In Part I here, I highlighted a 4-bond index portfolio (convertible bonds, high yield corporate bonds, long-term treasury and intermediate-term treasury) that:

*Gained almost as well as long-term treasuries

*Did so with a lot less volatility

*Has the potential to outperform long-term bonds if rates ever do rise again

In Part II here, I added seasonality to the mix, which:

*Involved holding only 2 of the 4 indexes each month

*Increased total return by roughly 3.5 times.

In Part III, we will go “out there” even further and – once again using seasonality – will hold only one index per month.

In the simplest terms possible, going from a buy/hold/rebalance approach using four bonds indexes to a hold one fund per month based on seasonality approach, moves one significantly higher up the “potential risks” and “potential rewards” spectrum.

The Indexes

The four indexes included in our testing are:

*Bloomberg Barclay’s Convertible Bond Index

*Bloomberg Barclays High Yield Very Liquid Index

*Bloomberg Barclays Treasury Long Index

*Bloomberg Barclay’s Intermediate Index

ETFs that either track these indexes (or something very similar) are:

Convertibles: CWB – SPDR Barclays Capital Convertible Bond ETF (tracks the Barclays Capital U.S. Convertible Bond >$500MM Index)

High Yield: JNK – SPDR Barclays High Yield Bond ETF (tracks the Barclays Capital High Yield Very Liquid Index) OR HYG – iShares iBoxx $ High Yield Corporate Bond ETF (tracks the iBoxx $ Liquid High Yield Index)

Long-Term Treasury: TLT – iShares 20+ Year Treasury Bond ETF (tracks the Barclays Capital U.S. 20+ Year Treasury Bond Index)

Intermediate-Term Treasury: IEI – iShares 3-7 Year Treasury Bond ETF (tracks the Barclays Capital U.S. 3-7 Year Treasury Bond Index)

For testing purposes, we are going to use the four Bloomberg Indexes listed as they provide a longer period of test data.

The Calendar

| Month | Index | ETF |

| Jan | Bloomberg Barclay’s Convertible Bond Index | CWB |

| Feb | Bloomberg Barclay’s Convertible Bond Index | CWB |

| Mar | Bloomberg Barclay’s Convertible Bond Index | CWB |

| Apr | Bloomberg Barclays High Yield Very Liquid Index | JNK (or HYG) |

| May | Bloomberg Barclays Treasury Long Index | TLT |

| Jun | Bloomberg Barclays Treasury Long Index | TLT |

| Jul | Bloomberg Barclays Treasury Long Index | TLT |

| Aug | Bloomberg Barclays Treasury Long Index | TLT |

| Sep | Bloomberg Barclay’s Treasury Intermediate Index | IEI |

| Oct | Bloomberg Barclay’s Treasury Intermediate Index | IEI |

| Nov | Bloomberg Barclay’s Treasury Intermediate Index | IEI |

| Dec | Bloomberg Barclay’s Convertible Bond Index | CWB |

Figure 1 – Jay’s 1-Bond Index per Month Calendar

As you can see, this “strategy” involves 4 trades a year.

The Results

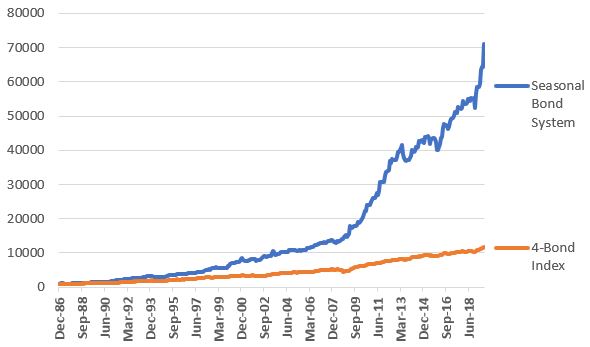

Figure 2 displays the hypothetical growth of $1,000 invested using the “One index at a time System” versus buying and holding (and rebalancing once a year) all four indexes.

Figure 2 – Growth of $1,000 invested using Jay’s 1-Bond Index per Month Strategy versus Buy/Hold/Rebalance All 4 Indexes; 1986-2019

Figure 3 displays the relevant comparative figures.

| Measure | 1-Bond Index per month Seasonal System | 4 Indexes Buy/Hold/Rebalance |

| Average 12 month % +(-) | 13.9% | 8.0 |

| Std. Deviation % | 10.00% | 6.77 |

| Ave/StdDev | 1.39 | 1.18 |

| Max Drawdown% | (-11.6%) | (14.8) |

| $1,000 becomes | $71,052 | $11,774 |

Figure 3 – Jay’s 1-Bond Index per Month Strategy versus Buy/Hold/ Rebalance; 1986-2019

From 12/31/1986 through 8/31/2019 the 1 Index per month Seasonal System gained +7,005% versus +1,077% (6.50 times as much) as the buy/hold and rebalance method.

Summary

So, is this 1 -Bond Index per month Seasonal Bond System the “be all, end all” of bond investing? Probably not. Anytime you go from trading a diversified portfolio of anything, to just one security at a time you introduce a potential level of risk that can clobber a portfolio when things go wrong “that one time.”

At the same time, a return that is 6.5 times a simple buy-and-hold approach may warrant some consideration as long as one comprehends the potential risks involved.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.