It has been nearly impossible lately to view the financial news in the 2020 and to not see some headline or story about “the coming explosion in Silver!!!!” (I left off a number of exclamation points in order to save space). While I do hold some bullish positions in metals it is more of a “trend-following thing” than an act of buying into the whole “MASSIVE RALLY AHEAD”.

Still, a quick recent look at all things silver suggests that if “something big” is going to happen, a good chunk of it might occur between now and the end of 2020. That’s not so much a “prediction” as it a “possibility to be aware of.”

To wit:

Figure 1 displays ticker SLV with a daily Elliott Wave count calculated using the objective EW algorithm built into ProfitSource by HUBB. As you can see, the current projection is for rally to at least 29.87 by roughly the end of the year.

Figure 1 – SLV daily Elliott Wave count (Courtesy ProfitSource by HUBB)

Figure 2 displays ticker SLV with a weekly Elliott Wave count calculated using the objective EW algorithm built into ProfitSource by HUBB. As you can see, it is making a similar projection to the daily one, i.e., projecting a possible move toward $30 a share – in this case in late 2020 or early 2021.

Figure 2 – SLV weekly Elliott Wave count (Courtesy ProfitSource by HUBB)

Two notes:

*I am not a true “Elliott Head”, but I do tend to pay attention when both the daily and weekly counts (using ProfitSource) line up as bullish or bearish

*Elliott Wave counts from ProfitSource are like a lot of other things in the market – sometimes they pan out, sometimes they don’t. There is no “magic” involved. But the fact that they are generated “objectively” (as opposed to say Me picking what I subjectively “think look like wave counts”) gives me a bit more confidence.

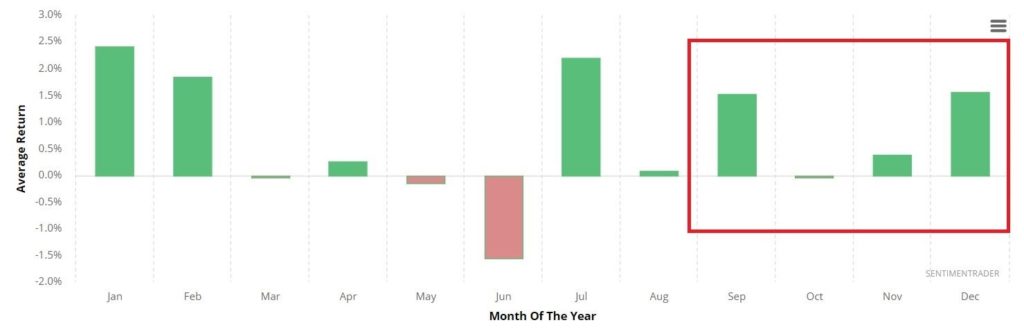

Figure 3 from www.Sentimentrader.com displays the monthly annual seasonal trend for silver futures. As you can see, the months ahead look fairly favorable. For the record, seasonality on the whole has seen a lot of things “out of whack” in 2020, so there is every chance this won’t pan out either. But for the moment I put it down as another factor in the “favorable” column.

Figure 3 – Silver seasonality by month (Courtesy Sentimentrader.com)

Figure 4 – also from www.Sentimentrader.com – displays the trader sentiment for ticker SLV. For the record, this one is presently technically (in my mind) “kinda neutral”. In other words, sentiment is neither excessively low nor excessively high.

Figure 4 – SLV Trader Sentiment (Courtesy Sentimentrader.com)

Given that all “hubbub” surrounding silver has been mostly bullish, I am actually counting it as a slight positive that sentiment is presently not “off the charts” bullish. Looking at it this way may be seen as a bit of a stretch to some, but it makes sense in my market-addled mind.

So, will SLV actually “explode higher” as all the talking heads have been prognosticating since (well, technically since the peak in 1979, but I digress) early this year? It beats me. But if one was considering making a bullish play in silver, it may be getting close to time to do so.

My favorite play would be something using options with a relatively low cost and low dollar risk.

Stay tuned…

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.

The historical gold / silver ratio also suggests that silver may have an upward bias.