There sure are a lot of ETFs out there. I mean let’s face it, the marketing and product development people stay up late. If they discern even a hint of potential interest in a small-cap growth fund that invests only in marijuana companies whose ticker symbol starts with the letter “A” then by god, there will be an ETF that “affords investors the opportunity to invest in this unique niche” (those marketing folks sure can turn a phrase can’t they). They might even create a “series of ETFs” – POT-A, POT-B, POT-C, etc. Then another ETF provider will copycat and launch BUZZ-A, BUZZ-B, BUZZ-C and so on. Next comes the large-cap, value and dividend-paying versions. You get the idea.

So, the reality is that there are roughly – and I am just spit-balling here – a bazillion ETFs in existence now. And the reality is that alot of them never gain any real traction and fail to garner any meaningful trading volume. And sometimes a nugget gets lost in their midst. Take ticker SDYL for example. But first…

The S&P 500 High Yield Dividends Aristocrats Index

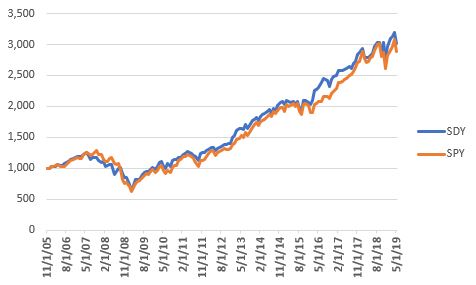

The S&P High Yield Dividend Aristocrats Index (apparently the folks who create indexes are staying up late too) is comprised of the 50 highest dividend yielding constituents of the stocks of the S&P Composite 1500 Index that have increased dividends every year for at least 25 consecutive years. Data for the index goes back to January 2000. Figure 1 displays the theoretical growth of $1,000 invested in the index versus the growth of $1,000 invested in the S&P 500 Index starting in January 2000.

Figure 1 – Growth of $1,000 invested in the S&P High Yield Dividend Aristocrats Index and the S&P 500 Index; 12/31/1990-5/31/2019

As you can see, since inception the index has significantly outperformed the S&P 500 Index, posting a gain of +551% versus +173% for the S&P 500. Of course, you can’t trade an index, you must trade a fund or ETF that attempts to track the given index. So, we turn our attention to…

Ticker SDY

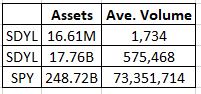

Ticker SDY is the SPDR ETF (SPDR S&P Dividend ETF) that tracks the S&P High Yield Dividend Aristocrats Index. The first full month of trading for SDY was December 2005. So, Figure 2 displays the growth of $1,000 invested in ticker SDY starting in December 2005 versus the growth of $1,000 invested in ticker SPY – an ETF that tracks the S&P 500 Index.

Figure 2 – Growth of $1,000 for SDY and SPY since 11/30/2005

Since SDY started trading it has slightly outperformed ticker SPY (+201% verus +189%). Combined with the index performance prior to SDY inception, this is pretty good all by itself. But it’s NOT good enough for the marketing person in the wee hours! And then it hit them – what we need is a leveraged version! Which leads us to…

Ticker SDYL

Ticker SDYL is the ETRACS Monthly Pay 2xLeveraged S&P Dividend ETN, an Exchange Traded Note linked to the monthly compounded 2x leveraged performance of the S&P High Yield Dividend Aristocrats® Index (the “Index”), reduced by the Accrued Fees. The first full month of trading for SDYL was June of 2012. Figure 3 displays the growth of $1,000 invested in SDYL, SDY and SPY since 5/31/2012.

Figure 3 – Growth of $1,000 for SDYL, SDY and SPY since 5/31/2012

Since 5/31/12:

SDYL = +418%

SDY = +143%

SPY = +148%

So does this mean SDYL is the best choice? Not necessarily. While it has made more than twice as much as the other 2 ETFs, that performance comes at the price of an average standard deviation and a maximum drawdown that is also twice as large. So, the risk factor is something to consider. But that’s no even the real problem. The real problem is that SDYL barely trades at all.

As you can see Figure 4, SDYL has failed to gain any traction with investors and holds only $16.6 million in assets and trades a paltry 1,734 shares a day. SDY trades 332 times as many shares per day as SDYL and SPY trades 42,302 time as many shares per day as SDYL.

Figure 4 – $’s in assets and average daily trading volume

Summary

For investors looking for profit potential, SDYL – at first blush looks – terrific. But will enough investors ever take notice enough for SDYL to trade with any real volume?

I don’t know. Maybe the marketing people need to stay up even later and figure out how to whip up some interest.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Bit of a short term track record for $SDY and $SDYL.

Joe, agreed. However, they do track the HY Dividend Aristocrats Index pretty closely and that has 19 years of history (which granted, some may not consider long enough to draw conclusions either). In any event, the stuff I post on the blog are “food for thought” only, not recommendations. BTW, I love your site (www.mcmverryreport.com) and visit every day! Take Care, Jay