In this article dated 7/14/20, I noted that:

*TSLA stock had “gone parabolic”

And

*That implied volatility on TSLA options was extremely high

This seemed to offer a (lucky – and already fairly well to do) stiff a good opportunity to sell covered calls against 200 shares of TSLA. The original trade involved:

*Holding 200 shares of TSLA (trading at $1,497)

*Selling 1 Aug07 2020 TSLA 1500 call @ $200

*Selling 1 Aug07 2020 TSLA 1800 call @ $115

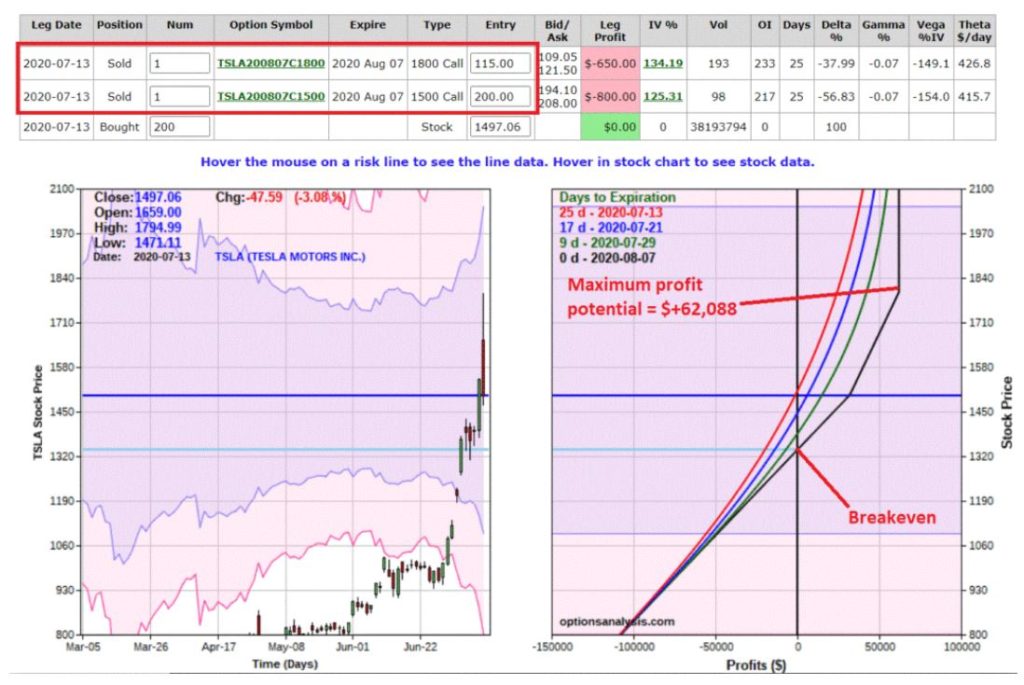

Figure 1 displays the risk curves on the original position.

Figure 1 – Original risk curves for TSLA covered call example (Courtesy www.OptionsAnalysis.com)

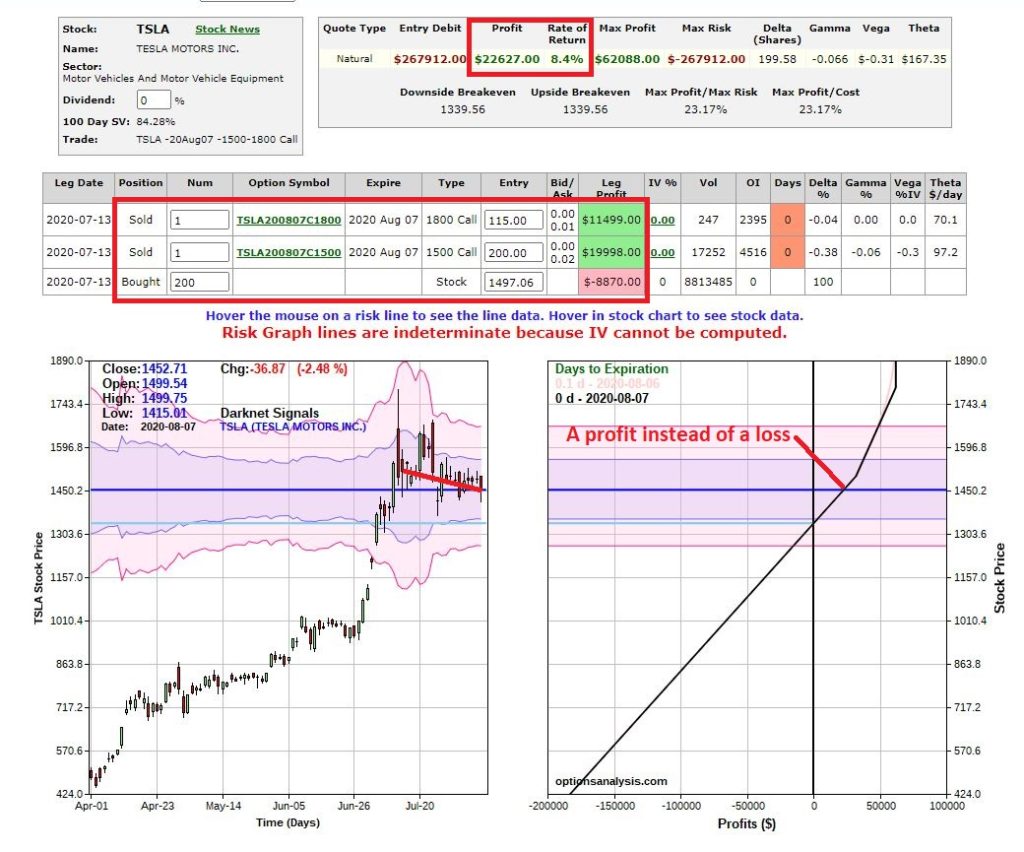

Expiration for the options involved was last Friday 8/7. So how did things work out? For a person holding only stock shares, not so great. For a person holding stocks shares having sold two covered calls, better.

*TSLA declined roughly 3% from $1,497.06 to $1,452.17. A 200-share position lost -$8,870 in value

*The August07 1500 call sold at $200, generated a profit of +$20,000

*The August07 1800 call sold at $115, generated a profit of +$11,500

The net result (near the close on 8/7 with the options still show a penny or two of value) appears in Figure 2.

Figure 2 – TSLA covered call example as of (technically just before) option expiration (Courtesy www.OptionsAnalysis.com)

*An investor who only held 200 shares of stock say his or her value decline by -$8,870.

*An investor who held 200 shares of stock but sold the two calls, lost $-8,870 on the stock but made +$31,500 on the short options, for a net profit of +$22,630, or +8.4% (in 24 calendar days while the underlying stock lost 3%).

Now you see why it may be/can be beneficial to sell covered calls on stocks you hold when implied volatility is extremely high.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.