Real Estate Investment Trusts (REITS) have held up well during the May selloff. As we will see in a moment, this probably should not come as a surprise. Based on the typical seasonal trend for REITs it might make sense to hold on a little longer.

A Bullish Stretch

Let’s keep it simple. Figure 1 displays the cumulative growth of $1,000 invested in Fidelity Select Real Estate fund (FRESX) ONLY during the months of March through July every year starting in 1987.

Figure 1 – Growth of $1,000 invested in FRESX March through July 1987-2019

Figure 1 – Growth of $1,000 invested in FRESX March through July 1987-2019

As you can see – while nothing is ever perfect – the sector has showed a strong tendency to perform well from late-winter into mid-summer.

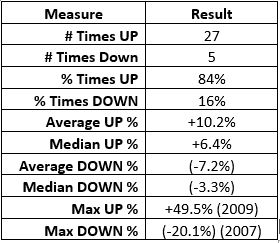

Figure 2 displays the year-by-year results and Figure 3 displays a few key facts and figures.

| Year | March-July % +(-) |

| 1987 | (-0.4%) |

| 1988 | +0.6% |

| 1989 | +14.5% |

| 1990 | +1.0% |

| 1991 | +10.9% |

| 1992 | +4.1% |

| 1993 | +4.4% |

| 1994 | (-3.3%) |

| 1995 | +6.4% |

| 1996 | +4.0% |

| 1997 | +9.0% |

| 1998 | (-9.6%) |

| 1999 | +3.8% |

| 2000 | +27.9% |

| 2001 | +8.7% |

| 2002 | +6.1% |

| 2003 | +18.2% |

| 2004 | +0.6% |

| 2005 | +20.6% |

| 2006 | +5.1% |

| 2007 | (-20.1%) |

| 2008 | +3.5% |

| 2009 | +49.5% |

| 2010 | +15.9% |

| 2011 | +3.7% |

| 2012 | +10.7% |

| 2013 | +1.8% |

| 2014 | +8.7% |

| 2015 | (-2.8%) |

| 2016 | +22.0% |

| 2017 | +1.5% |

| 2018 | +13.8% |

Figure 2 – Year-by-Year Results

Figure 3 – Facts and Figures

Summary

FRESX has showed a gain since the end of February 2019. Can we be sure that things will improve between now and the end of July? Not at all. But history seems to suggest that that may be the way to bet.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.