Well it’s not an investment idea that many people know – or even care – about. Nevertheless, opportunity is where you find it. Anyway, history suggests that January and February are a good time (in fact, the only good time really) to hold a long position in platinum.

The purest way to play platinum is via platinum futures – which is something that the vast majority of investors have no interest in doing (and given the risks involved – wisely so). Fortunately, there are alternatives. But more about that in a moment. First let’s highlight the facts.

Platinum by the Month

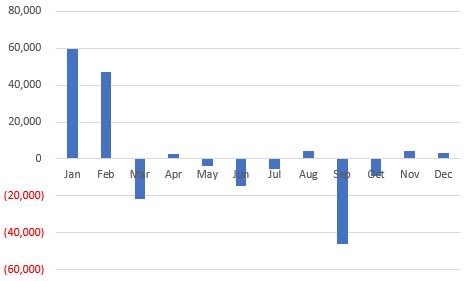

Platinum futures trade at a value of $50 per point. Figure 1 displays the cumulative gain by month achieved by holding a long position in platinum futures during each individual month starting in 1979.

Figure 1 – Platinum month-by-month (1979-2018)

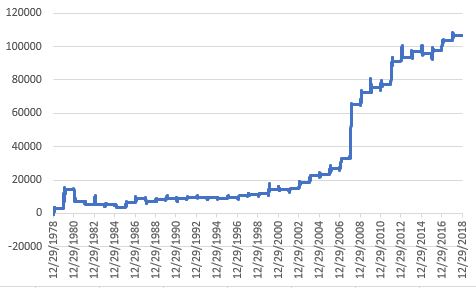

As you can see in Figure 1 the only months that show any kind of significance on the long side are January and February. Figure 2 shows the cumulative dollar gain achieved by holding a long position in platinum futures during Jan and Feb starting in 1979.

Figure 2 – Cumulative $ gain holding long platinum futures during January and February ONLY (1979-2018)

Some relevant facts:

*# times up = 32 (75%)

*# times down = 8 (35%)

*Average % +- = +8.0%

For what its worth, platinum has showed a gain during Jan-Feb in 22 of the past 23 years.

An Investment Alternative

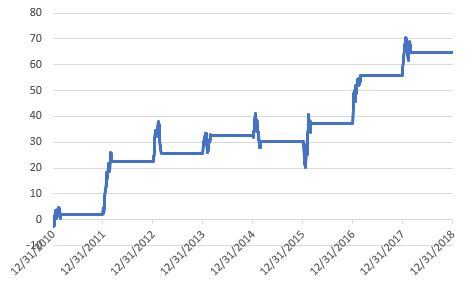

As I intimated earlier, trading platinum futures is not for most investors (In fact if one of your New Years Resolutions was “I need to trade more platinum futures” I strongly suggest you review the rest of your list carefully). One viable alternative is an ETF ticker symbol PPLT (Aberdeen Standard Physical Platinum Shares ETF), which is intended to track the price of platinum bullion. It started trading in 2010.

Figure 3 displays the cumulative % gain for PPLT only during Jan and Feb each year starting in 2011.

Figure 3 – PPLT cumulative Jan-FEb % +(-); 2011-2018

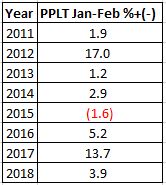

Figure 4 displays the year-by-year results for PPLT during Jan-Feb.

Figure 4 – PPLT Jan-Feb % +(-); 2011-2018

Summary

So, is platinum sure to rise between now and the end of February? Not at all. In fact, given that 22 of the last 23 years have seen a gain, some would argue that the law of averages suggests it is due for a down year.

But like I said, opportunity is wherever you find it.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.