In this article in early August I highlighted the possibility for a bullish move in crude oil as well as an example trade using options on ticker USO – an ETF intended to track the price of crude oil.

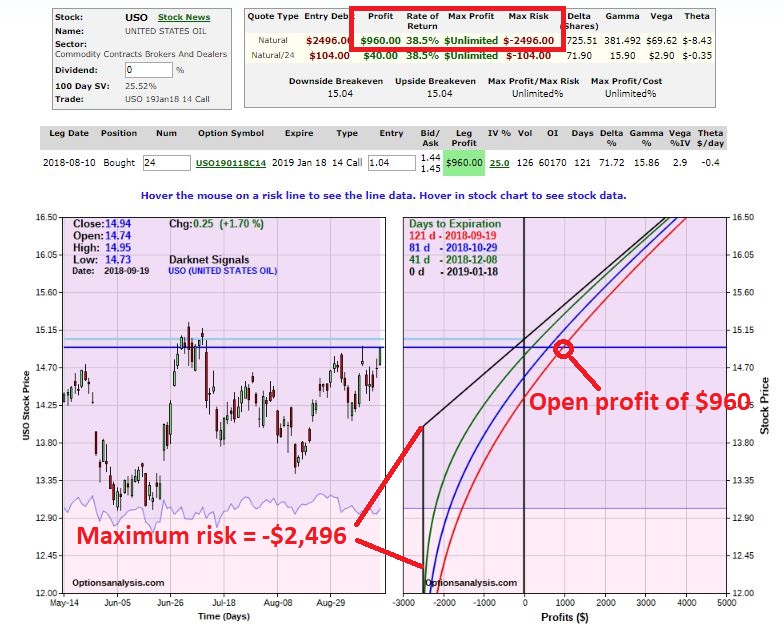

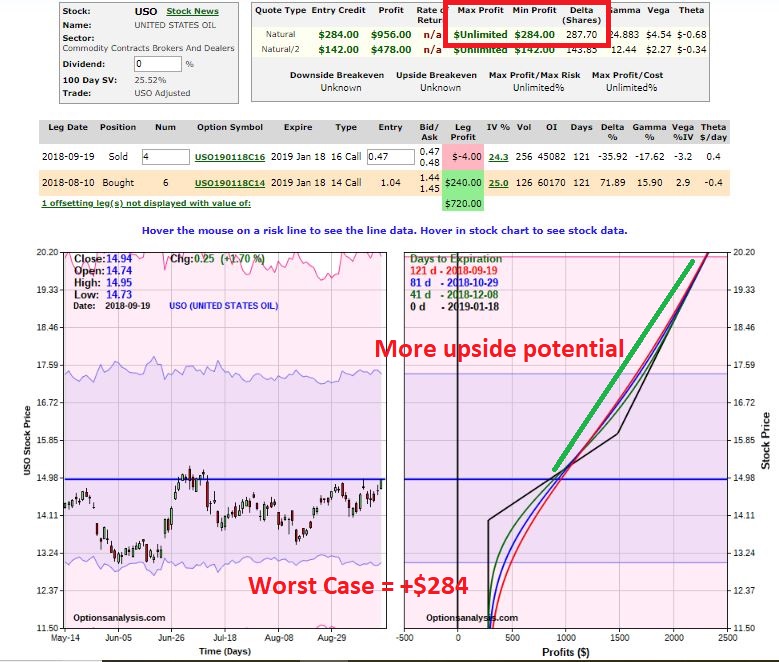

At the time the daily and weekly Elliott Wave counts (generated using the EW algorithm in ProfitSource by HUBB software) for crude oil futures – and the daily Elliott Wave count for ticker USO – were all pointing to a potential Wave 5 advance. Since that time USO has advanced roughly 7%, from $14.01 a share to $14.94 a share. As you can see in Figure 1, the example USO option trade is now showing an open profit of of 38% ($960 on an original cost of $2,496).

