I haven’t written much lately. That is partly a function of “What’s to say? Stock market goes up every day, metals go up every day, bonds go up most days, everything else, who cares?”

Simple.

The one major one casualty in all of this is the U.S. Dollar. Seems the markets sense that having the money-printing machine whirring at top speed all day every day might somehow make the buck less valuable. Hmmm. Interesting concept that. The trend-following investor in me is clearly inclined to play the short side. However, the contrarian short-term trader in me is looking to play the long side for a bounce higher.

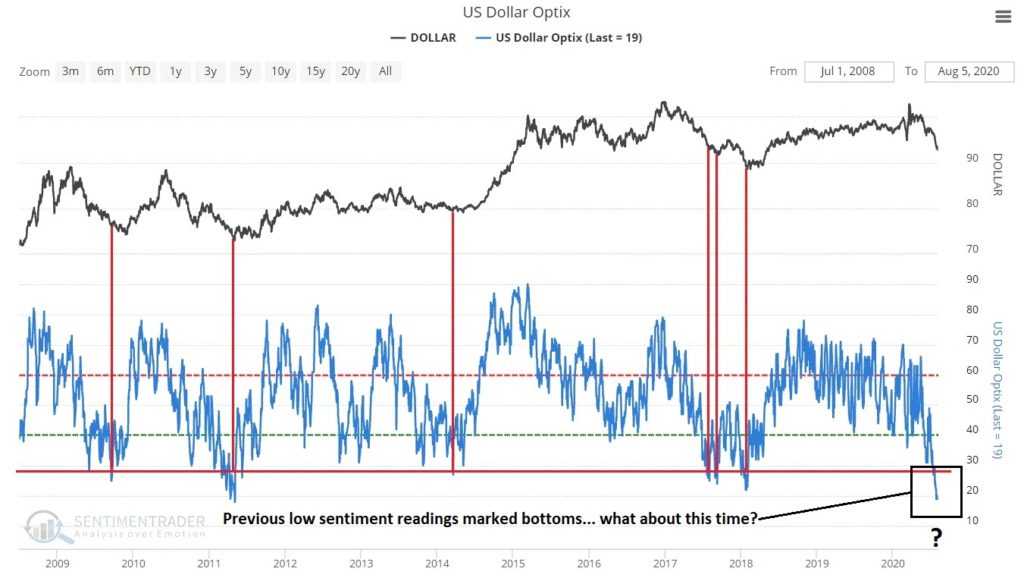

This is partly a function of, a) an oversold market, and b) the fact that sentiment has reached an extremely bearish extreme (which as a contrarian indicator is potentially bullish). At the far right of Figure 1 you see the current plight of the dollar. A sharp decline accompanied by bullish sentiment that is essentially at a 9-year low.

Figure 1 – U.S. Dollar falling hard, bullish sentiment at a 9-year low (Courtesy Sentimentrader.com)

Does this mean the U.S. Dollar has to bounce higher? Not at all. Which is why what follows is for short-term speculative traders only.

