Much has been said and written about the underperformance of small-cap stocks relative to large-cap stocks in recent years. Of course, like a lot of things – growth vs. value, U.S. vs. international. Stocks vs. Bonds, etc. – there are no “permanent advantages” in the financial markets. The ebb and flow among assets classes and sectors function much like waves in the ocean. Some are more or less pronounced and/or last longer or shorter than others, but nothing lasts forever.

A Small-Cap “Thrust”

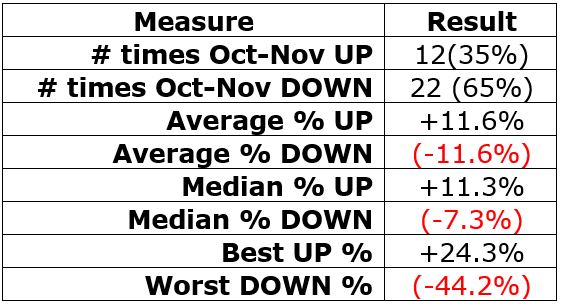

Jason Goepfert of www.Sentimentrader.com highlighted a potentially significant development in the small-cap space. As you can see in Figure 1, previously when the Russell 2000 Index has rallied more than 10% in 10 trading days the index has tended to continue to move higher. Specifically, it has been higher 1 month later 100% of the time.

Figure 1 – Russell 2000 when it rises 10%+ in 10 trading days (Courtesy Sentimentrader.com)

Important Caveat: This IS NOT meant to imply that there is a 100% probability that RUT will be higher 1-month from now “this time around.” It is simply meant to highlight an opportunity with the potential for success and the importance of trying to put the odds in your favor as much as – and whenever – possible.

