As I discussed here, the advent of ETF’s has opened a vast array of opportunities to investors that was previously hard to reach. In the linked article I discussed the current “state of things” for the euro – which a non-commodity trader can trade using the ETF ticker FXE.

In this piece we will discuss the current state of the soybean market – which can be traded via ETF ticker SOYB.

Ticker SOYB

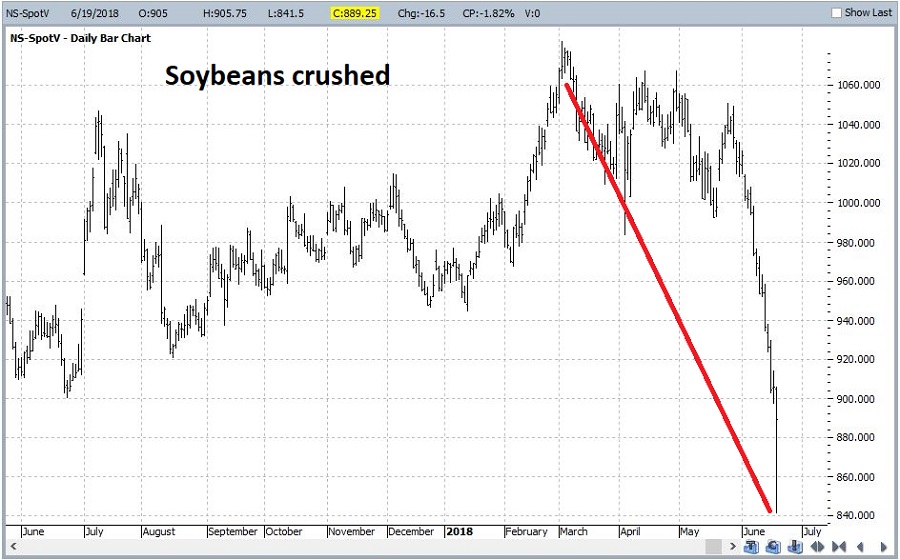

To examine beans, we will look at the spot soybean futures contract. In Figure 1 we see a precipitous decline in the price of soybeans recently. This is due in large part to uncertainty relating to the potential for a trade war which might impact the amount of soybeans getting traded internationally. It is also a function of the mild winter and good planting season this year, which is expected to result in a bumper crop – i.e., a large supply – for soybeans this year.

(click to enlarge) Figure 1 – Soybeans sell off hard (Courtesy ProfitSource by HUBB)

Figure 1 – Soybeans sell off hard (Courtesy ProfitSource by HUBB)

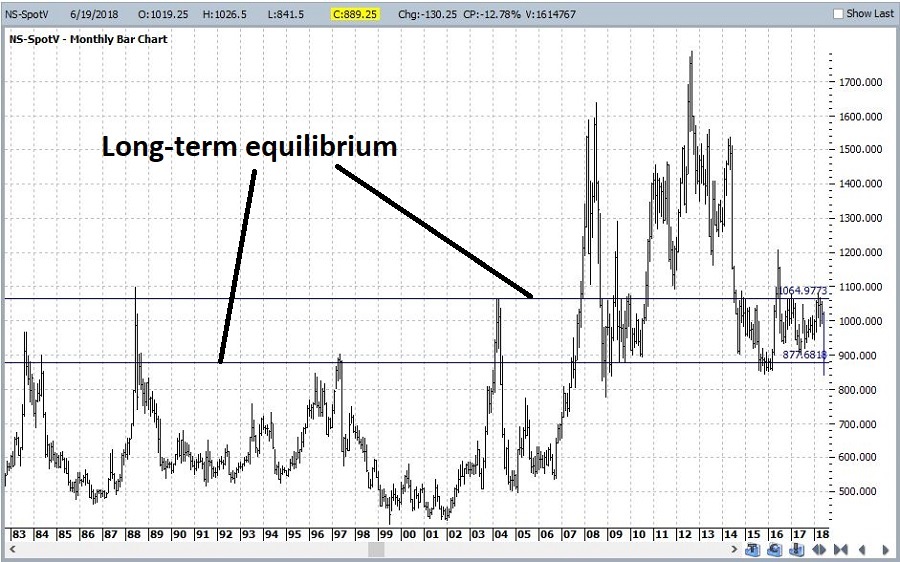

Figure 2 displays a long-term monthly chart for soybeans. The chart includes two arbitrarily drawn “equilibrium” lines to help give a sense of where support and resistance may arise from a very long-term perspective.

