In a series of recent articles (here, here and here) I wrote about seasonality in the bond market. In this piece we will look at a “practical application”.

The Caveats

*Everything that I write here should be considered “food for thought” and NOT “an immediate call to action.”

*Trading a leveraged fund has inherent risks that an investor should carefully consider BEFORE entering a position.

The Strategy

This strategy uses funds available at Profunds, as follows:

*FYAIX (Access Flex High Yield) – High yield bonds

*GVPIX (U.S. Government Plus – 20+ year treasuries leveraged 1.25 to 1)

*MPIXX – Government Money Market fund

The Baseline

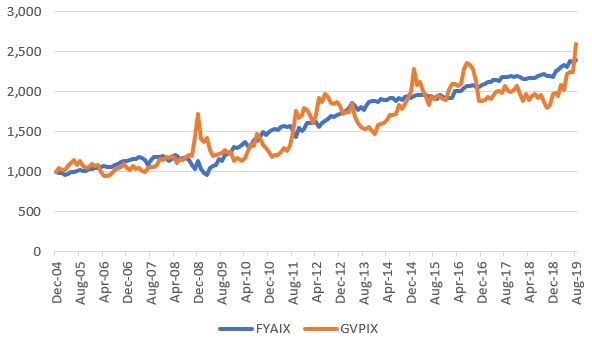

Figure 1 displays the growth of $1,000 invested in FYAIX and GVPIX on a buy-and-hold basis starting 12/31/2004 through 8/31/2019

Figure 1 – Growth of $1,000 invested in High Yield Bonds (FYAIX; blue) and Long-Term Treasuries (GVPIX – orange); 12/31/2004-8/31/2019

*$1,000 in FYAIX grew to $2,398

*$1,000 in GVPIX grew to $2,600

Jay’s Profunds Bond Calendar

Now let’s use the following calendar:

| Jan | FYAIX |

| Feb | FYAIX |

| Mar | FYAIX |

| Apr | FYAIX |

| May | GVPIX |

| Jun | GVPIX |

| Jul | GVPIX |

| Aug | GVPIX |

| Sep | MPIXX |

| Oct | MPIXX |

| Nov | MPIXX |

| Dec | FYAIX |

Figure 2 – Jay’s Profunds Bond Calendar

Results

Figure 3 displays the growth $1,000 invested using the calendar in Figure 2 versus buying and holding either FYAIX or GVPIX

Figure 3 – Growth of $1,000 invested using Jay’s Profunds Bond Calendar (blue line) versus buying and holding FYAIX or GVPIX; 12/31/1994-8/31/2019

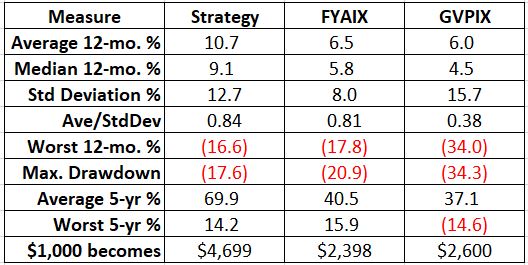

Figure 4 displays the relevant facts and figures.

Figure 4 – Jay’s Profunds Bond Calendar System versus buy-and-hold

The key things to note is that the Calendar System:

*Generated significantly more return

*Had a lower drawdown

*Generated more consistent returns

Summary

Is this anyway to trade the bond market?

Well it’s one way.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.