With the stock market indexes flirting with new highs I am starting to hear “mentions” of a potential “meltup” in stock prices.

I am always dubious of such prognostications (sorry, it’s just my nature). And I am definitely not very good at making those types of projections myself. Still, if the stock market “wants” to take off and run to sharply higher ground I certainly have no objections. And in fact, I would like to go along for the ride. Now chances are if you are reading this article, first off – well, Thank You very much, but more importantly chances are you already have at least some money in the stock market. And chances are you too are a little dubious of making a big bet on a “shooting star” type of market move.

But what about a small wager?

Risking a Little to Make Alot

The hypothetical trade that appears next is NOT a recommendation, only an example of one way to make a low dollar cost play on a big move in the market. The trade involves:

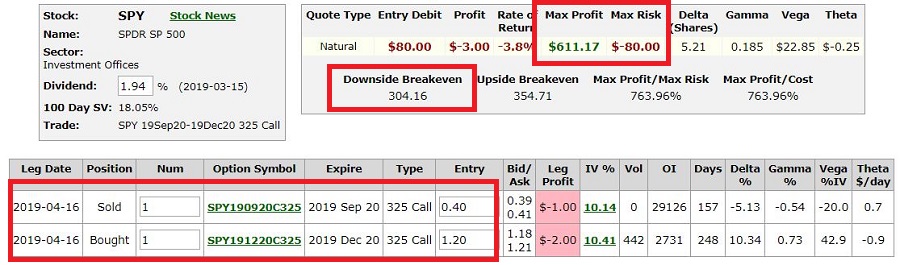

*Buying 1 SPY Dec2019 325 call @ $1.20

*Selling 1 SPY Sep2019 325 call @ $0.40

The particulars appear in Figure 1 and the risk curves in Figure 2. Figure 1 – SPY Calendar Spread details (Courtesy www.OptionsAnalysis.com)

Figure 1 – SPY Calendar Spread details (Courtesy www.OptionsAnalysis.com)

Figure 2 – SPY Calendar Spread risk curves (Courtesy www.OptionsAnalysis.com)

Figure 2 – SPY Calendar Spread risk curves (Courtesy www.OptionsAnalysis.com)

In a nutshell, if SPY does in fact “meltup” (and again, I am not implying that it will, only highlighting a cheap way to speculate on the possibility) this trade will make money until SPY reaches $325 a share (roughly 12% above current prices), at which point some sort of action would be needed since above that price the risk curves “roll over”.

If SPY reaches $325 a share the open profit will likely be between $170 and $610 – depending on whether the move occurs sooner or later (and can be affected by changes in implied volatility).

Summary

As the major indexes approach and test their previous highs, there is a lot hanging in the balance.

*If they test these levels and fail then all of a sudden everyone will be talking about “double and/or triple tops” and things could change for the worse.

*Another possibility is that the indexes stage a “false breakout” and then drop back below their previous highs. This too could spell trouble.

*One other possibility is the “breakout and meltup” scenario we’ve already discussed.

Is this last possibility likely to happen? It beats me. But the real question is “are you willing to risk $80 bucks on the chance that it might?”

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.