Gold and silver have both been trading in ever tightening ranges for almost a couple of years now. A lot of pundits – myself included – see this type of action and recognize that historically this type of “coiling” action is almost invariably ultimately followed by a significant breakout to a sharply higher or lower price level.

I got all excited at several points in the last year pointing this out. And then one day it hit me that this could go on for some time. So I wrote about some ways (here and here) to set a position using options and just wait and see if anything ever happens.

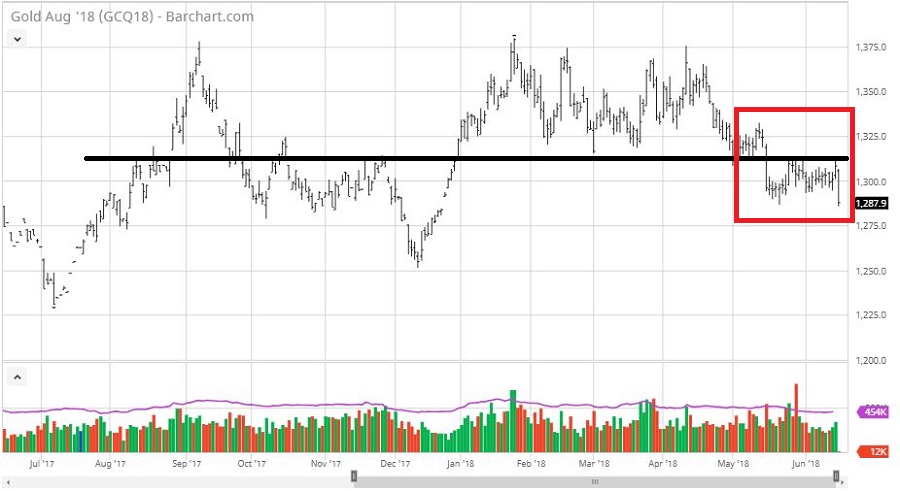

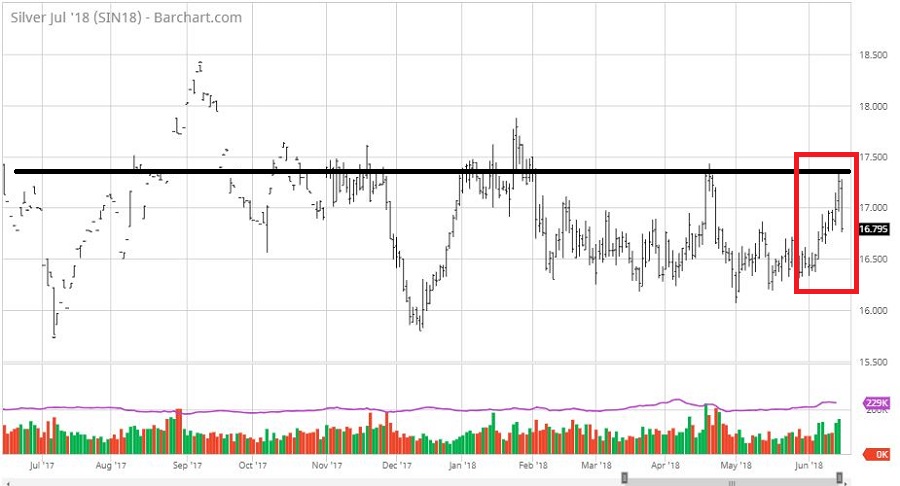

Well something tried to happen as gold and (especially) silver tried to rally. And – no surprise really – they appear to have been rebuffed again today as you can see in Figures 1 and 2.

Figure 1 – Gold futures (Courtesy www.Barchart.com)

Figure 1 – Gold futures (Courtesy www.Barchart.com)

Figure 2 – Silver futures (Courtesy www.Barchart.com)

Figure 2 – Silver futures (Courtesy www.Barchart.com)

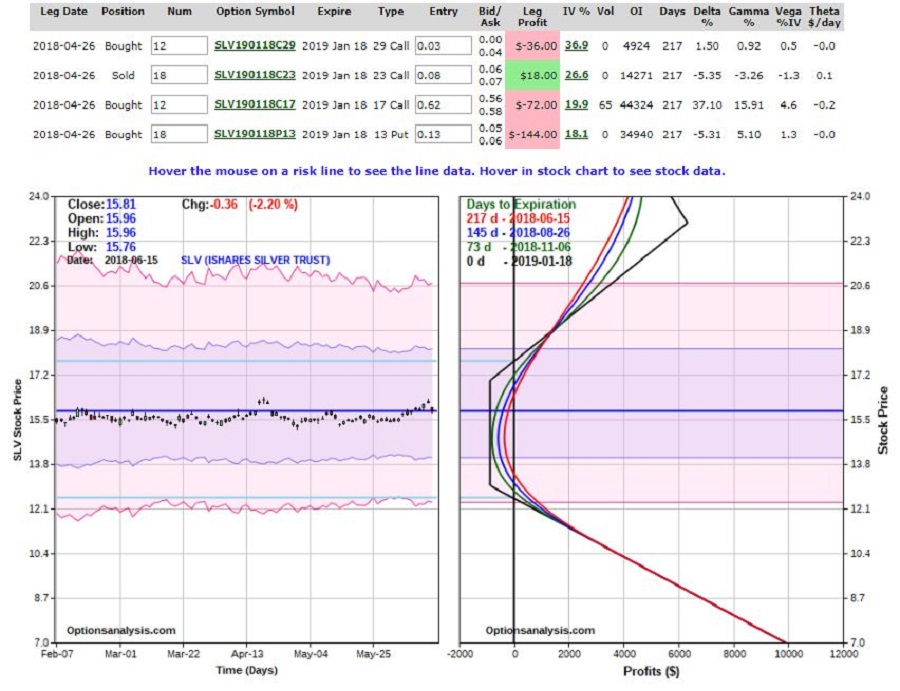

Sigh. So back into “the range” for a while. Figure 3 displays the latest status of the (“Crazy”) SLV option trade I highlighted back in April. This trade involves January 2019 options so there is still plenty of time for SLV to decide to actually do something.

Figure 3 – SLV Jan2019 “In case anything ever happens” option trade (Courtesy www.OptionsAnalysis.com)

Figure 3 – SLV Jan2019 “In case anything ever happens” option trade (Courtesy www.OptionsAnalysis.com)

Which reminds me of:

Jay’s Trading Maxim #162: Long-term option trades are great because they give the underlying security a lot of time to move. Long-term option trades are also awful because they will drive you crazy in the meantime.

Welcome to “the meantime.”

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.