As it applies to the stock market, the rule is simple: Don’t Fight the Fed! When the Federal Reserve is pumping money, the stock market goes up. That’s pretty much all you need to know on that topic as far as the stock market is concerned.

With the bond market, things are a little different.

Ostensibly, an accommodative Fed is beneficial for the bond market as the goal is to force interest rates lower. Lower interest rates = higher bond prices. Simple. But not quite so simple 100% of the time. Because here is the “dirty little secret.” While the Fed exerts overwhelming influence over short-term interest rates, the same is not true of long-term interest rates.

Wait, what?

Yes, that’s the reality. It makes perfect sense that the Fed flooding the financial system with an ocean of cash (supply) would force the short-term cost of borrowing (demand) lower. But 30-years (as in, a 30-year bond) is a long time. A lot can happen along the way – rates may rise eventually, inflation may rise thereby decreasing the long-term value of fixed income investments, and so on. Did I mention that excessive Fed pumping can be inflationary in the long run?

The Big Picture…

I want to avoid making this into one of those “ominous doom and gloom about the future” pieces that are, quite frankly, pretty easy to write. I just want to highlight a few realities of the bond market that investors should put and keep in the back of their heads.

To boil it all down as succinctly as possible, bond prices move primarily based on:

*Current liquidity

*Perceptions regarding future liquidity

*Current inflation

*Perceptions regarding future inflation

(Note: Non-treasury issued bonds fluctuate based on creditworthiness)

The State of “Things” Today

So where do “things” stand at the moment? As near as I can tell, thusly:

*Current liquidity (“Things are swell! The Fed is pumping like crazy!”)

*Perceptions regarding future liquidity (“Things are swell! The Fed has stated that they will keep pumping like crazy!”)

*Current inflation (“Inflation? Inflation? What’s inflation?”)

*Perceptions regarding future inflation (“What, me worry?”)

Now let’s take a closer look at other “things”.

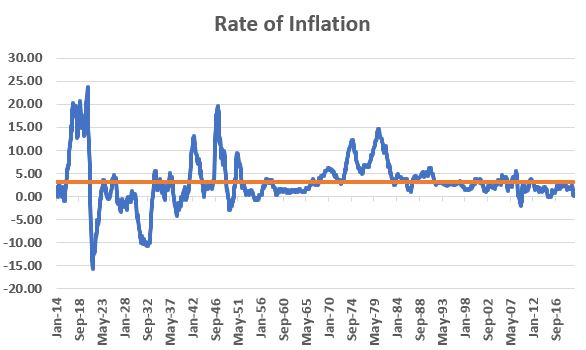

In Figure 1 we see the rate of inflation (measured using the 12-month change in the Consumer Price Index) since 1914. As you can see, in the past 30+ years inflation has not really been much of an issue. But do take a glimpse at the left 2/3’s of the chart and note the, um, “fluctuations”.

Figure 1 – Rate of Inflation 1914-present; inflation has not been a concern in over 30 years

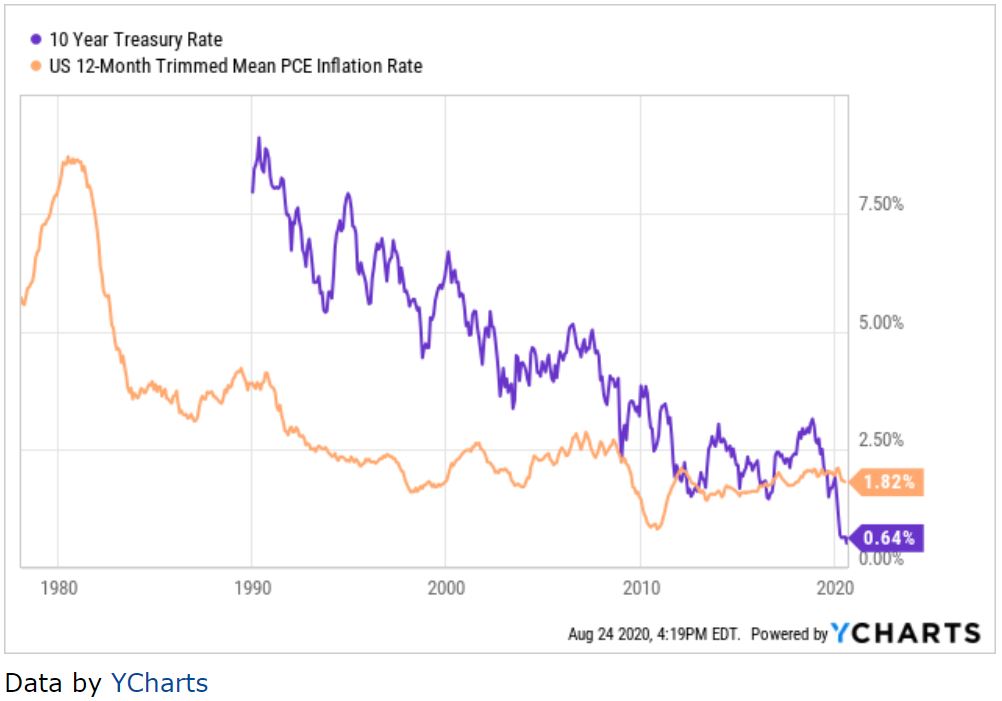

In Figure 2 from www.QCharts.com we see the general correlation between interest rates and inflation. At the moment – and essentially for the past 40 years – no problem.

Figure 2 – 10-Year Treasury Yield versus Inflation; Bond Yields are highly correlated to the trend in inflation (Source: www.QCharts.com)

…The Lesson for Today

There is no “call to action” in today’s piece. I am not even issuing any “stark warnings”. The purpose is merely to alert you to a fact of life that roughly 99.99% of all investors have completely forgotten in the past 30-40 years.

The thing I would ask you to put into the back of your head is this:

*Low inflation WILL NOT last forever!

More to follow.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.