I have written lately (also here) about my belief that the investment landscape in the next 10 years will look very different from the last 10 years. This article (“A Sharp Market Selloff Looms Amidst A Historic Capital Rotation”) from KCI Research Ltd. is of the same vein. While I am not necessarily issuing any warnings about an imminent sharp market selloff, I do agree with a lot of the future possibilities highlighted in the article.

Most notably:

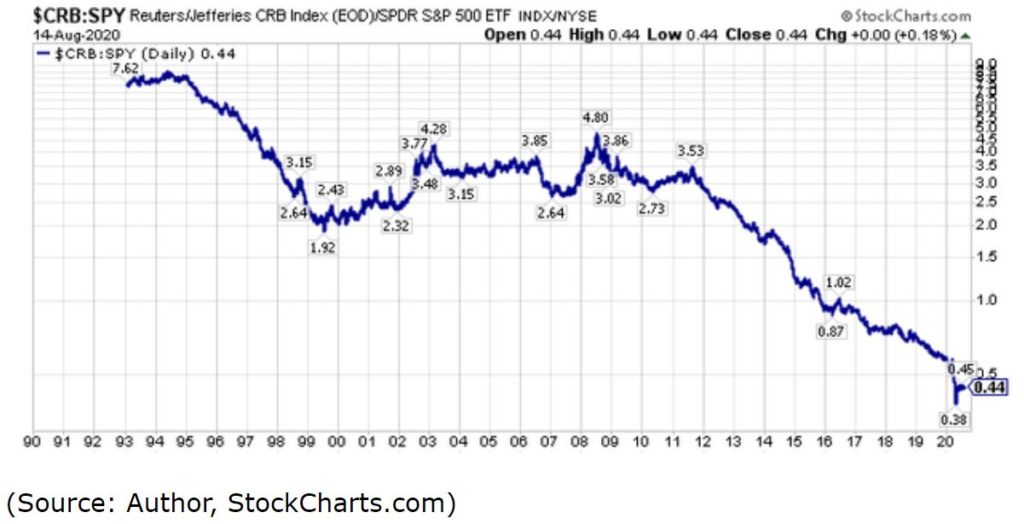

#1. Commodities are loathed, despised, hated and seriously undervalued relative to the S&P 500 Index. This is unlikely to last forever. Figure 1 displays the performance of the CRB Commodity Index by an ETF that tracks the S&P 500 Index.

Figure 1 – Commodities seriously undervalued relative to S&P 500 (Source: StockCharts.com)

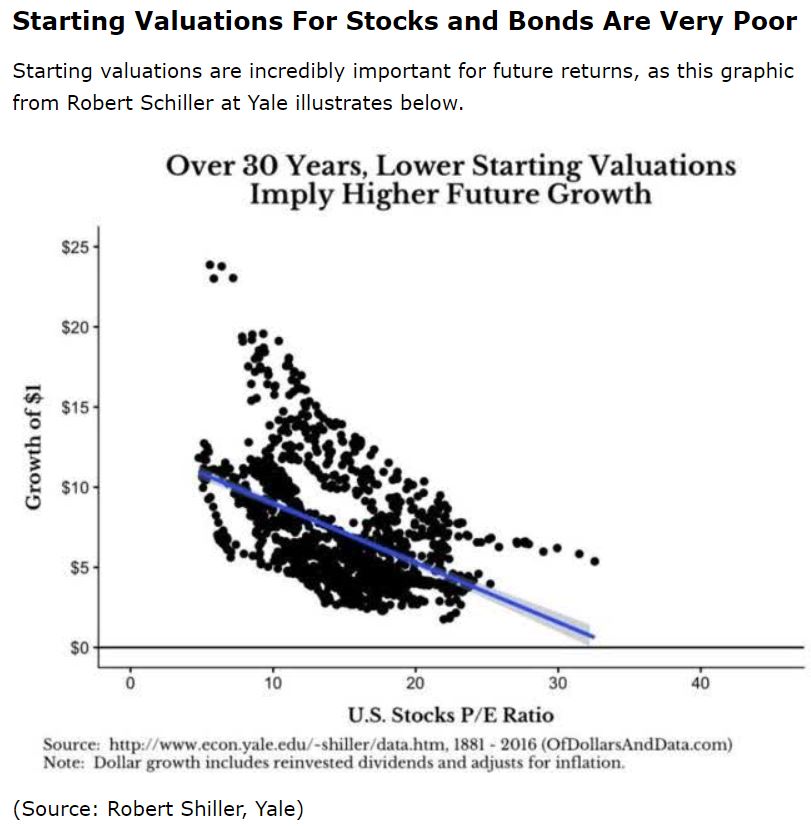

#2. The Shiller P/E Ratio is at 31.78, one of its highest readings ever. This suggests much lower longer-term returns going forward (i.e., low P/E’s tend to be followed by higher long-term returns and vice versa)

Figure 2 – Current Valuations as a predictor of future long-term results (Source: Robert Shiller)

#3. Large-Cap/Growth/Tech/Momentum is presently all the rage. If there is one things we should have learned from the markets by now, it is that no trend last forever. This one WILL NOT be an exception.

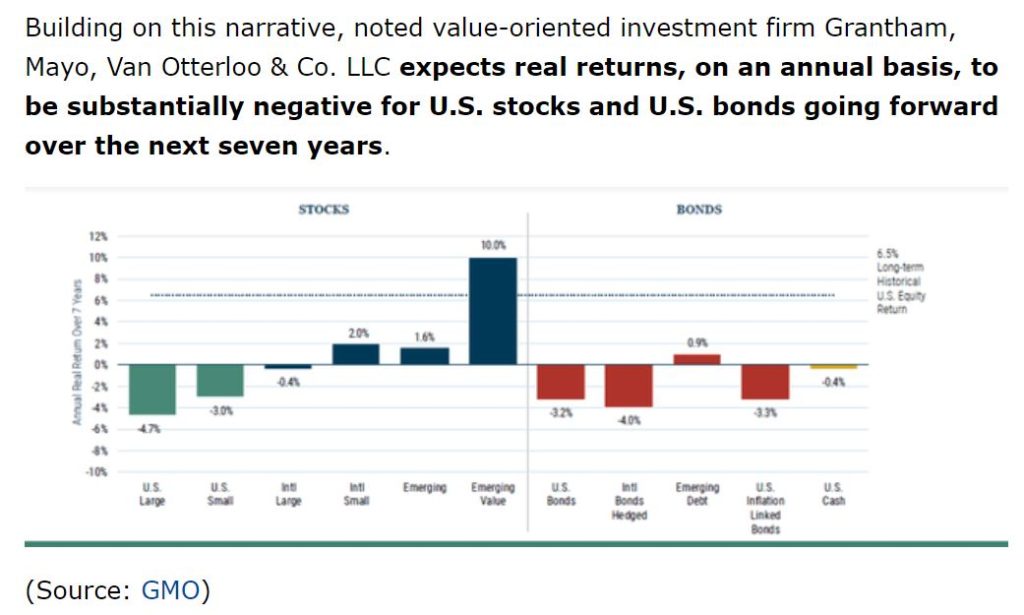

While the projections in Figure 3 are just that – someone’s projections, and may or may not come true, they highlight the potential for a very different market environment in the years ahead than the one that investors have grown very accustomed to of late.

Figure 3 – A serious rotation in relative returns (Source: GMO)

As I have stated in the past, I still see a lot of this stuff NOT as “a call to action”, but rather as “a call to pay attention.”

So, um, pay attention.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.