(click to enlarge) Figure 1 – Original example USO trade as of 9/19 (Courtesy www.OptionsAnalysis.com)

Figure 1 – Original example USO trade as of 9/19 (Courtesy www.OptionsAnalysis.com)

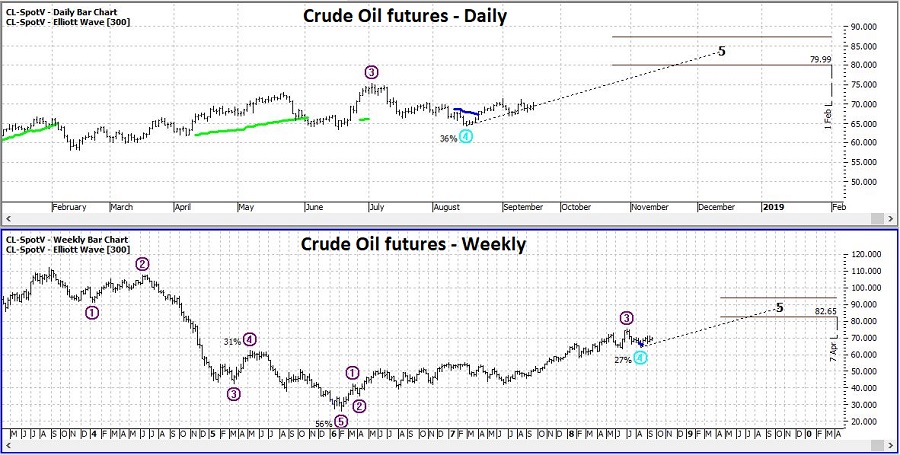

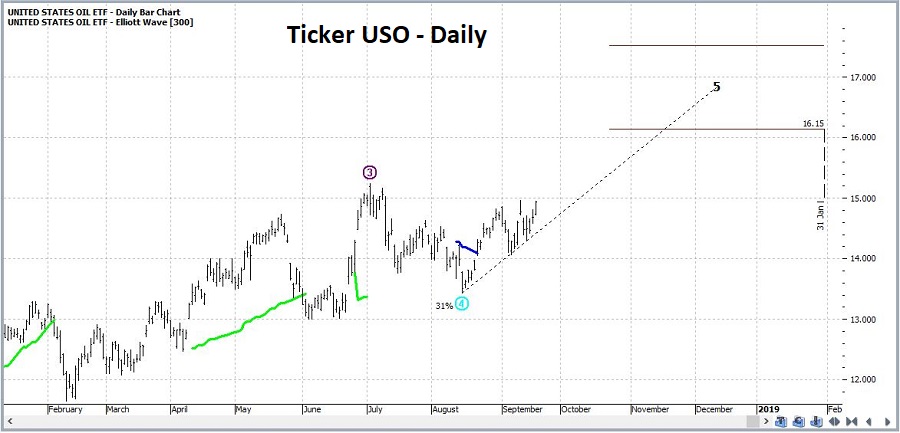

Looking forward there is – what else? – Good News and Bad News. As you can see in Figures 2 and 3, the Elliott Wave count for both daily and weekly crude oil futures and daily USO continue to suggest that more upside potential may lie ahead.

(click to enlarge) Figure 2 – Crude oil futures – daily and weekly both with bullish Elliott Wave projections (Courtesy ProfitSource by HUBB)

Figure 2 – Crude oil futures – daily and weekly both with bullish Elliott Wave projections (Courtesy ProfitSource by HUBB)

(click to enlarge) Figure 3 – Ticker USO daily with bullish Elliott Wave projection (Courtesy ProfitSource by HUBB)

Figure 3 – Ticker USO daily with bullish Elliott Wave projection (Courtesy ProfitSource by HUBB)

