I suppose a more accurate title would be, “A Bunch of Single Country ETFs, Interrupted”, but, well, that just doesn’t have quite the same succinct simplicity.

I always (always, always) try to make an effort to focus on “the current trend” and to avoid focusing on things that “maybe might prove to be ominous signs in retrospect” or to imply that a certain tidbit of information is predictive when in reality it is mostly just anecdotal. Still, human nature is – unfortunately, in this case – a powerful force. Which reminds me to invoke:

Jay’s Trading Maxim #17: Human nature is a detriment to trading and investment success, and should be avoided as much as, well, humanly possible.

The bottom line is that despite my very own warnings and admonitions, sometimes that pesky human nature gets the best of me.

What Has My Attention

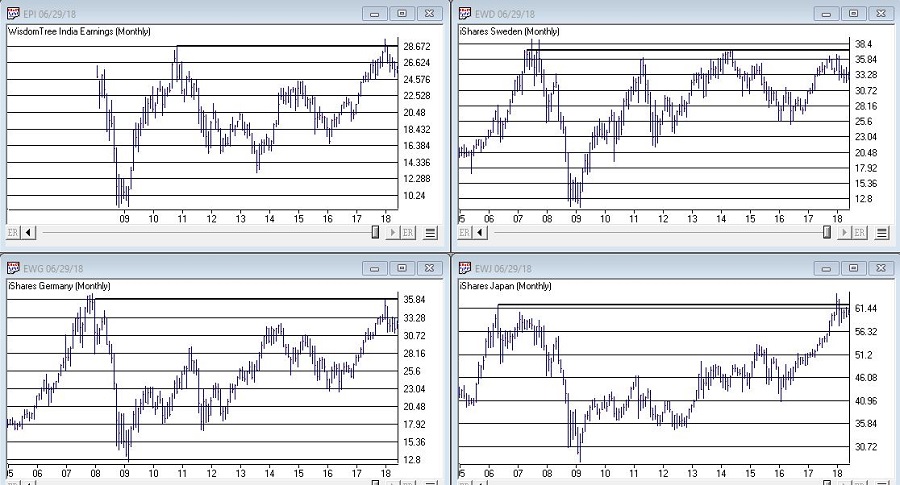

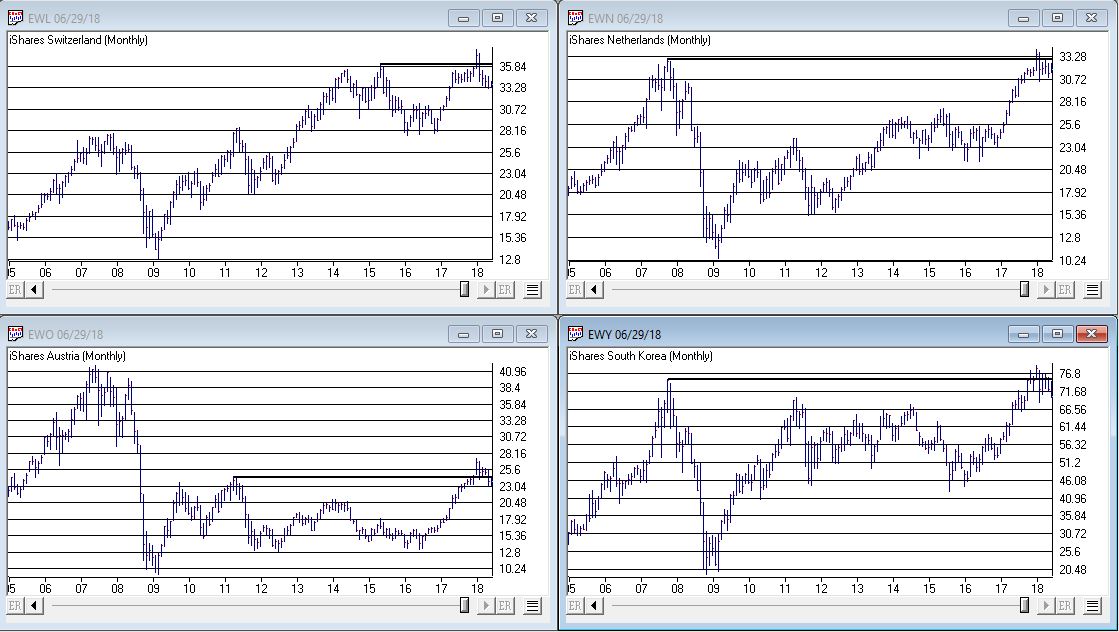

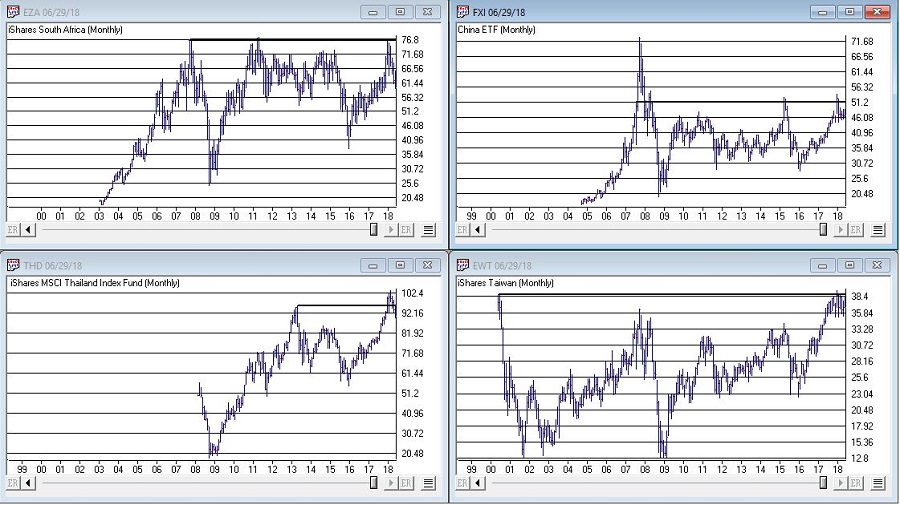

OK, rather than me telling you what I think, please simply peruse the charts in Figures 1, 2 and 3 and see if anything jumps out at you.

(click to enlarge) Figure 1 – India, Sweden, Japan, Germany (clockwise); (Courtesy AIQ TradingExpert)

Figure 1 – India, Sweden, Japan, Germany (clockwise); (Courtesy AIQ TradingExpert)

(click to enlarge) Figure 2 – Switzerland, Netherlands, South Korea, Austria (clockwise); (Courtesy AIQ TradingExpert)

Figure 2 – Switzerland, Netherlands, South Korea, Austria (clockwise); (Courtesy AIQ TradingExpert)

(click to enlarge) Figure 3 – South Africa, China, Taiwan, Thailand (clockwise); (Courtesy AIQ TradingExpert)

Figure 3 – South Africa, China, Taiwan, Thailand (clockwise); (Courtesy AIQ TradingExpert)

Perhaps you noticed the same thing I did, i.e., a whole bunch of single country ETF’s hitting new highs or testing old resistance and getting rejected. In a number of cases, after appearing to break out to new highs for a period of weeks or month only to fall back below the “line in the sand.”

It’s sort of like the World Cup of Failed Breakouts.

Summary

Now here’s the thing. I have displayed a bunch of charts that anecdotally seem to imply something bearish. To spell it out, failed breakouts are often – though definitely not always – followed by something much worse.

So the line of reasoning goes like this, “If the stock market in umpteen countries is failing to advance then this must be a bad thing.”

But the reality is that all these markets have to do is rally and this whole sort of made up area of concern goes away.

Still, until that actually happens I think I will:

a) Enjoy the rally here in the U.S.

b) Remain vigilant

It seems like a reasonable plan.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.