How to Play

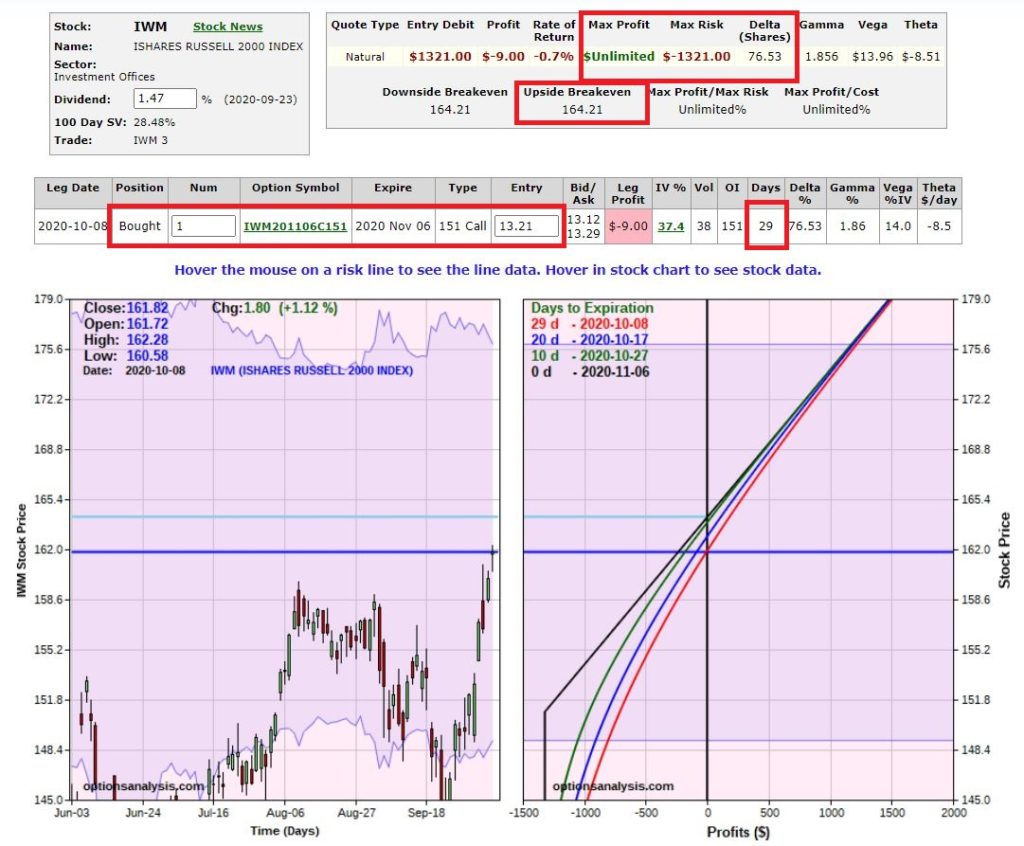

The most straightforward approach to making a play would likely be to simply buy 100 shares of ticker IWM (the iShares ETF that tracks the Russell 2000 Index). Figure 2 displays the risk “curves” for holding long 100 shares of IWM.

Figure 2 – Risk curves for holding long 100 shares of IWM (Courtesy www.OptionsAnalysis.com)

With IWM trading at $161.82 a share, the cost to enter this trade is $16,182. As you can see, for a stock position the risk “curves” are simply a straight line. For each $1 IWM rises in price the position gains $100 ($1 x 100 shares) and for each $1 IWM declines in price the position losses $100. Like I said, pretty straightforward.

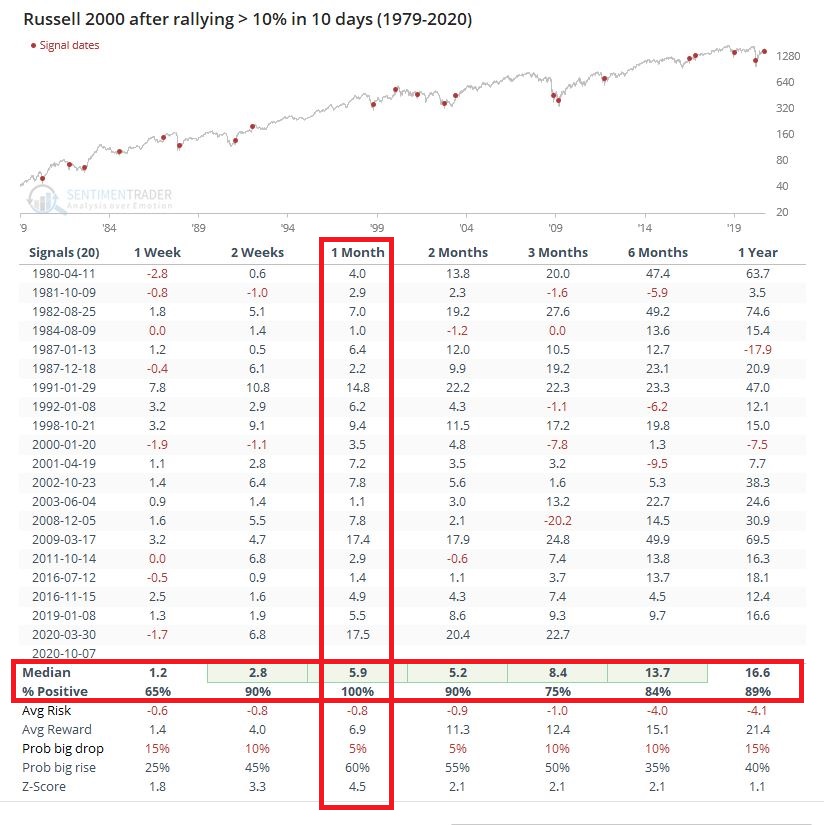

Now let’s consider a hypothetical Trader A, who wants to enter a bullish position for 1-month, but does not necessarily want to plunk down $16+ grand for the privilege.

One potential alternative might be to buy the IWN Nov06 151 strike price call. If Trader A buys this call at $13.21 for a 1-lot they would pay $1,321 for a 1-lot (which costs 92% less than buying 100 share).

