Everyone hates the commodities markets. That’s a fact – at least if we look at price performance relative to say the S&P 500 Index. Still, in this article I highlighted my own opinion that commodities are overdue for a period of outperformance. That doesn’t necessarily mean its going to start today.

There are several implications of all of this:

*The chart in Figure 1 divides the performance of the Goldman Sachs Commodity Index by the performance of the S&P 500 Index since 1971. You don’t actually need my commentary to grasp the implication of activity in recent years. They are practically giving commodities away (again, at least relative to stocks).

Figure 1 – Goldman Sachs Commodity Index / S&P 500 Index (1971-2020)

*Nevertheless, despite the fact that commodities as an asset class are as beaten down, washed out, unloved as any time in history, that does NOT necessarily mean that now is the time to “load up” (although I personally am not opposed to “accumulating” a few things here and there at what appear to be low prices, rather than waiting for that “one great moment” to dive in head long).

So, what’s an investor to do? One simple trick might be to keep an eye on the Australian Dollar. No, seriously.

Figure 2 displays Aussie Dollar spot futures in the top clip and the CRB Index (an index of commodities) in the bottom clip. Please note:

*The high correlation between the two, and;

*The slightly leading nature of the Aussies Dollar

Figure 2-Australian Dollar and CRB (commodity) Index (2001-2020) (Courtesy ProfitSource by HUBB)

The Test

*To test long-term results, we will use the same Aussie Dollar spot futures contract in Figure 2 versus its 24-month exponential moving average (also plotted in Figure 1).

*To measure commodity performance we will use the monthly total return for the Goldman Sachs Commodity Index (GSCI)

*When the Aussie Dollar closes above its 24-month EMA we will buy and hold the Goldman Sachs Commodity Index (GSCI).

*We will also track the performance of the GSCI when the Aussie Dollar is below its 24-month EMA.

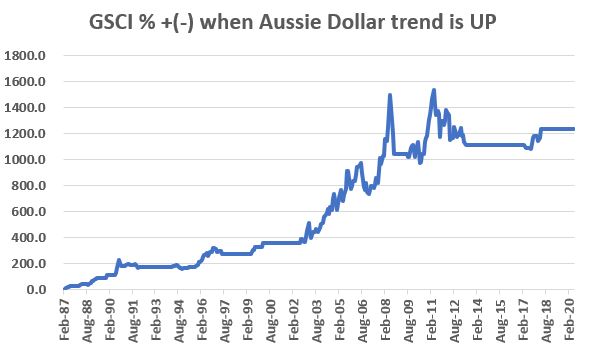

Figure 3 displays the growth of equity from holding the GSCI when the Aussies Dollar is above its 24-month EMA.

Figure 3 – GSCI Cumulative +(-) when Aussie Dollar > 24-month EMA (1987-2020)

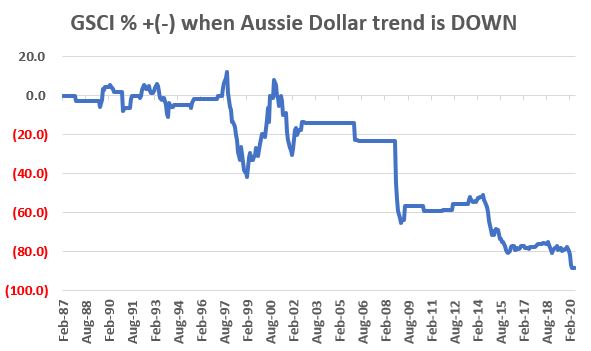

Figure 4 displays the growth of equity from holding the GSCI when the Aussie Dollar is below its 24-month EMA.

Figure 4 – GSCI Cumulative +(-) when Aussie Dollar < 24-month EMA (1987-2020)

The Results

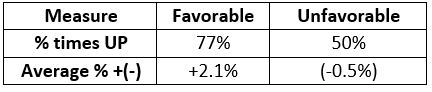

From January 1987 through April 2020:

*The cumulative gain for GSCI when the Aussie Dollar > 24-mo. EMA was +1,234%

*The cumulative loss for GSCI when the Aussie Dollar < 24-mo. EMA was -88%

The bottom line: avoiding commodities when the Aussie Dollar is trending lower sounds like a good idea.

A Real-World Application

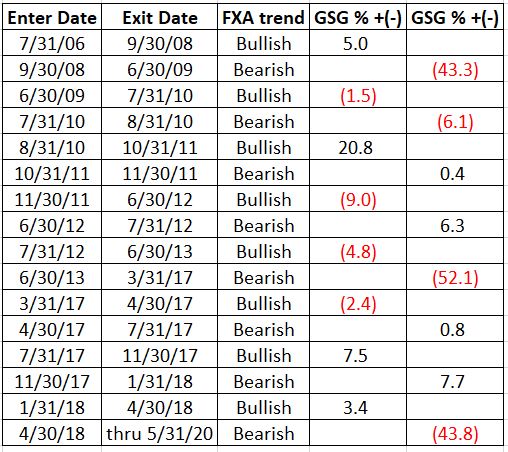

A simpler approach to tracking the Aussies Dollar might be to follow ticker FXA (an ETF that tracks the Aussie Dollar) versus its 24-month EMA. Also, ticker GSG is an ETF that tracks the Goldman Sachs Commodity Index, which can be used for actually trading an index comprised of a basket of commodities.

A trader could consider going long GSG when FXA is above its 24-month EMA and possibly selling short GSG when FXA is below its 24-month EMA.

Figure 5 displays the returns for GSG during both bullish (i.e., FXA > 24-month EMA) and bearish (i.e., FXA < 24-month EMA) periods since GSG started trading in 2006.

Figure 5 – Ticker GSG performance based on FXA trend

What to Watch For

The trend for FXA has been bearish since 4/30/2018 and remains so today. As I write, FXA is at $67.69 a share and the 24-month EMA is at $68.63. If FXA closes June above its 24-month EMA then a bullish signal for commodities in general – and GSG in particular – would occur.

So for now, this “model” (such as it is) remains “bearish” for commodities. But the Aussie Dollar has rallied strongly off of its March lows, so now is the time to be “paying attention.”

For the record, I am not suggesting that anyone should buy or sell commodities based solely on the action of one indicator. But as a trend indicator for commodities, the Australian Dollar has historically shown itself to be useful.

See also Jay’s “A Strategy You Probably Haven’t Considered” Video

See also Video – The Long-Term…Now More Important Than Ever

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.