If I had a dollar for every time I’ve heard “gold is set to soar in the coming days/weeks/months/years ahead” since I started in this business, Jeff Bezos would be bringing me coffee. You would think at some point investors would just tune out all the gold hype and move on. Yet the allure remains.

And now here we are again. Go onto any financial news aggregating site and you will find plenty of “gold is ready to move” material. Actually, it seems to usually appear with a question mark attached, as in “Is Gold About to Soar?” (reminding us once again of that important market forecasting adage which states: Nobody knows anything”) rather than in declarative form, i.e., “Gold is Set to Soar.” But it doesn’t rally matter, the effect is the same. Call it “Gold Angst”. Investors sit there and wonder “should I or shouldn’t I” take the plunge?

Here is one way to get the whole gold angst thing off your plate: Buy the January 2021 GDX 22 strike price call. Now – and as always – this is not an actual “investment recommendation”. I have no firm opinion as to whether or not this position will ultimately make money. But here is what it does do:

*It gives an investor a position in gold (OK, sort of, since we are merely buying shares of an ETF that tracks gold stocks)

*It gives gold about a year and a half to decide whether or not it finally wants to make a move.

*It doesn’t cost very much

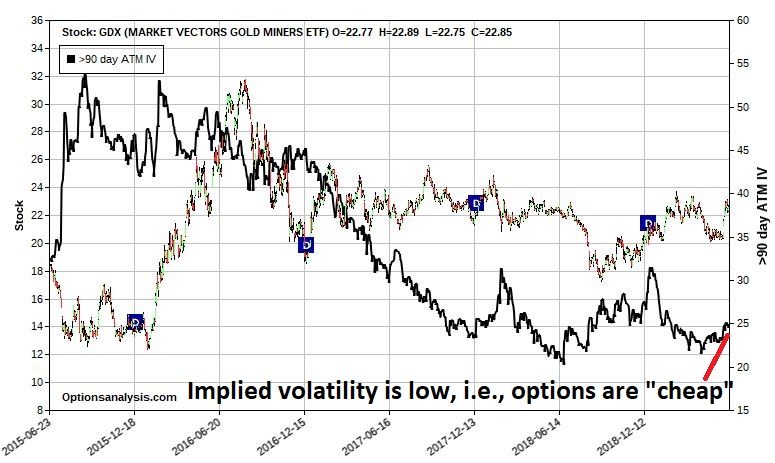

As you can see in Figure 1, the implied volatility for options on GDX is still at the low end of the historical range. What this means to option trader is that the time premium built into GDX options is relatively low, i.e., options are “cheap”. If volatility picks up at some point in the next year and a half, the time premium built into the options will increase, which could boost the profitability of a long position (or at least reduce the downside loss in the interim). Figure 1 – Long Jan2021 GDX 22 call (Courtesy www.OptionsAnalysis.com)

Figure 1 – Long Jan2021 GDX 22 call (Courtesy www.OptionsAnalysis.com)

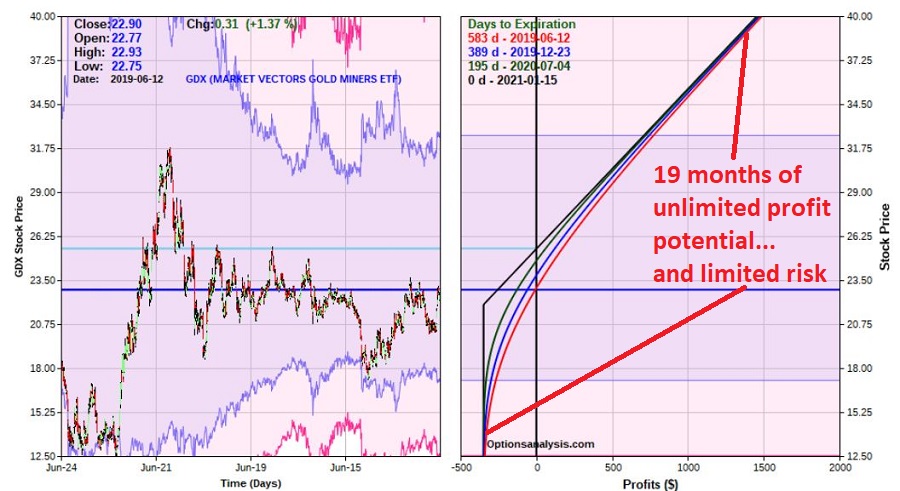

Figure 2 displays the trade particulars and Figure 3 displays the risk curves. Figure 2 – GDX Jan 2021 22 call (Courtesy www.OptionsAnalysis.com)

Figure 2 – GDX Jan 2021 22 call (Courtesy www.OptionsAnalysis.com)

Figure 3 – GDX Jan 2021 22 call risk curves (Courtesy www.OptionsAnalysis.com)

Figure 3 – GDX Jan 2021 22 call risk curves (Courtesy www.OptionsAnalysis.com)

It’s pretty straightforward. If gold does not rally in the next year and a half this position can lose up to $348. If gold does rally in the next year and a half, this position can make good money – potentially a lot if the people screaming “Gold is About to Soar” ever actually turn out to be right.

Summary

Bottom line: Gold has rallied many times in the past several years only to peter out and sink, so there is reason to doubt the recent “pop” in price. What happens from here? I am offering no opinion. So, don’t go out and buy GDX options solely because you read this article.

But if you find yourself suffering from “Gold Angst” do consider the possibilities. By buying a cheap call option (risking maybe 1% to 3% of one’s investment capital) an investor has a position in gold and the “should I or shouldn’t I jump into gold” angst is relieved. If the bullish forecasts actually turn out to be correct in the next 19 months the possibility to make a decent return exists. And if not, the investor has sacrificed 1% to 3% of his or her investment capital.

In sorting things out, this simple two question quiz may help:

- Are you feeling angst because you think gold may make a big move and you will be left out?

- Do you have $348 bucks?

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.