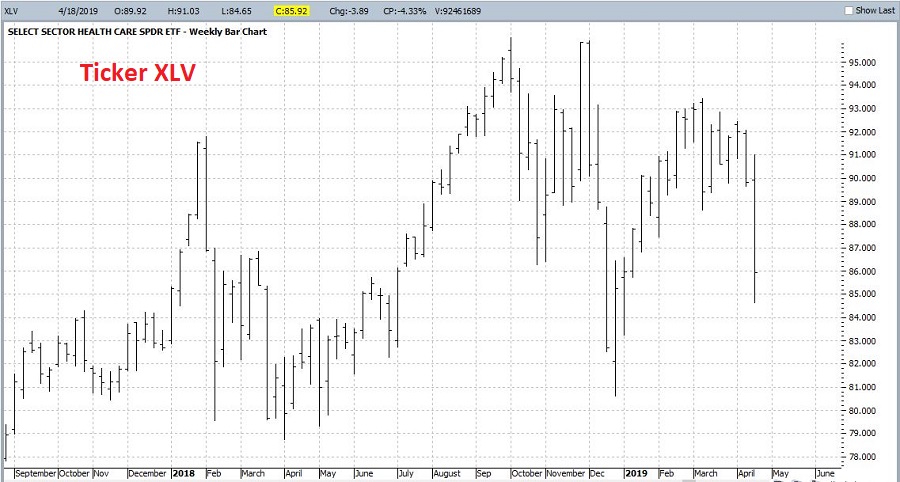

The big news in the stock market of late was the beating absorbed by the health care sector. Virtually every subgroup within the broader health care umbrella sold off heavily last week. As you can see in Figure 1, to a lot of technical analyst types, this looks like a breakdown form a “classic” multiple top formation. And they may be on to something.

Figure 1 – Ticker XLV (Courtesy ProfitSource by HUBB)

Figure 1 – Ticker XLV (Courtesy ProfitSource by HUBB)

Definitely, not a pretty picture. But is the end nigh for health care stocks?

For the record:

*In general, I am not a fan of buying into “things” that have just broken down.

*I am not “predicting” an imminent turnaround, nor am I “recommending” the health care sector.

*What I am doing is highlighting the historical tendency for health care to perform well during the period of May through July.

The Funds

For testing purposes, I am using the Fidelity health care regulated sector funds. The test starts in 1981 with just FSPHX, with other funds added as they came into existence.

FSPHX – Health Care (July 1981)

FBIOX – Biotech (December 1985)

FSHCX – Health Care Services (June 1986)

FSMEX – Medical Technology and Devices (April 1998)

FPHAX – Pharmaceuticals (June 2001)

For each year we look at the performance for these funds during May through July.

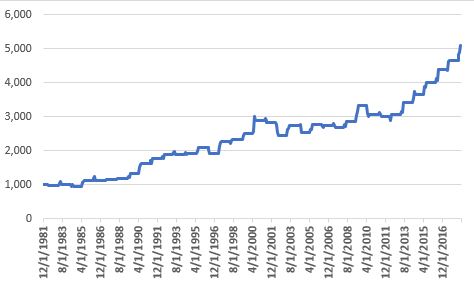

Figure 2 displays the cumulative growth of $1,000 invested only in these healthcare related funds during May, June and July.

Figure 2 – Growth of $1,000 invested in Fidelity healthcare-related sector funds May-July ONLY (1982-2018)

Figure 3 displays the year-by-year results

| Year | % +(-) |

| 1982 | (0.6) |

| 1983 | 1.4 |

| 1984 | (4.7) |

| 1985 | 15.9 |

| 1986 | 0.5 |

| 1987 | 4.1 |

| 1988 | 1.6 |

| 1989 | 12.8 |

| 1990 | 20.9 |

| 1991 | 10.4 |

| 1992 | 5.5 |

| 1993 | 1.2 |

| 1994 | 0.7 |

| 1995 | 9.1 |

| 1996 | (7.6) |

| 1997 | 17.9 |

| 1998 | 2.5 |

| 1999 | 7.4 |

| 2000 | 15.1 |

| 2001 | (1.6) |

| 2002 | (13.9) |

| 2003 | 11.9 |

| 2004 | (6.7) |

| 2005 | 9.2 |

| 2006 | (1.3) |

| 2007 | (2.3) |

| 2008 | 6.6 |

| 2009 | 16.6 |

| 2010 | (7.9) |

| 2011 | (2.5) |

| 2012 | 2.0 |

| 2013 | 12.1 |

| 2014 | 7.1 |

| 2015 | 9.3 |

| 2016 | 9.6 |

| 2017 | 5.8 |

| 2018 | 9.2 |

Figure 3 – Year-by-Year May-July % +(-)

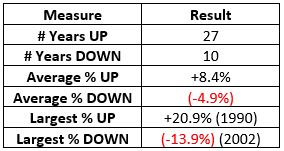

Some things to note:

Figure 4 – Summary Results (1982-2018)

Summary

So, is healthcare certain to “bounce” in the months ahead? Not at all. While the results shown here display a positive bias there is no “sure thing” edge built in.

Still, the main point is that history does seem to suggest that now may not be the ideal time for investors to panic and dump their healthcare holdings. Likewise, shorter-term traders might look for some buying opportunities in this sector in the near-term.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

You are very correct about Healthcare sector being bullish between May and August months.