Many traders are aware of the connection between the stock market and the 4-year presidential election cycle. Not many are aware of the connection between long-term treasury bonds and the same election cycle.

The Calendar

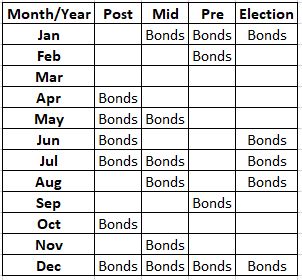

Figure 1 displays my own “calendar” for long-term treasuries as it relates to the 4-year cycle.

Figure 1 – Jay’s Election Cycle Bond Calendar

So how do bonds perform relative to this calendar?

The Test

For testing purposes (though not necessarily for trading purposes) we will use ticker VWESX (Vanguard Long-Term Treasury Fund) which has data going back to 1973. For testing purposes, we will refer to those months labeled “”Bonds” in Figure 1 as “Good Months” and all other months as “Other Months.”

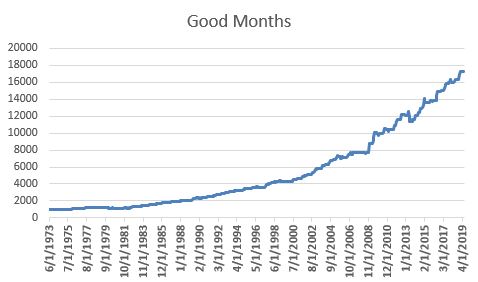

Figure 2 displays the relative performance between “Good Months” and “Other Months”.

Figure 2 – Good Months versus Other Months

Notes:

*The “average” Good Month gained four times the “average” Other Month

*The “median” Good Month gained over three times the “median” Other Month

*Good Months had a slightly lower standard deviation than Other Months

*In 242 “Good Months” since 1973 VWESX gained +1,620%

*In 309 “Other Months” since 1973 VWESX gained +131%

Figure 3 displays the cumulative growth of $1,000 invested in VWESX ONLY during “Good Months”.

Figure 3 – Growth of $1,000 in VWESX ONLY during Good Months

Figure 4 displays the cumulative growth of $1,000 invested in VWESX ONLY during “Other Months”.

Figure 4 – Growth of $1,000 in VWESX ONLY during Other Months

Summary

Is any of this actually useful? Hey, I just report what I see, you take it from there.

In Part II we will look at an actual trading application.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.