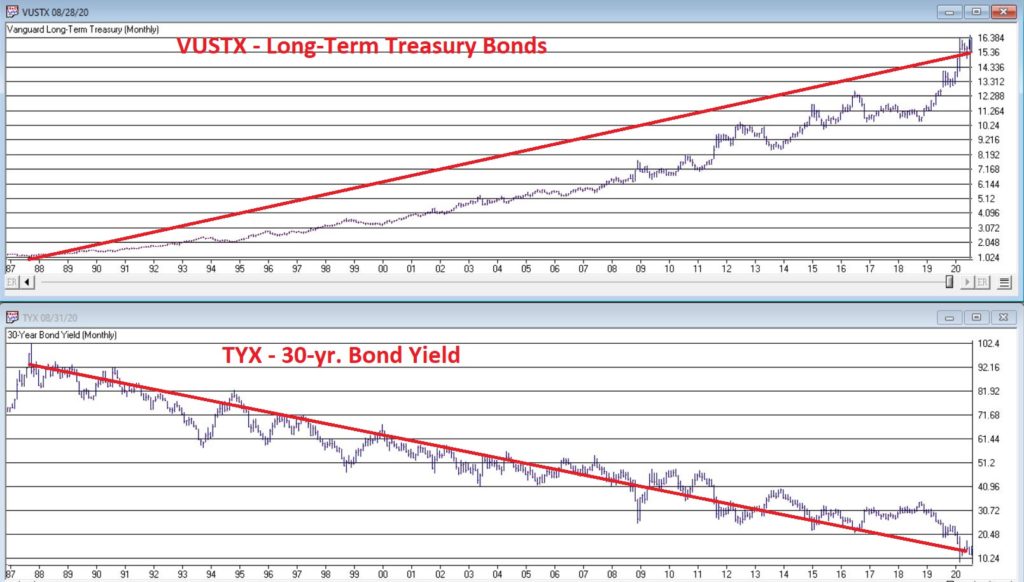

Figure 1 “says” it all. The top clip is price action for ticker VUSTX (Vanguard Long-Term Treasury) and the bottom clip is ticker $TYX (an index that tracks the yield on 30-year treasuries times 10 – so if TYX is at 20, it means the yield on LT treasuries is 2%).

Figure 1 – Ticker VUSTX and ticker TYX (Courtesy AIQ TradingExpert)

The obvious thing to note is the inverse relationship.

The 2 Big Questions

The “2 Big Questions” in this example are:

*Where will long-term interest rates go from here?

*What will happen to long-term treasury bonds as a result?

Interestingly, the answers are:

“No one really knows for sure”

“We can calculate it almost exactly”

There is lots of speculation regarding where interest rates will go from here. One camp says the Fed will keep forcing rates lower – possibly even into negative territory (it has already happened in other parts of the world, and “Yes”, it can happen here).

The other camp argues that all the money printing will spark inflation and that will lead to higher rates.

Again, no one knows for sure. Fortunately, the one thing we can do – with only the help of a handy bond calculator – is figure out how long-term treasury bond prices will react.

An Example

Let’s assume a new 30-year treasury bond is issued today with a yield of 1.35%. These means:

*Buyer pays $1,000 to buy the bond

*Every year for the next 30 years the treasury pays bondholder $135 in interest

*In 30 years, the treasury pays the bondholder back the original $1,000

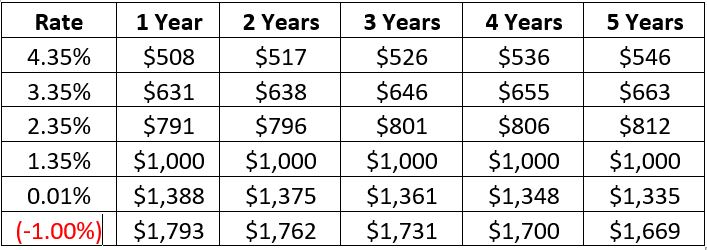

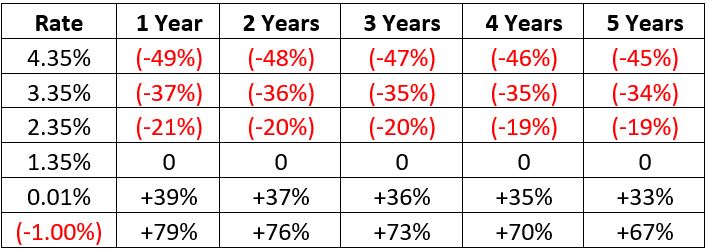

The calculations below estimate the expected change in price and $ value of a 30-year treasury bond based on interest rate movement and the passage of time.

NOTE: The data in the tables “may not compute” in your head at first. If not, I strongly encourage you to step back and then take another shot. Because this data spells out the potential risks and rewards pretty explicitly.

Figure 2 displays the expected dollar value of a current 30-year treasury 1 to 5 years from now based on some future level of interest rates.

Figure 3 displays the expected percentage change in dollar value of a current 30-year treasury 1 to 5 years from now based on some future level of interest rates.

Figure 2 – Expected $ Value of 30-year 1.35% bond based on change in current interest rate and the passage of time

Figure 3 – Expected % change in price of 30-year 1.35% bond based on change in current interest rate and the passage of time

So, let’s use the extremes as examples:

*If rates fall to -1.00% one year from now, today’s 30-year treasury will rise in value from $1,000 to $1,793 or +79%

*If rates rise to 4.35% five years from now, today’s 30-year treasury will be priced at $546, or -45% below today’s price level.

What It All Means

First off note that investments in shorter-term securities will have less volatility in terms of price movement, but will still be affected by changes in rates.

If interest rates rise:

*Bond holders – especially holders of long-term bonds – will get hurt.

*As you can see in Figures 2 and 3, if rates were to rise over the next several years long-term bonds would be severely underwater and could take as long as waiting until maturity to get back to $1,000 in value.

If interest rates fall:

*Bond holders can still profit significantly.

*If the bottom fell out of interest rates and they plunged to -1.00% a year from now, our 30-year treasury bond would gain a massive +79%.

BUT BEWARE: Remember – even if rates did fall to -1.00% a year from now, and if our 30-year bond soared in value to $1,793 a year from now – ultimately our 30-year bond is going to mature at a value of $1,000. So, any gains above that value would eventually evaporate.

To spell it out: If interest rates do decline towards 0% or even below, hitting the “Sell” button would likely make sense at some point.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.