In this article I highlighted four sector funds that tend to perform well during the month of February. As of the close on 2/27 the average of these four for February 2019 was a gain of roughly 4.7% versus 3.5% for the S&P 500 Index.

With the phrase “past performance is no guarantee of future results” firmly in mind, for March we will expand the list slightly to include 5 sectors.

The March 5

FDLSX – Fidelity Select Leisure

FRESX – Fidelity Select Real Estate

FSESX – Fidelity Select Energy Services

FSRFX – Fidelity Select Transportation

FSRPX – Fidelity Select Retailing

The History

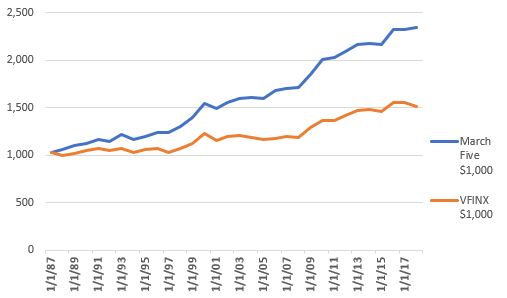

Figure 1 displays the growth of $1,000 invested in these 5 funds ONLY during the month of March every year starting in 1987. For comparison sake it also displays the growth of $1,000 invested in an S&P 500 Index fund (VFINX) ONLY during March during the same period.

Figure 1 – Growth of $1,000 invested in Jay’s March 5 sector funds (blue) versus ticker VFINX ONLY during the month of March; 1987-2018

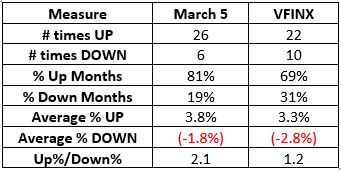

Figure 2 displays some relevant fact and figures regarding the March 5 performance versus that of an S&P 500 index fund.

Figure 2 – Comparative Figures – Jay’s March 5 vs. VFINX; 1987-2018

Figure 3 displays year-by-year results

| Year | March Five | VFINX |

| 1987 | 2.9 | 2.9 |

| 1988 | 2.8 | (3.0) |

| 1989 | 3.8 | 2.3 |

| 1990 | 2.5 | 2.6 |

| 1991 | 3.5 | 2.4 |

| 1992 | (2.0) | (1.9) |

| 1993 | 6.4 | 2.1 |

| 1994 | (3.8) | (4.4) |

| 1995 | 2.2 | 3.0 |

| 1996 | 3.4 | 1.0 |

| 1997 | 0.7 | (4.1) |

| 1998 | 5.0 | 5.1 |

| 1999 | 6.9 | 4.0 |

| 2000 | 10.9 | 9.8 |

| 2001 | (3.5) | (6.4) |

| 2002 | 4.5 | 3.7 |

| 2003 | 2.1 | 1.0 |

| 2004 | 1.1 | (1.5) |

| 2005 | (0.6) | (1.8) |

| 2006 | 5.0 | 1.2 |

| 2007 | 1.0 | 1.1 |

| 2008 | 0.8 | (0.4) |

| 2009 | 8.1 | 8.8 |

| 2010 | 8.5 | 6.0 |

| 2011 | 1.2 | 0.0 |

| 2012 | 2.9 | 3.3 |

| 2013 | 3.6 | 3.7 |

| 2014 | 0.3 | 0.8 |

| 2015 | (0.5) | (1.6) |

| 2016 | 7.7 | 6.8 |

| 2017 | (0.2) | 0.1 |

| 2018 | 1.0 | (2.6) |

Figure 3 – Year-by-Year March % return

Summary

Repeating now, “past performance is no guarantee of future results” and as always I am not “recommending” that anyone rush out and trade anything. My purpose here is simply highlighting a potential long-term “edge” in the market.

The reality is that the performance of the 5 sector funds highlighted above will vary greatly from year to year. Some years will be great, some years will be down, and some years will be (in the words of all the kids these days) “Meh”. Likewise, some years the March 5 will outperform the S&P 500 and some years it won’t.

Still, a lot of investing success hinges on

*Finding an “Edge”

*Exploiting that edge over and over

Have a Nice Month.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.