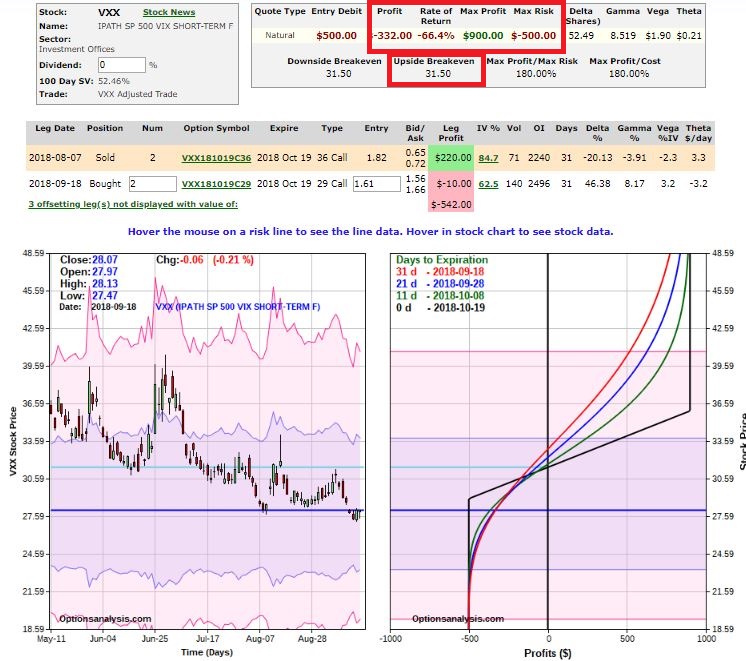

In this article in early August I highlighted the potential for the VIX Index to “bounce” and highlighted a hypothetical bullish trade using options on ticker VXX – an ETF intended to track the VIX Index. The original trade looked like what you see in Figures 1 and 2.

Figure 1 – Original VXX position (Courtesy www.OptionsAnalysis.com)

Figure 1 – Original VXX position (Courtesy www.OptionsAnalysis.com)

Figure 2 – Original VXX risk curves (Courtesy www.OptionsAnalysis.com)

Figure 2 – Original VXX risk curves (Courtesy www.OptionsAnalysis.com)

Interestingly, 3 trading days later this position showed an open gain of 46% as displayed in Figure 3, as VXX rallied from $28.14 a share to $31.80.

(click to enlarge) Figure 3 – Original position 3 days later; as of 8/13 (Courtesy www.OptionsAnalysis.com)

Figure 3 – Original position 3 days later; as of 8/13 (Courtesy www.OptionsAnalysis.com)

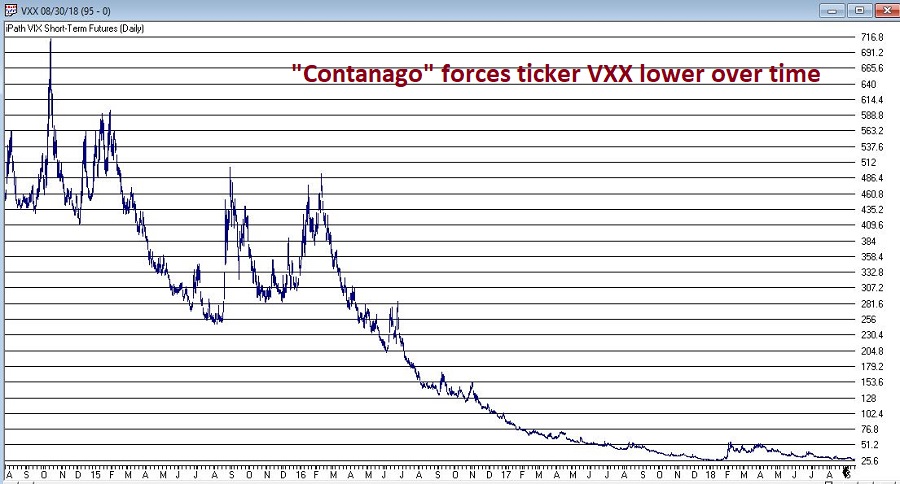

The 1st (unwritten) rule of trading bullish positions in VXX is “Take your profits while you have them”. To understand this viewpoint simply glance at the long-term chart of ticker VXX in Figure 4. Figure 4 – VXX daily bar chart (Courtesy AIQ TradingExpert)

Figure 4 – VXX daily bar chart (Courtesy AIQ TradingExpert)

While there can and will be sharp rallies along the way, the long-term trajectory is inexorably long (this is due to “contango” in the futures market – which I AM NOT going to explain here. If you want to know more just do an internet search).

But let’s assume for a moment that our hypothetical trader did not take a profit in our hypothetical VXX position, hoping for a bigger up move. Bottom line, it hasn’t worked out well at all. The stock market has rallied and VXX has once again slumped. The current status appears in Figure 5.

(click to enlarge) Figure 5 – Original VXX position as of 9/19 (Courtesy www.OptionsAnalysis.com)

Figure 5 – Original VXX position as of 9/19 (Courtesy www.OptionsAnalysis.com)

As you can see in Figure 5 this trade is in “some trouble”. With VXX trading at $28.07 the breakeven price is $32.28, and the maximum risk is -$642.

HERE COMES THE POINT…..

A trader who bought shares of VXX would have two choices:

a) Hold the shares

b) Sell the shares

A trader who put on our hypothetical trade has three choices:

a) Hold the position

b) Close the position

c) Adjust the position

It is this third option that makes option trading appealing, i.e., the potential opportunity to improve the odds of an existing trade “on the fly”. How, you might ask. Let’s walk through one example.

First, the goals of adjusting an existing position are typically one or more of the following:

*Improve profit potential

*Reduce dollar risk

*Improve probability of profit

Typically (though not always) attempting to improve the profit potential of an existing trade that is showing a loss involves assume more risk. In this instance we are going to de-emphasize profit potential and focus on reducing our risk and improving our odds of making any profit.

Here are the hypothetical adjustments to our hypothetical trade:

*Sell 5 Oct 19 VXX 31 calls (exit existing long calls)

*Buy 2 Oct 19 VXX 29 calls (buy fewer closer to the money calls)

*Buy 2 Oct 19 VXX 36 calls (reduce existing short call position)

What does all of this accomplish? Consider Figure 6.

(click to enlarge) Figure 6 – Adjusted VXX position (Courtesy www.OptionsAnalysis.com)

Figure 6 – Adjusted VXX position (Courtesy www.OptionsAnalysis.com)

First the Bad News:

*VXX still MUST rally sometime between now and 10/19 in order for this trade to show a profit.

*This adjustment caps our maximum profit potential at $900.

The Good News:

*We have reduced our dollar risk from -$642 to -$500. So, if the worst-case scenario plays out at least we save about a hundred and forty bucks.

*We have reduced the breakeven price (at expiration) from $32.28 to $31.50.

Summary

As always please remember this is all hypothetical and I am not suggesting that everyone rush out and put on bullish trade in ticker VXX. The real point of this piece is to highlight the potential to, a) make trade with limited dollar risk using options, and, b) the potential to adjust an existing option position “on the fly” to make it a more attractive position.

It’s a pretty good arrow to have in one’s quiver.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.