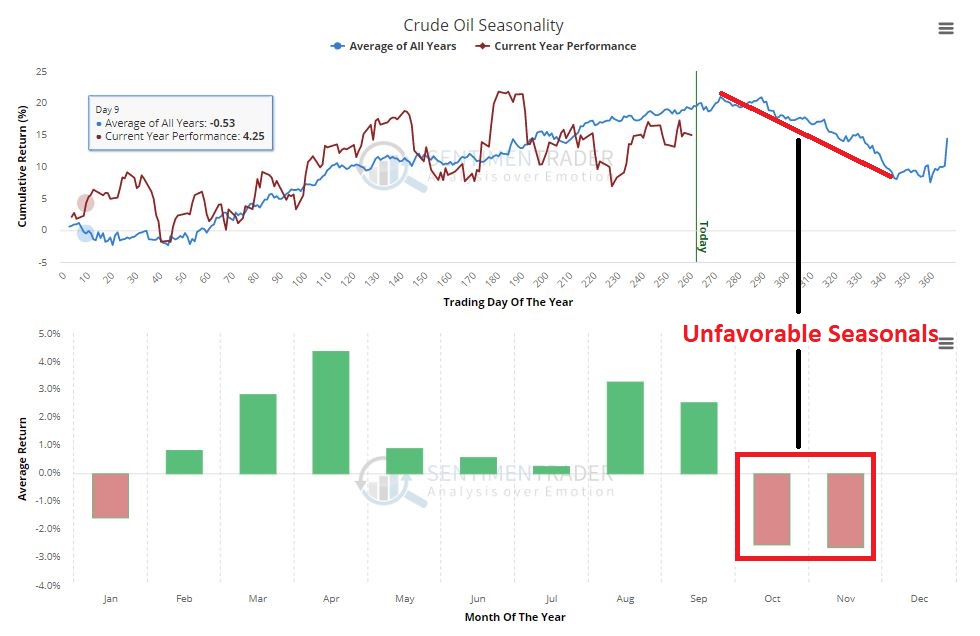

That’s the Good News. The Bad News is that we are 10 calendar days from the beginning of the least fabvorable seasonal period for crude oil – from late September into early December – as you can see in the chart from www.sentimentrader.com in Figure 4.

(click to enlarge) Figure 4 – Annual Seasonbal Trend for crude oil is nearing the unfavorable time of year (Courtesy Sentimentrader.com)

Figure 4 – Annual Seasonbal Trend for crude oil is nearing the unfavorable time of year (Courtesy Sentimentrader.com)

So, Elliott Waves counts say “bullish” and seasonal trends say “bearish”. Which one will be right in the months ahead. Sorry folks, gotta go with my standard response of “It beats me.” Predictions aren’t something I am too good at.

But for a person holding our hypothetical (and bullish) option position, some determination needs to be made. So, let’s consider two possibilities.

Course of Action #1: Damn the Torpedoes, Full Speed Ahead!

If a trader is expecting crude to break out above resistance and rally ahead strongly just like the Elliott Wave counts suggests, there is no real need to take any action Just hold the position, wait for the big advance and cash in a big winner. Or – just to cover all the bases – give it all back and lose all or part of your initial $2,496 investment. Maximum reward, maximum risk, Hoo Ha!

Course of Action #2: Lock in a Profit and Let the Rest Ride

Another course of action might be to hedge one’s bet by adjusting the trade to lock in a profit while still allowing for more upside profit potential if the bullish scenario does in fact play out. Often this type of action comes at the cost of reduced upside potential.

In the example below a trader gives up a substantial amount of upside profit potential as a trade off for locking in a profit while still allowing for further upside potential.

The example adjustment:

*Sell 18 USO Jan2019 14 calls (reducing long position from 24 to 6 contracts)

*Sell 4 USO Jan2019 16 calls (a new position)

The net result of this adjustment appears in Figure 5.

(click to enlarge)

Figure 5 – Adjusted USO trade (Courtesy www.OptionsAnalysis.com)

Figure 5 – Adjusted USO trade (Courtesy www.OptionsAnalysis.com)

This adjusted position:

*Locks in a minimum profit of $284 if crude oil reverses and heads lower

*Also retains unlimited profit potential

*The bad news is that this new position has a delta of 288 versus the original position which has a delta of 1,726. This means that for each full $1 USO might advance in price the original trade will gain roughly $1,726 in new profits while the new adjusted position will gain only $288 in new profits.

The stark difference between these two positions is obvious in Figure 6

(click to enlarge) Figure 6 – Original USO trade (higher reward, higher risk) versus adjusted USO trade (lower reward, lower risk) (Courtesy www.OptionsAnalysis.com)

Figure 6 – Original USO trade (higher reward, higher risk) versus adjusted USO trade (lower reward, lower risk) (Courtesy www.OptionsAnalysis.com)

Clearly the original position is an all-or-nothing bet on higher prices, while the adjusted position is designed to keep the position from turning into a loss while still allowing for additional profit potential if USO rallies – but far less upside potential than the original trade.

Which one is better? Please see my “standard response” above…

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.