(click to enlarge) Figure 2 – Weekly Soybeans (Courtesy ProfitSource by HUBB)

Figure 2 – Weekly Soybeans (Courtesy ProfitSource by HUBB)

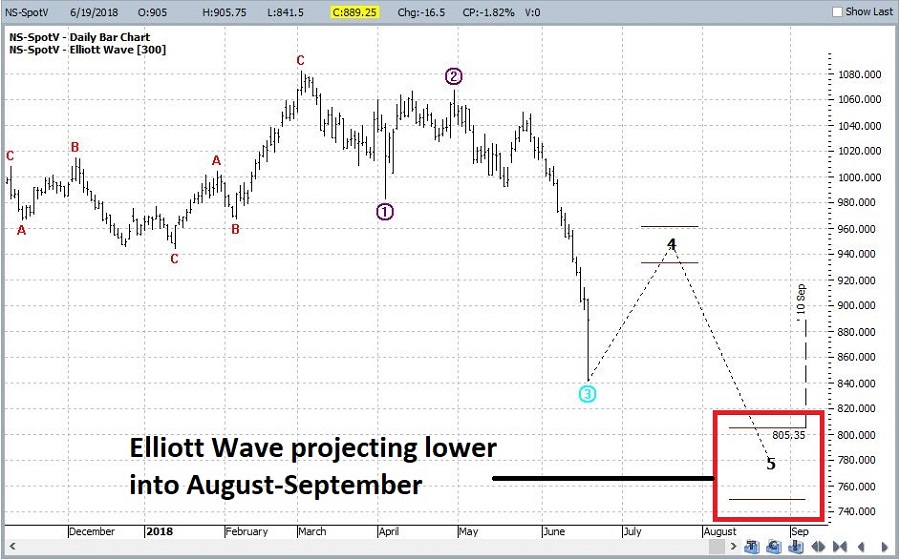

Figure 3 goes back to a daily chart and shows the latest Elliott Wave count generated from ProfitSource by HUBB. It is presently projecting another leg lower into July or August.

(click to enlarge) Figure 3 – Daily Soybeans with Elliott Wave (Courtesy ProfitSource by HUBB)

Figure 3 – Daily Soybeans with Elliott Wave (Courtesy ProfitSource by HUBB)

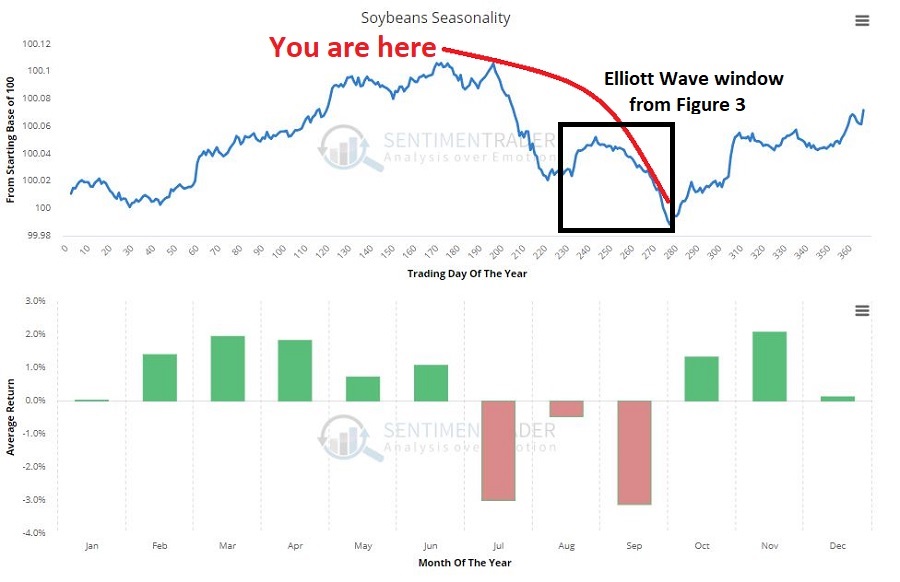

Finally, Figure 4 shows the annual seasonal trend for soybeans from one of my favorite websites, www.sentimentrader.com. As you can see in Figure 4, July and September are the typical “weak spots” for beans. The projected low in Figure 4 coincides pretty closely with the start of a strong second half seasonal upward bias.

(click to enlarge) Figure 4 – Soybeans Annual Seasonality (Courtesy www.sentimentrader.com)

Figure 4 – Soybeans Annual Seasonality (Courtesy www.sentimentrader.com)

So is now a great time to jump in? Perhaps not. But here is my off-the-cuff thinking: If soybeans are still very beaten down in the late-September timeframe it might present an excellent buying opportunity for ticker SOYB.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.