Options are foreign to many investors. And yes, there is a degree of complexity and a necessary learning curve involved. But understanding even a few basic option strategies can open a world of opportunity.

In a nutshell I typically describe options as offering 3 basic avenues:

*Expressing a market opinion (i.e., profiting if a security moves in the direction you think it will go), typically at a fraction of the cost of trading shares of stock

*Hedging an existing position or portfolio (i.e., the ability to protect yourself without having to sell your stock holdings)

*Taking advantage of unique situations (selling premium to make money in a neutral market, buying a straddle to profit if a move takes place in either direction, and so on.)

What follows is NOT a recommended trade or opportunity. It is simply an example that compares buying stock versus buying an option to illustrate the relative pros and cons.

Ticker CMCSA

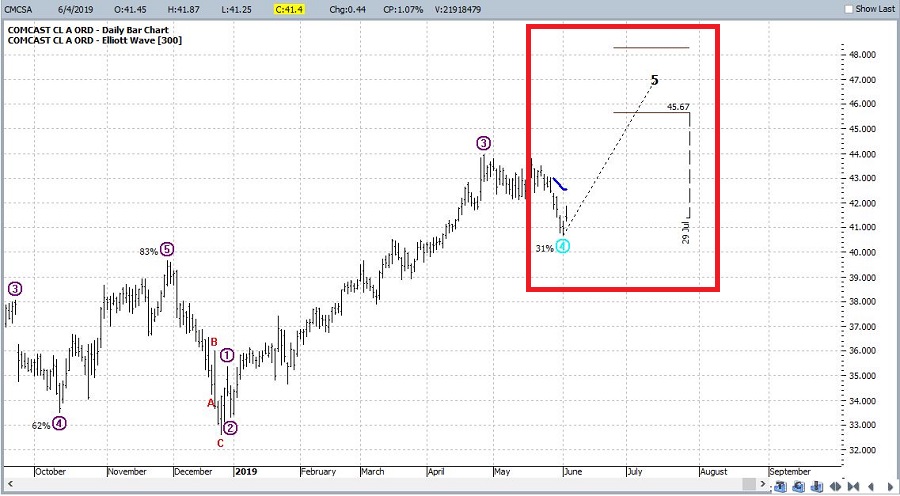

According to the Elliott Wave count from ProfitSource by HUBB, Comcast (CMCSA) is setting up for a Wave 4 advance in price. Now the caveats: I like and use ProfitSource and I find the built in Elliott Wave count to be useful. That being said, no given “setup” or “Wave count” is EVER guaranteed to pan out. I have no idea whether this latest count for CMCSA will ultimately be a good one or a bad one. In this instance I am simply using it as a potential catalyst for a hypothetical trade for illustrative purposes.

Figure 1 – Potentially bullish Elliott Wave count for CMCSA (Courtesy ProfitSource by HUBB)

Figure 1 – Potentially bullish Elliott Wave count for CMCSA (Courtesy ProfitSource by HUBB)

This wave count is projecting that CMCSA will rise to somewhere between $45.67 and $48.30 by the end of July.

Let’s assume that we believe the wave count in Figure 1 will play out and that we want to speculate on this opportunity. The simplest approach would be to buy 100 shares of CMCSA stock. With the stock trading at $41.40 a share, this would involve spending $4,140 to buy 100 shares. This position appears in Figure 2. Note that for every $1 the stock goes up the position makes $100 and vice versa. A 100 shares of stock position has a “delta” of 100.

Figure 2 – Buy 100 shares of CMCSA (Courtesy www.OptionsAnalysis.com)

Figure 2 – Buy 100 shares of CMCSA (Courtesy www.OptionsAnalysis.com)

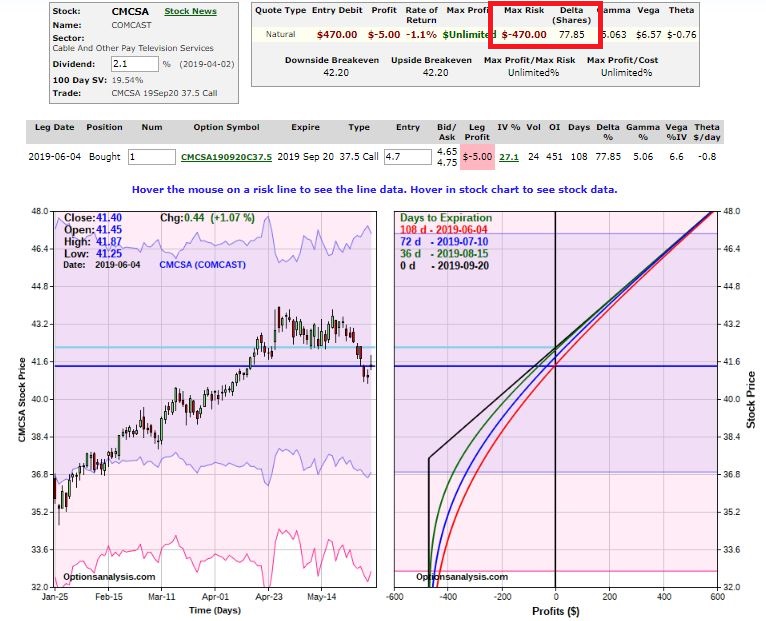

Another possibility (among many) would be to buy the September 37.50 strike price call for $470. This is only about 10% of what the stock trader must put up. This trade appears in Figure 3.

Figure 3 – Buy 1 Sep2019 37.5 strike price call (Courtesy www.OptionsAnalysis.com)

Figure 3 – Buy 1 Sep2019 37.5 strike price call (Courtesy www.OptionsAnalysis.com)

A few things to note:

*The worst-case loss for the option trade is -$470

*The trade has a “delta” of roughly 78. While delta value can and will change over time, for now it means that this position is essentially equivalent to holding 78 shares of stock. In other words, the option buyer in this example buys 78 deltas for $470 versus the stock trader who buys 100 deltas for $4,410.

How will this all play out? It beats me (and remember I am NOT suggesting that CMCSA is bullish nor am I recommending either of these positions).

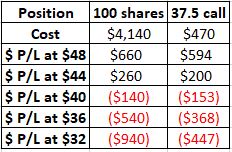

Figure 4 displays the expected dollar profit or loss from the two positions at various prices for CMCSA stock as of the end of July.

Figure 4 – Expected $ P/L at various price at end of July

Note that at higher price the call option makes almost as much total $ return as the stock position while committing 90% less capital. Likewise, as price sinks progressively lower the stock position just keeps losing more and more, while the option position cannot lose more than $470.

While the number are helpful, still probably the best way to illustrate the relative tradeoffs is to overlay the two position on one chart. See Figure 5.

Figure 5 – Comparative Risk Curves for stock versus option (Courtesy www.OptionsAnalysis.com)

Figure 5 – Comparative Risk Curves for stock versus option (Courtesy www.OptionsAnalysis.com)

Summary

So, is better to buy the call option than the stock shares? That’s for each trader to decide in each situation. While in this illustration the option appears to have some advantages, another scenario involves the stock “going nowhere” for a while before making a move higher. In that scenario the stock trader can simply hold the stock shares and wait. The option will expire in September and the option trader will have to make another trading decision.

In any event, remember that the purpose of this article is NOT to prompt you to take action regarding CMCSA. The purpose is simply to illustrate the relative pros and cons of options versus stocks in certain situations.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Why don’t you do an article on how to hedge a portfolio with options for newcomers to options.

Glenn, that’s a great idea! Thanks for the comment, Jay