This position has a “delta” of 76.53 – which means that the profit/loss potential is roughly the same as buying 76 or 77 shares of IWM. Figure 3 displays the particulars for this position.

Figure 3 – Long 1 IWM Nov06 151 call (Courtesy www.OptionsAnalysis.com)

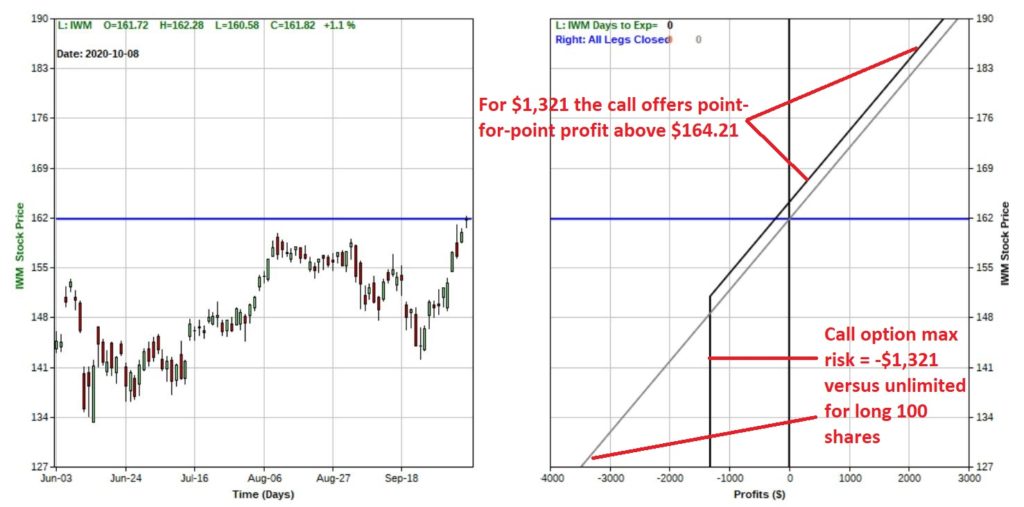

Now let’s compare the two positions. Figure 4 overlays the risk curves for the long 100 shares of IWM position (gray line) versus holding the 151-strike price call (black line).

Figure 4 – Long stock vs. long call option (Courtesy www.OptionsAnalysis.com)

Things to Note:

*The stock position costs $16,182 to enter and offers point-for-point profit with the underlying shares. The breakeven price is $161.82 a share, profit potential is unlimited and the $ loss increases with each point IWM declines.

*The option position costs $1,321 to enter. The breakeven price is $164.21. Above this price the option position enjoys point-for-point movement with the stock. The maximum risk is $1,321.

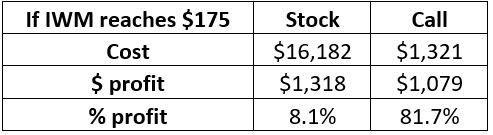

To put things in perspective, let’s assume that on the day of option expiration that IWM is trading at $175 a share:

Figure 5 – What if? IWM is at $175 a share at option expiration (Courtesy www.OptionsAnalysis.com)

Call option pros:

*The cost is only $1,321 versus $16,182 for the stock position

*Above $164.21 a share, the call offers point-for-point profit with the stock

*Potential % return is much greater

*Worst case: if IWM were to crash the loss is capped at -$1,321 below $151 a share

Call option cons:

*Because of time premium, the call option gives up the first few points of profit potential with a breakeven price of $164.21.

*The option expires in 28 days so IWM must make a move within that time frame in order to generate a profit.

Summary

So, is a bullish trade on small-cap stocks warranted? And if so, which is the better play – shares or a call option?

Neither of these questions are for me to answer.

For the record, I am not recommending small-cap stocks nor options versus shares. The sole purpose is to educate investors and traders about how to spot potential opportunities and how to compare the relative pros and cons of various alternative trading approaches.

Each trader must weigh the pros and cons of both the potential and the risks of the opportunity itself and the various “ways to play” and make their own decisions.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.