The “Election Cycle” is a widely acknowledged “thing” stock market. As it turns out there may be uses elsewhere. Take gold mining stocks for instance.

The Calendar

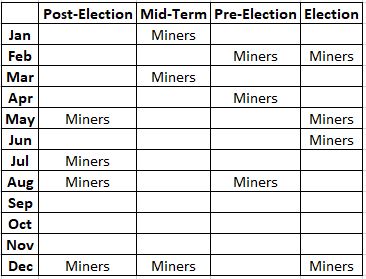

After the election cycle ending in 2008, I developed the calendar below.

Figure 1 – Jay’s Gold Stock Calendar

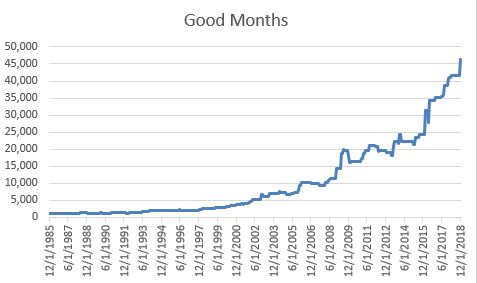

Figure 2 displays the growth of $1,000 invested in FSAGX only during the months labeled “Miners” in Figure 1.

Figure 2 – Growth of $1,000 invested in ticker FSAGX only during “Good Months” (those labeled “Miners” in Figure 1); 12/31/1985-12/31/2018

Figure 3 displays the growth of $1,000 invested in FSAGX only during the months NOT labeled “Miners” in Figure 1.

Figure 3 – Growth of $1,000 invested in ticker FSAGX only during “Other Months” (those NOT labeled “Miners” in Figure 1); 12/31/1985-12/31/2018

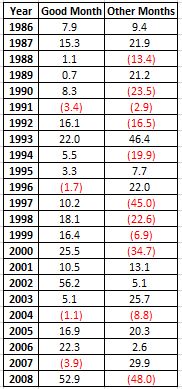

Figure 4 displays the annual results for the “Good Months” versus the “Other Months” through the end of the initial 1986-2008 testing period.

Figure 4 – Annual Results during Testing Period; 12/31/1985-12/31/2008

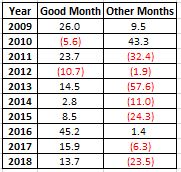

Figure 5 displays the annual results since 2009.

Figure 5 – Annual Results starting in 2009

Important Note

First off, as always, I am not recommending the above as a trading system that you should go out and risk money on. That being said, it should be noted that the results shown here are generated using Fidelity Select Gold (FSAGX). Traders should be aware that Fidelity has certain switching restrictions that could impact one’s ability to use the schedule shown in Figure 1. A likely alternative is ticker GDX (Market Vectors Gold Miners ETF).

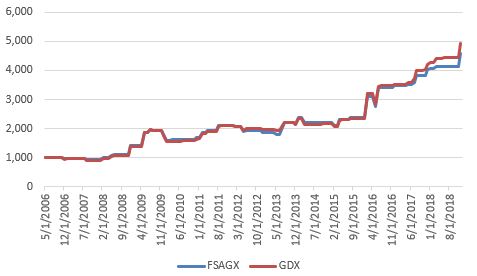

For the record, since GDX started trading in 2006, the results generated using the calendar in Figure 1 have been slightly higher with GDX, as show in Figure 6.

Figure 6 – Growth of $1,000 in FSAGX versus GDX since 2006

Summary

So, is this the “Holy Grail of Gold Stock Trading”? Let me be very clear here – “Absolutely NOT”. Gold stocks are extremely volatile and as sure as you are reading this article, “Good Months” will experience some significant declines and “Other Months” will experience significant rallies.

With that warning firmly in place, still, the results might merit a closer look.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.