In this article I highlighted the fact that – on a historical basis – the financial sector is in “oversold” territory. In this article I highlighted the fact that we are approaching a typically seasonally favorable period for financial stocks (i.e., the 2nd half of election years). In this piece we will look at the full election cycle and how it impacts financial stocks.

Financials in the Election Cycle

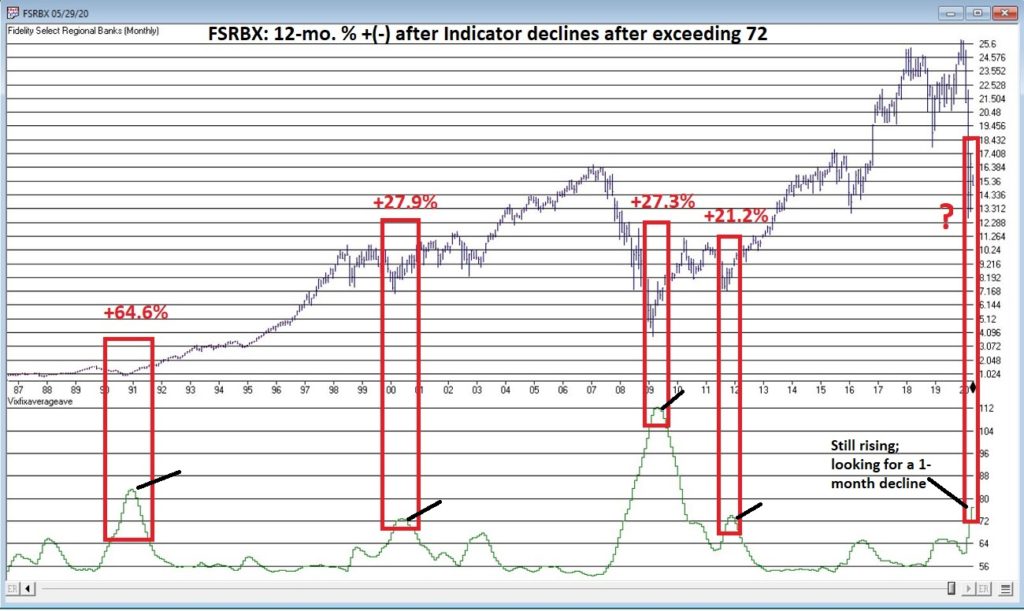

As our proxy for the financial sector we will use ticker FSRBX (Fidelity Select Banking). Figure 1 displays the “election cycle calendar” for financial stocks.

Figure 1 – Favorable Election Cycle Periods

There are essentially four “favorable” periods:

Period 1: March through July Post-Election year

Period 2: November Post-Election year through April Mid-Term year

Period 3: October Mid-Term year through July Pre-Election year

Period 4: July through December Election year

Figure 2 displays the cumulative total return for FSRBX if held only during the months indicated in Figure 1 starting with fund inception in 1986.

Figure 2 – FSRBX total % return during favorable election cycle periods (1986-2020)

Through March 2020 the cumulative gain is +8,020%.

For contrast, Figure 3 displays the cumulative return for FSRBX if held during all “non-favorable” months (the blank squares in Figure 1).

Figure 3 – FSRBX total % return during non-favorable election cycle periods (1986-2020)

Through March 2020 the cumulative loss was -70%.

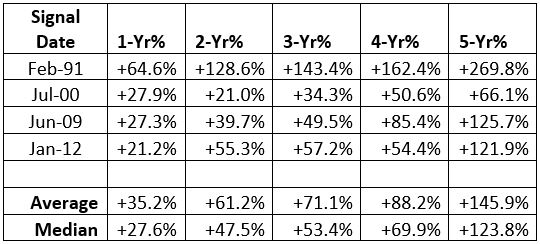

Figure 4 displays results across each 4-year election cycle.

Figure 4 – FSRBX across the election cycle

As you can see in Figure 4, on a period by period basis there are no “sure things”. There is no guarantee that a “favorable period” will see a gain nor that a “non-favorable period” will see a loss. And with seasonal trends the reality is that there are no guarantees that they will continue ad infinitum into the future. But for now, the long-term results using ticker FSRBX as a proxy for financial stocks are fairly compelling.

With financial stocks currently flirting with a potential oversold buy alert, and with a seasonally favorable period set to begin July 1st, I for one will be keeping a close eye on the financial sector.

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.