Correlations between markets and one market influencing another is by no means a new concept. But it is one that a lot of investors never really bother to think about. Turns out those people may be missing out on some useful intel.

Consider ticker EWZ – an ETF that tracks the Brazilian stock market – and its love/hate relationship with the U.S. dollar.

Ticker EWZ vs. Ticker UUP

The U.S. soccer team may have missed the World Cup while Brazil is one of the favorites – but when it comes to the stock market, the U.S. dollar appears to have a not insignificant influence on the Brazilian stock market.

The basic theory we will test is this:

*Dollar Strong = Bad for EWZ

*Dollar Weak = Good for EWZ

EWZ started trading in 2001. For testing purposes, I used the U.S. dollar futures data from 2001 through 2013 as a proxy for – what else? – the U.S. dollar. In 2014 I started using ticker UUP – an ETF that tracks – you guessed it – the U.S. dollar.

The Test

*If the 5-week average of closing prices for the U.S. dollar is below the 30-week average of closing price for the dollar, we are long EWZ

*If the 5-week average of closing prices for the U.S. dollar is above the 30-week average of closing price for the dollar, we are out of EWZ

For the record, this is not intended to be a standalone trading “system” because it takes no account of the actual trend in the price of EWZ. This “method” simply measures EWZ performance based on whether the U.S. dollar is trending higher or lower.

The Results

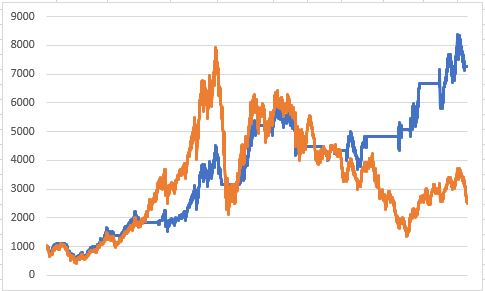

In Figure 1:

*The blue line displays the growth of $1,000 invested in EWZ ONLY when the U.S. dollar is in a downtrend

*The orange line displays the growth of $1,000 invested in EWZ on a buy-and-hold basis

Figure 1 – Growth of $1,000 invested in EWZ ONLY when U.S. dollar 5wk. ma< 30wk ma (blue line) versus $1,000 invested in EWZ on a buy-and-hold basis (orange); 7/31/2001-6/21/2018

The results in Figure 1 or of the “Tortoise and the Hare” variety. The “method” underperformed significantly during the huge bull run leading up to 2008, but fared much better during the significant bear markets.

Figure 2 is also enlightening as it displays the growth of $1,000 invested in EWZ ONLY when the U.S. dollar is in an uptrend (i.e., 5-week average above 30-week average).

Figure 2 – Growth of $1,000 invested in EWZ ONLY when U.S. dollar 5wk. ma> 30wk ma (blue line); 7/31/2001-6/21/2018

For the record, from 7/31/2001 through 6/21/2018:

*$1,000 invested in EWZ buy-and-hold grew to $2,510

*$1,000 invested in EWZ ONLY when the U.S. dollar was in a downtrend grew to $7,261

*$1,000 invested in EWZ ONLY when the U.S. dollar was in an uptrend shrank to $346

To put it another way:

*Dollar trending down = EWZ up +626%

*Dollar trending up = EWZ down (-65%)

Summary

There are many factors besides the U.S. dollar that can affect the Brazilian stock market. So like I said, this one factor “method” should not be considered a standalone system.

Still, the results strongly suggest that anyone looking at ticker EWZ might want to take a glance at ticker UUP first.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

I bet you could apply that to many EM ETFs… FXI perhaps? 😉

Probably so. I am sure alot of Country ETFs share a similar type of correlation with the U.S. Jay