Playing for Bounce in the Buck

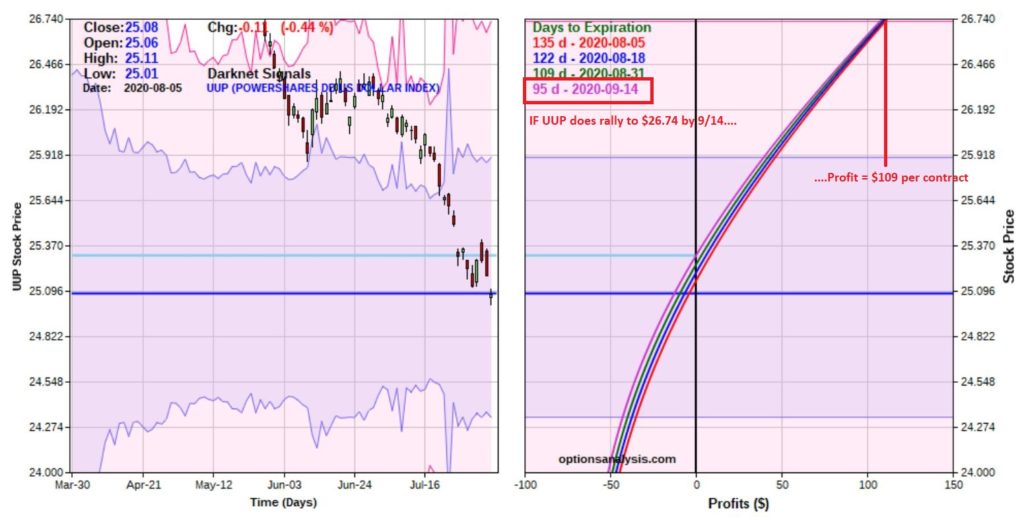

Let’s start with the usual caveat that what follows is NOT a “recommendation”, only an example of one (of many) way(s) that a trader might choose to bet on a short-term bounce in the dollar. In Figure 2 we see a projected Elliott Wave count for ticker UUP (an ETF that tracks the U.S. Dollar). It suggests a potential bounce in the next month or so (interestingly, followed by a further decline). For the record, this is not an “exact prediction” on the part of ProfitSource, it is merely a suggestion of how UUP might be expected to act in the months ahead. But for our purposes, let’s use this to consider a short-term bullish trade.

As such, we will attempt to answer the following question: “How can I make money if UUP rallies to roughly $26.50+ a share by mid-September?” All the while we must also understand that this will be an extremely risky (got that?) counter-trend trade – the implication being that we should, a) not bet the ranch, and b) look to limit our risk as much as possible.

Figure 2 – Ticker UUP (Courtesy ProfitSource by HUBB)

A Long Call on UUP

In order to enter a bullish trade with limited risk we will look to buy a call option on UUP. There is a September option series for UUP that expires on September 18, which might seem perfect at first blush. However, buying a call option that expires September 18th would mean that we would experience maximum time decay working against us (remember, options lose all of their time premium by expiration, with the bulk of that decay coming in the month leading up to expiration day).

So instead we will look at December 2020 call options. We are not playing for a “massive rally”, just for a short-term bounce of a reasonable amount (hopefully toward the $26.50 range). So, let’s consider that at-the-money December 25 strike price call. If we are able to buy it at the midpoint of the bid/ask spread, we can buy one call option for $66.

(Additional Math: If a trader has a $25,000 and wants to risk roughly 1% on this trade, he or she can buy 4 call options – $25,000 * 0.01 = $250. $250/$66 = 3.8 so we will round up to 4. Risking 2% of capital allows a trader to buy 7 or 8 calls, etc.)

Figure 3 displays the particulars and the risk curves for this trade between now and December option expiration (the curves change over time due to time decay).

Figure 3 – UUP December 2020 25 call details and risk curves (Courtesy www.OptionsAnalysis.com)

This Trade in Reality

A couple things to note:

A trader entering this position must be prepared to sustain a 100% loss of capital invested – which is why we are using a relatively low percent of capital paired with a limited risk vehicle (a call option). However, remember that we are initially looking for a bounce by mid-September. So, let’s redraw the risk curves through the date of 9/14. These appear in Figure 4.

Figure 4 – UUP December 2020 25 call risk curves between now and 9/14 (Courtesy www.OptionsAnalysis.com)

The bottom line:

*If UUP does in fact rally to our target of $26.74 this call option would generate an expected profit of $109 per contract, or 165% of capital invested ($66).

*Above roughly $25.30 a share for UUP this trade will show some profit

*If UUP fails to rally this trade loses money, plain and simple. As of 9/14, if UUP is at $24.00 a share this trade would be down roughly -$50.

Summary

Make no mistake, in this environment of strongly trending markets and with the federal government seeming to be actively weakening the dollar, this is should be considered a high risk, low probability trade. This position makes money only if UUP rallies in price from its current level. Under any other scenario this trade is a loser.

Still, for a speculative trader willing to make a contrarian bet, this example position offers the potential to generate a nice return on capital for a relatively low dollar risk.

See also Jay Kaeppel Interview in July 2020 issue of Technical Analysis of Stocks and Commodities magazine

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.